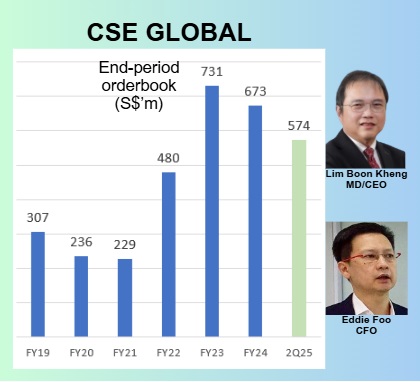

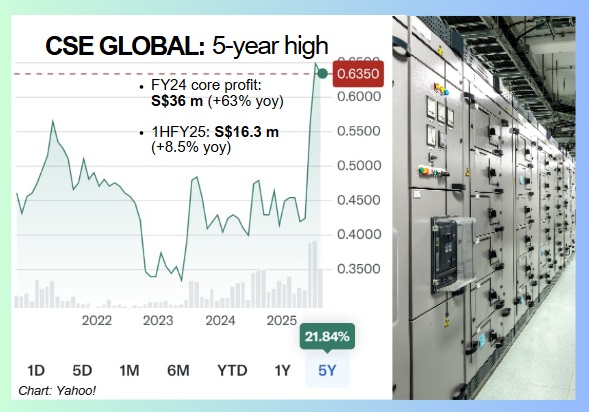

• Three years ago, CSE Global began modestly to serve the data centre sector, reaping just S$5 million in revenue. Since then, it has achieved an impressive three-year compound annual growth rate (CAGR) exceeding 150%. This rapid scaling is evident in year-to-date (YTD) wins totaling S$79 million in new US data centre contracts. • Singapore-based CSE, in which Temasek Holdings holds the No.1 stake (~23%), is a systems integrator specializing in electrification, communications, and automation, is increasingly positioning itself as a key player in the data centre sector. • McKinsey's estimates US$2-3 trillion in US capex for data centres, a boom that sees CSE is qualifying for 1-2 more hyperscaler clients, which could significantly boost FY26-28E earnings. CSE has made a strategic shift away from lower-value municipal projects and toward larger-scale data centre and infrastructure opportunities in the US. Thus its current order book declined (see chart) but analysts foresee a rebound through data centre-driven wins.  Electrification segment accounted for S$292 m of the 1HFY25 orderbook. The other segments: Automation (S$175 m), Communication (S$107 m). Electrification segment accounted for S$292 m of the 1HFY25 orderbook. The other segments: Automation (S$175 m), Communication (S$107 m).• Outpacing the other two business segments of CSE, the"electrification" segment has contributed nicely to the orderbook. See the chart and caption above. • CSE (market cap: S$451 m, stock price 63 cents) has made a strategic move to reserve capacity and focused on clients in the data centre and utility spaces, notes Maybank Kim Eng analyst Jarick Seet. • Risks: CSE faces challenges like foreign currency ups and downs, and the ever-present risk of project cost-overruns. Read excerpts of CGS's report below .... |

Excerpts from CGS report

Analysts: Lim Siew Khee & Tan Jie Hui

■ CSE continues to focus on electrification and communications for growth while automation steadies with solid volume despite softer contract values. |

|||||

| Leveraging DC growth; gunning for sustainable recurring contracts |

CSE’s data centre (DC) segment, which started just three years ago with a modest c.S$5m revenue contribution, has scaled rapidly, delivering an impressive 3-year CAGR of over 150% and securing approximately S$79m in new US DC contracts YTD.

The company now targets a double-digit revenue contribution from the DC segment for FY25F, reflecting its growing strategic importance. Target prices for the stock : 84 cents (Maybank KE), 85 cents (UOB KH)

Target prices for the stock : 84 cents (Maybank KE), 85 cents (UOB KH)

In the medium term, CSE expects its DC contracts to transition into a flow-type business model, driven by recurring maintenance revenue rather than lumpy project wins.

This shift should support a more predictable revenue stream, in our view, and given that flow business typically yields higher margins than greenfield projects, we anticipate margin improvement as CSE continues to expand its DC footprint.

| CSE’s near-term focus: electrification and communication |

For the electrification segment, CSE will continue to deepen its exposure to DCs and infrastructure, with plans to increase its real estate capacity in the coming years.

While site acquisitions remain the preferred route, the company is open to leasing where suitable locations are unavailable, particularly for high-potential opportunities.

However, those projects may yield thinner margins due to leasing costs, which could slightly moderate profitability despite robust revenue growth, in our view.

For communications, CSE said growth will be driven by strategic, EPS-accretive acquisitions aimed at enhancing local presence and customer base, targeting a minimum ROE/ROIC hurdle rate of 10%.

Automation growth is expected to stay muted in the near term.

The segment remains anchored in the US and Singapore, where demand has proven resilient, especially in the US, driven by diversification beyond oil & gas into broader industries. Although contract sizes have moderated, sustained volume has helped support overall performance

Reiterate Add as we believe CSE will continue to ride on secular tailwinds of urbanisation, electrification, decarbonisation and AI. |

See full report here.