DBS Vickers ups United Envirotech's target price to $1.18

Analyst: Tan Ai Teng

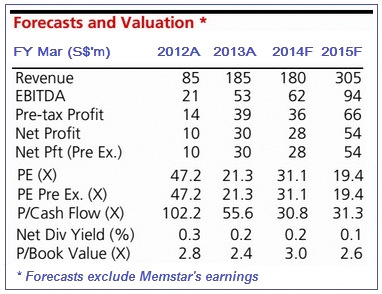

FY15 is shaping up to be a banner year for EPC. UENV has won another EPC contract worth RMB250m after securing a RMB160m BOT agreement two days ago.

FY15 is shaping up to be a banner year for EPC. UENV has won another EPC contract worth RMB250m after securing a RMB160m BOT agreement two days ago.UENV has clinched c.RMB877m of EPC contracts so far in FY14. More order wins are possible as RMB500-600m of contracts are in advanced bidding stages.

Based on new win assumption of RMB800m (from RMB400m previously) in FY15 and 12-18 months completion timeline, we estimate that EPC’s revenue could almost double to a record high of S$199m in FY15.

This is 63% higher than our previous EPC sales forecast of S$122m.

Memstar is a key catalyst to earnings and value. Assuming 20% growth on Memstar’s annualised FY14 June YE PATMI, underpinned by a potential increase in orders from a major customer, we estimated that Memstar could generate S$16m net profits in FY15.

Dr Lin Yucheng, CEO of United Envirotech. NextInsight file photoBased on 20x PE, this would add S$0.28 to UENV’s fully-diluted SOTP valuation.

Dr Lin Yucheng, CEO of United Envirotech. NextInsight file photoBased on 20x PE, this would add S$0.28 to UENV’s fully-diluted SOTP valuation.Upgrade to BUY, SOTP raised to S$1.18 including Memstar’s contribution and higher new win assumptions. With the strong rally in share price recently, UENV may see near-term profit-taking.

Investors with a medium term horizon should take advantage of pullbacks to take position in the stock, which could see upside from stronger-than-expected earnings from Memstar or contract wins.

A potential tie-up or partial takeover by a bigger entity is also possible, considering the growing participation of SOEs in the water sector. On the contrary, risks on the downside would be failure to complete the Memstar acquisition or a significant shortfall in EPC wins.

Recent story: China BOT water treatment players @ 15-30 times PE on S'pore bourse

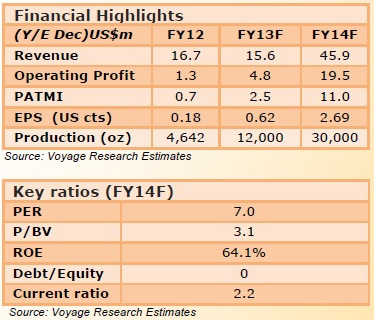

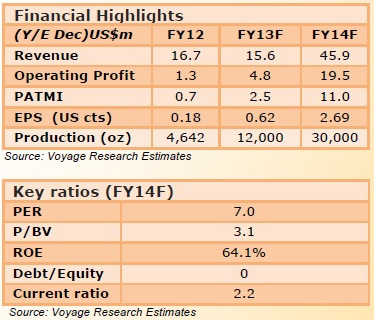

Voyage Research optimistic about CNMC Goldmine Holdings' outlook

Analyst: Liu Jinshu

Chris Lim, CEO of CNMC Goldmine.

Chris Lim, CEO of CNMC Goldmine. NextInsight file photoCNMC Goldmine Holdings Limited announced in Dec 2013 that:

a) it has formed a joint venture with the Perak state government to explore tin mining and

b) it will be paying its maiden dividend of 0.1 S cents per share on 20 Jan 2014.

We reiterate our highly positive outlook on CNMC on the back of increased production following the completion of leaching pad 2 in Sep 2013. Maintain Increase Exposure.

Reiterates Record Gold Pour in Nov: We recall that CNMC successfully commissioned its second gold de-absorption plant in Nov 2013, following record gold pours of 2,131oz (or 66.3kg) of gold dore bars from the new plant.

In contrast, the company produced 81.5kg (or 2,620oz) of gold dore bars in Oct 2013.

The new plant tripled overall gold de-absorption capacity to 3 t. per cycle to match the 2014 1m t. of ore heap leaching capacity.

Gold Prices Remain above Model Input: Spot gold currently trades at US$1252/oz, which remains above the input gold price of US$1200/oz which we applied towards our forecasts and valuation of CNMC.

Gold Prices Remain above Model Input: Spot gold currently trades at US$1252/oz, which remains above the input gold price of US$1200/oz which we applied towards our forecasts and valuation of CNMC.

We are unfazed by lower gold prices, as falling unit costs and higher production are expected to more than offset price declines.

Moreover, the decline in gold prices seemed to have slowed since 3Q 2013 (down 2.7% from end 3Q 2013 to 14 Jan 2014).

CNMC reported an impressive low all-in sustaining cost of US$566/oz in 3Q 2013. We remain optimistic about CNMC’s 4Q 2013 results and 2014 outlook.

Recent story: CNMC Goldmine ventures into tin mining as tin price rises

In contrast, the company produced 81.5kg (or 2,620oz) of gold dore bars in Oct 2013.

The new plant tripled overall gold de-absorption capacity to 3 t. per cycle to match the 2014 1m t. of ore heap leaching capacity.

Gold Prices Remain above Model Input: Spot gold currently trades at US$1252/oz, which remains above the input gold price of US$1200/oz which we applied towards our forecasts and valuation of CNMC.

Gold Prices Remain above Model Input: Spot gold currently trades at US$1252/oz, which remains above the input gold price of US$1200/oz which we applied towards our forecasts and valuation of CNMC. We are unfazed by lower gold prices, as falling unit costs and higher production are expected to more than offset price declines.

Moreover, the decline in gold prices seemed to have slowed since 3Q 2013 (down 2.7% from end 3Q 2013 to 14 Jan 2014).

CNMC reported an impressive low all-in sustaining cost of US$566/oz in 3Q 2013. We remain optimistic about CNMC’s 4Q 2013 results and 2014 outlook.

Recent story: CNMC Goldmine ventures into tin mining as tin price rises