CIMB has unchanged end-2013 target of 3,460 for index

Analyst: Kenneth NG, CFA

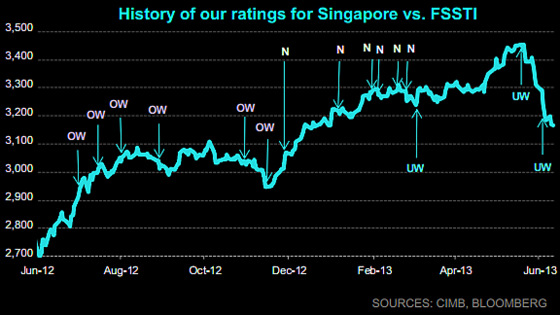

The FSSTI has fallen 9% from its mid-May peak. We were positive on the FSSTI for most of 2012 but turned cautious in Dec 2012 prior to our Underweight rating in March 2013.

Having given up all its gains YTD, any further fall in the FSSTI will drive a more positive view.

We remain Underweight on Singapore for now, with an unchanged end-2013 FSSTI target of 3,460 (bottom-up).

The stocks that have fallen the most in the past month are REITs, developers, ST Engineering, DBS, M1, Starhub and Noble.

We prefer non-REIT yield stocks, developers and banks to REITs, telcos and commodity stocks.

Our top picks are DBS, Thai Bev and UOL.

The stocks that have fallen the most in the past month are REITs, developers, ST Engineering, DBS, M1, Starhub and Noble.

We prefer non-REIT yield stocks, developers and banks to REITs, telcos and commodity stocks.

Our top picks are DBS, Thai Bev and UOL.

UOL, ST Engineering and CapitaLand look particularly attractive after their respective corrections.

We use 2011-12 trough valuation multiples as a guide, to extrapolate a valuation floor. On a 12M forward rolling P/E basis, the FSSTI bottomed at 11.9x P/E in 2011 (2,529), which is equivalent to 2,740 today.

On a P/BV basis, the FSSTI bottomed at 1.37x P/BV, which translates to 2,955 now.

On a P/BV basis, the FSSTI bottomed at 1.37x P/BV, which translates to 2,955 now.

UOB KH highlights growing Asian investor interest in Chinese stocks

This is mainly a valuation call; based on Bloomberg consensus, MSCI China now trades at 9.5x FY13F PE, the second cheapest market in Asia ex-Japan.

However, improvement in investors’ sentiment has been kept in check by the lack of clear positive catalysts and numerous outstanding structural issues.

Analysts: Tham Mun Hon & Fan Zhang

Our meetings with Asian investors over the past week confirm that interest in Chinese equities is increasing. This is mainly a valuation call; based on Bloomberg consensus, MSCI China now trades at 9.5x FY13F PE, the second cheapest market in Asia ex-Japan.

However, improvement in investors’ sentiment has been kept in check by the lack of clear positive catalysts and numerous outstanding structural issues.

Feedback suggests that investors’ main holdings are in property developers, Macau gaming, and utilities.

They share our view that the market is likely to range-trade going forward and rotation into laggards is a more appropriate strategy.

Geely Auto (HKD3.60) has a market cap of HKD29.9 billion, trading at a PE of 10.5X.

Geely Auto (HKD3.60) has a market cap of HKD29.9 billion, trading at a PE of 10.5X.

Photo: Company

Based on current Bloomberg earnings forecast, we recommend raising allocation to consumer discretionary, industrials and materials.

However, in terms of sector allocation, we are only OVERWEIGHT on consumer discretionary, healthcare, IT and utilities.

Our top BUYs are Anhui Conch, China Glass, China Railway Group, CNBM, Golden Eagle, Geely Auto, Sino Biopharmaceutical, and Sihuan Pharmaceutical.

They share our view that the market is likely to range-trade going forward and rotation into laggards is a more appropriate strategy.

Geely Auto (HKD3.60) has a market cap of HKD29.9 billion, trading at a PE of 10.5X.

Geely Auto (HKD3.60) has a market cap of HKD29.9 billion, trading at a PE of 10.5X. Photo: Company

Based on current Bloomberg earnings forecast, we recommend raising allocation to consumer discretionary, industrials and materials.

However, in terms of sector allocation, we are only OVERWEIGHT on consumer discretionary, healthcare, IT and utilities.

Our top BUYs are Anhui Conch, China Glass, China Railway Group, CNBM, Golden Eagle, Geely Auto, Sino Biopharmaceutical, and Sihuan Pharmaceutical.

personally, i would analyse stocks based on their fundamentals and buy when they are cheap enough with a reasonable safety level.

http://paulcokefreedom.blogspot.sg

valuations are more attractive now. QE tapering is unlikely to start until December, but regardless, QE exit should be positive for equities as bond funds shift to equities."