Photo: ToREAD

Main reference: Story in Sinafinance

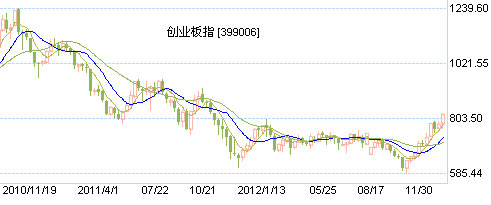

THE CHINEXT BOARD, the three year old capital raising platform for PRC-listed SMEs, has soared to a one-year high.

Who are some of the heavy lifters on “China’s Nasdaq?”

First, a bit about “China’s Nasdaq” as the Dragon Year roars to a close and the Snake Year comes slithering in.

As of mid-February, there were 355 companies selling shares on the ChiNext with a total market value not far south of one trillion yuan (977.3 billion).

The average P/E ratio stands at a rather high watermark of nearly 36 times.

That is nearly three times the current P/E ratio for A-shares overall, which is at just 13 times.

“China’s Nasdaq” is currently at a 12-month high of 823.03, rising 1.1% and 2.2% on the final two trading days of the Year of the Dragon.

The ChiNext has also surged 41% since December 3, and has risen 11% since the beginning of 2013.

Firms have found it relatively less difficult to sell shares on the ChiNext, with triple digit P/Es a common phenomenon when the board was first launched in late 2009, but now with a more palatable average P/E for investors taking a first look at the startup board.

But while having a lower listing threshold, ChiNext does offer riskier but potentially more lucrative investment opportunities, while mandating more stringent requirements on trading, information disclosure and procedures for delisting.

So which firms and their high P/Es have been tugging the ChiNext Index higher recently?

Beijing Dinghan

Beijing Dinghan Technology Co Ltd (SZA: 300011) has a current P/E ratio of 163 times, or approaching five times the ChiNext average.

Triple digit levels like this are quite rare now on the ChiNext but were a frequent phenomenon in the early days of “China’s Nasdaq.”

The firm provides a wide range of goods and services for rail transit power-supply systems, subway electrical and mechanical subsystems.

China’s massive commitment in both money and manpower to linking cities by rail and urbanites by subway has paid off handsomely for Beijing Dinghan.

And with a newly-stated commitment to transportation infrastructure development from the new national government in Beijing, investors are hopeful that the ChiNext-listed engineering play will ride the boom in high-speed railway and subway construction even further.

Beijing ToREAD

Beijing ToREAD Outdoor Products Co Ltd (SZA: 300005) was one of a handful of bold Chinese capital-starved startups to list on the ChiNext’s first official day of trading – October 30, 2009.

Currently trading at 15.81 yuan, its P/E ratio is over 41 times, a comfortable distance above the ChiNext Index average of 36 times, and its share price has surged over 20% since late November.

In a recent quarter, institutional investors focused on A-shares – of which ChiNext shares are a part -- boosted their holdings in textile/apparel-related stocks by 37.5%, with Beijing ToREAD likely receiving enhanced attention.

With China officially becoming a majority urban population in 2011 and no sign of the gradual population shift from farms to cities slowing, Beijing ToREAD – a maker of outdoor products like hiking shoes, tents, ski jackets and backpacks – expects to appeal to a growing middle class in China’s cities looking to get away from the grind.

“China’s cities continue to grow with active government support for the ongoing urbanization drive, so our target market is growing alongside this trend.

“Urban areas also have higher per capita GDPs and larger disposable incomes as well as more leisure time and appreciation for physical fitness/outdoor activities,” said Beijing ToREAD Securities Affairs Representative Tao Xu at a recent Aries Consulting-sponsored investment conference in Shenzhen – home of the ChiNext.

BlueFocus

BlueFocus Communication Group Co Ltd (SZA: 300058) is Asia’s No.1 PR firm and provider of brand management services.

Its ChiNext-listed shares are currently trading at nearly 29 yuan -- a 52-week high.

And with a current P/E ratio of nearly 43 times, it is also at a level respectably above the ChiNext Index average.

Helping matters greatly was the Beijing-based PR firm’s recent financial performance, with third quarter net profit skyrocketing 112% to over 200 million yuan.

BlueFocus credits most of its business expansion to a very proactive acquisition campaign.

“In recent years, BlueFocus has continuously maintained both a rapid organic expansion rate as well as aggressive growth via M&As.

“We will continue building upon its leading position in both China and the region to further enhance its standing as a top-rate media marketing organization covering advertising, public relations, promotional activities and others to broaden its operating scope and client base even wider,” said BlueFocus Deputy General Manager Mr. Xu Zhiping at a recent investor gathering.

BlueFocus has boosted its own brand cachet in the PR industry by taking on some high-profile globally recognizable clientele including Toyota, Hyundai, VW, BMW, Sony, Canon, Microsoft and China’s own Lenovo.

See also:

BLUEFOCUS: Asia’s Top PR Firm Master Of M&As

TOREAD: Outdoor Products Hiking Up Sales Amid Urbanization