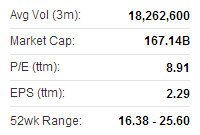

Credit Suisse: HK PROPERTY ‘Market Weight’

Credit Suisse said it is maintaining its “Market Weight” recommendation on Hong Kong-listed property developers.

“Hong Kong developers show a positive, yet rational, attitude towards landbanking,” Credit Suisse said.

Photo: COLIThe Hong Kong government announced this month that COLI (HK: 688) defeated 28 other contenders to win the tender for Kai Tak 1H1 and 1H2 residential sites, designated as “Hong Kong Properties for Hong Kong Residents,” for a combined 4.54 billion hkd/5,158 hkd psf, which falls at the high-end of the market estimates.

Photo: COLIThe Hong Kong government announced this month that COLI (HK: 688) defeated 28 other contenders to win the tender for Kai Tak 1H1 and 1H2 residential sites, designated as “Hong Kong Properties for Hong Kong Residents,” for a combined 4.54 billion hkd/5,158 hkd psf, which falls at the high-end of the market estimates.

There were 29 tenders submitted in all, including those from Cheung Kong (HK: 1), Henderson Land (HK: 12) and SHKP (HK: 16).

“We believe the project needs to be priced at an 8% premium to the secondary market ASP in order to have 25% margin. Assuming the pricing is at par with the secondary market, the project would still have 19% margin,” Credit Suisse said.

The research house said it sees at least two takeaways, in terms of Hong Kong developers’ attitude, from the tender results:

(1) they remain active in landbanking in HK, showing their vote of confidence in the HK property sector which is being supported by strong local demand; (2) they remain rational in bidding for sites, and generally allow for 30%+ margin even assuming that the property prices stay flat from the current level. COLI recently 20.45 hkd“In the coming quarter, there are at least seven major land sites up for sale.

COLI recently 20.45 hkd“In the coming quarter, there are at least seven major land sites up for sale.

“We expect developers to be active in the tender process, which in turn should push them to be active in the primary launches in order to generate proceeds for the landbanking.”

The note to investors said developers remain keen on landbanking in Hong Kong, as there were 29 tenders received, showing their vote of confidence in the Hong Kong property sector which is being supported by strong local demand.

“Hong Kong developers are rational in bidding for sites, and generally allow for 30%+ margin even assuming that the property price stays flat from the current level.”

Bocom: HK-listed property plays ‘Outperform’

Bocom International said it is staying “Outperform” on the listed real estate sector in Hong Kong.

Yet it also believes policy risk seems to have returned recently, given renewed rumors of widening property tax trial and restrained new home supply in Beijing amid the price limit measures.

“The surge in US Treasury yields has renewed market concerns of a rate hike. Nevertheless, such a potential rate hike should not be news, and the developers should have prepared for that when they bid for new projects,” Bocom said.

Source: BocomThe research house said it estimates quantitative easing since 2009 has contributed to a 20% increase in property prices and the market may face similar pressure upon tightening, bringing back mortgage rate from 2.2% at current to the “pre-easing” level of 5%.

Source: BocomThe research house said it estimates quantitative easing since 2009 has contributed to a 20% increase in property prices and the market may face similar pressure upon tightening, bringing back mortgage rate from 2.2% at current to the “pre-easing” level of 5%.

“We expect such pressure could be absorbed by inflation/income growth, as long as the rate hike is spread across 3-4 years. We estimate a mild 3-5% property price correction for every 25bp increase in mortgage rate, but this can be quickly offset by the release of end user-driven purchasing power, similar to the pattern in April/May,” Bocom said.

It anticipates overall property prices in Hong Kong to remain stable and developers to have little incentive to cut prices to boost volume.

Bocom has "Buy" calls on Agile (HK: 3383) and Shimao (HK: 813).

"We remain cautious on Midland (HK: 1200), due to the risk of 1H13 loss, given the thin volume in both the primary and secondary markets.”

Photo: GreentownABCI: GREENTOWN ‘Top Buy’

Photo: GreentownABCI: GREENTOWN ‘Top Buy’

ABC International said Greentown (HK: 3900) is its “Top Buy” among Hong Kong-listed developers.

“We prefer quality mid-cap plays with strong sales performance YTD, due to a much cheaper valuation of 5.5x 2013E PE (vs 9.8x for large caps).

“Greentown is our ‘Top Buy’ mainly due to its solid improvement in financing and executing via its JV with Wharf (HK: 4) and Sunac (HK: 1918),” ABCI said.

The research house added that for Kaisa (HK: 1638), it also initiates coverage with a “Buy” as margins should improve on increasing urban redevelopment projects.

“We also recommend “Buy” for Sunac, given its strong execution skills in the past.

"In terms of large-cap developers, we prefer COLI (HK: 688) given its industry leading margin.”

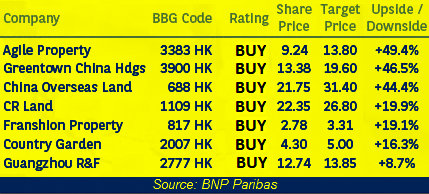

BNP Paribas: COLI, GREENTOWN, AGILE ‘Top Buys’

BNP Paribas said its “Top Buys” among Hong Kong-listed property developers are COLI (HK: 688), Greentown (HK: 3900) and Agile (HK: 3383) as they present the most upside from current prices.

“The new land auction system has been on trial in Beijing since 2H11 and there are now plans to implement it more extensively.

“The new administration is keen to maintain price stability in the mid-to-long term, not just in the short term,” BNP said.

The French research house said this involves implementing comprehensive structural reforms to address issues related to land cost, local government funding and housing supply structures.

“We are positive about the government’s strategy as it should reduce the risk of shock and disruption to property transaction volumes in the short and medium term.

“We expect contracted sales momentum to remain strong in 2H13, similar to the trend seen in 1H13.”

BNP is reiterating “Buy” calls on its top seven stocks: COLI, Country Garden, Guangzhou R&F, Greentown, Agile, Franshion and CR Land.

See also:

HOUSE IT GOING? China Property Plays