Main reference: Story in Sinafinance

INVESTORS WHO chronically lose money in China’s stock market almost always share some or all of these 10 bad habits, says a Sinafinance blogger.

First and most importantly, investors who end up losing money over an extended period often lack the gift of objectivity.

Losing investors share some common traits. Photo: jmmwHaving a subjective affinity for certain stocks or an emotionally-based positive position on some sectors over others will blind investors to sudden opportunities and signals in areas outside their comfort zone.

Losing investors share some common traits. Photo: jmmwHaving a subjective affinity for certain stocks or an emotionally-based positive position on some sectors over others will blind investors to sudden opportunities and signals in areas outside their comfort zone.

It is important to remember that the market is a dispassionate unfeeling entity, and those who develop an emotional attachment to parts of it are likely to be run roughshod over by more objective and experienced bourse players.

Second, many investors lack the ability to remain cool under pressure, and hesitate when the moment of truth and decision-making arrives.

Whether it be based in anxiety, procrastination, lack of self confidence or fear of failure, often those investors who choose to do nothing when something should be done end up losing everything.

Third, the novice investor often limits himself to self-set pricing limits, but stubbornly refuses to alter these guidelines to correspond with evolving individual counter circumstances.

An investor’s pledge to himself to dump a share if it falls by 5% or rises by 10% may look good on paper.

But in reality, said share may have already risen 20% in the week prior to it coming to the shareholder’s attention.

Therefore, customization and not uniformity should be the modus operandi for successful investors on a counter-by-counter basis.

Fourth, impatience is a frequent trait among failed investors.

By avoiding some bad habits, investors might be able to beat the house rather than just play the odds. Photo: GalaxyCashing out too early is one of the most commonly-heard lamentations among shareholders, with many admitting they were more interested in quitting while they were ahead than taking a long-term position with a potential winner.

By avoiding some bad habits, investors might be able to beat the house rather than just play the odds. Photo: GalaxyCashing out too early is one of the most commonly-heard lamentations among shareholders, with many admitting they were more interested in quitting while they were ahead than taking a long-term position with a potential winner.

Fifth, loss-making investors are often overly sensitive.

When a portfolio pick begins heading south, they at first vigorously deny they might have made a mistake and therefore suspend judgment – preferring instead to resort to pride and emotion.

By the time they have come to their rational senses, the share price has often fallen into an irreparable state.

This isn’t just a shareholder flaw, but a shortcoming in human nature itself – the reluctance to confront one’s mistakes early and head-on.

Sixth, many investors are too lazy or lacking in technologically savvy to find reliable, real time sources of financial information.

They are often too willing to “go it alone” and forego even the most affordable financial consulting services both, for reasons of ego and to save a few bucks.

Seventh, losing investors have an almost universal fear of buying stocks that are trading at historical or even near-term highs.

Oftentimes, share prices continue to rise because they truly have inherent value, and finding those that are still underappreciated within this group is another important chore of successful investing.

Eighth, investors naturally – and to their detriment – have an affinity for known entities, especially high brand recognition firms.

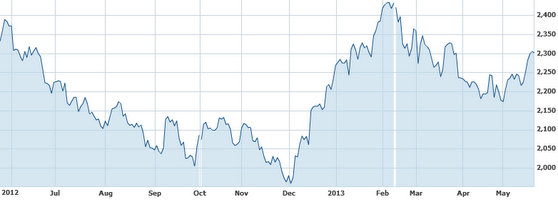

Recent China shares performance. Source: Yahoo Finance

Recent China shares performance. Source: Yahoo Finance

Buying based on brand image is a bit like nepotism – you may know your own son better than anyone else, but he is not necessarily the best candidate to be your company’s new executive vice president.

Ninth, investors finishing in the red often become fixated on one share aspect over another, whether it be dividend payout history, P/E ratios or historical pricing trends.

Successful investors find ways to look at all factors both independently and complementarily in making their share buying and selling decisions.

Finally, the rumor mill plays too large a role in the failed investor’s information-gathering process.

Most rumors are initiated by those with a personal vested interest in the gullible listener’s acting upon them.

Also, tips from “crack brokers” are more often than not meant to drum up investor interest in one of the many clients he represents.

See also:

Stock Gains Earn Young PRC Investor Two Homes