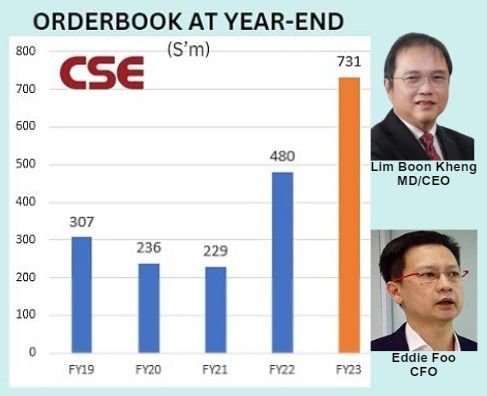

• Electric cars are heading for the mainstream. Less obvious are solar energy and wind power. But they all embody one of the transformational trends in human history -- Electrification of Everything Everywhere. • Companies in a broad range of sectors and industries stand to benefit significantly. One of them is Singapore-listed CSE Global.  Electrification segment accounted for S$434 million of the end-FY23 orderbook. The other segments: Automation (S$192 million), Communication (S$105 million). Electrification segment accounted for S$434 million of the end-FY23 orderbook. The other segments: Automation (S$192 million), Communication (S$105 million).• CSE provides systems integration solutions related to electrification, communication and automation. This electrification segment has been a significant driver of the company's revenue growth, particularly due to rising demand in the data centre, power, utility, and energy storage markets. • Electrification accounted for a whopping 72% of CSE's 1Q2024 revenue. By the way, CSE counts Temasek Holdings as its No.1 shareholder and the Singapore Governmnent as one of its clients. Read more of the business from UOB KH's latest report below ... |

Excerpts from UOB Kay Hian report

Analysts: John Cheong & Heidi Mo

CSE Global (CSE SP)

Outlook Remains Positive, Backed By Healthy Orderbook And Pipeline Of New Projects

| CSE maintains its positive outlook. Backed by an orderbook of more than S$700m and healthy order wins which grew 17% yoy in 1Q24, earnings could grow at a healthy rate of 11% for 2024. CSE is looking at a robust project pipeline in electrification and communication solutions in the infrastructure and energy industries. The electrification business is CSE’s largest contributor, at 46% of its 2023 revenue. Also, CSE is exploring potential acquisition targets. Maintain BUY. Target price: S$0.56. |

WHAT’S NEW

• CSE maintains positive outlook and commitment to growth. CSE Global (CSE) is maintaining its positive outlook in achieving a stronger financial performance in 2024, on the back of its strong orderbook of S$719m in 1Q24 that is 50% higher yoy.

|

CSE |

|

|

Share price: |

Target: |

We are expecting earnings growth of 11% yoy for 2024.

CSE is committed to expanding its business as it sees opportunities arising on the back of megatrends such as urbanisation, electrification and decarbonisation.

CSE sees promising prospects in the electrification trend as it is one of the most important strategies for reducing carbon emissions via substituting fossil-fuel sources of power with electricity generated from renewable energy sources.

As a result of the emerging trend, there is increasing demand for key products including power systems protection and control solutions, critical communications, wind and solar systems, battery energy storage systems and electric-vehicle charging infrastructure.

• Building on diversification initiatives, with a focus on electrification and communications. CSE is planning to build its electrification business in the US and New Zealand by securing more water and power distribution projects to support rising demand for power.

In addition, it is actively pursuing opportunities in renewables, energy storage, data centres and related infrastructure.

The electrification business is CSE's largest contributor, accounting for 46% of its total revenue in 2023.

On the other hand, CSE is strengthening its communications business in ANZ/UK through integration of acquired businesses and focusing on critical communications and security solutions.

Communication business is CSE's second-largest revenue contributor, forming 30% of revenue in 2023.

• Acquisition remains a key growth strategy. CSE's acquisition strategy will focus on the electrification and critical communications businesses in the US, Europe, Australia and New Zealand.

Management has shared that it is currently in talks with potential targets in the critical communications sector in Australia and the Americas region. This approach will help CSE scale growth.

To recap, CSE has completed 30-40 acquisitions to date with a high rate of integration. CSE's S$24m gross proceeds from the recent share placement will be used to finance value-accretive acquisitions.

STOCK IMPACT

• CSE continues to see stable financial performance in the infrastructure and mining & minerals sectors. This is supported by a steady stream of projects arising from requirements in digitalisation, communications and enhancements in physical and cyber security globally, and from data centres and water utilities in the Americas and Asia Pacific regions.  John Cheong, analystIn 1Q24, CSE successfully generated >60% of its business from infrastructure and mining/minerals customers, which brought in S$91m or 49% of 1Q24's order intake. John Cheong, analystIn 1Q24, CSE successfully generated >60% of its business from infrastructure and mining/minerals customers, which brought in S$91m or 49% of 1Q24's order intake. This allows CSE to diversify into new markets and ride on the trends of urbanisation, electrification and decarbonisation. • Dividend yield remains attractive. We expect CSE to maintain its full-year dividend at 2.75 S cents/share for 2024, translating to an above-average dividend yield of about 6% vs the FSSTI's of around 4.0%. |

EARNINGS REVISION/RISK

• We maintain our earnings forecast.

VALUATION/RECOMMENDATION

• Maintain BUY with a target price of S$0.56. Our target price is pegged to 15x 2024F PE (based on +1SD above mean) and implies a 2024 dividend yield of 6.8% as we expect CSE to maintain a full-year dividend of 2.75 S cents/share for 2024.

SHARE PRICE CATALYST

• Large infrastructure project wins.

• Accretive acquisitions.

Full report here.