• CSE Global stock (72 cents this morning) has surged +73% year-to-date as it rides the wave of Artificial Intelligence, a transformative force reshaping the global economy. CSE, a Singapore-based company, is helping to power the backbone of AI -- data centres (DC) -- and the US is the world's largest (with reportedly 5,500 data centres, or 10X more than the closest peer) and most advanced data center market. • CSE, in which Temasek Holdings holds the No.1 stake (~23%), is engaged in projects that enhance electrical infrastructure, which includes working on substations, switchgear, switchboards, and transformers. These projects are crucial as power needs increase. • The order book is set to be boosted as CSE is likely to win large data centre-related contracts before 2025 is over, says Maybank Kim Eng Securities in a new report.  Electrification segment accounted for S$292 m of the 1HFY25 orderbook. The other segments: Automation (S$175 m), Communication (S$107 m). Electrification segment accounted for S$292 m of the 1HFY25 orderbook. The other segments: Automation (S$175 m), Communication (S$107 m).Read excerpts of Maybank's report below .... |

Excerpts from Maybank KE report

Analyst: Jarick Seet

Large DC orders likely incoming

|

|||||

| Gross and net margins likely to improve |

CSE’s gross and net margins for 1H25 both improved to 27.9% and 3.7%, respectively, from 27.6% and 3.5% in 1H24.

Revenue grew 2.8% YoY to SGD440.9m despite the depreciation of USD vs SGD.

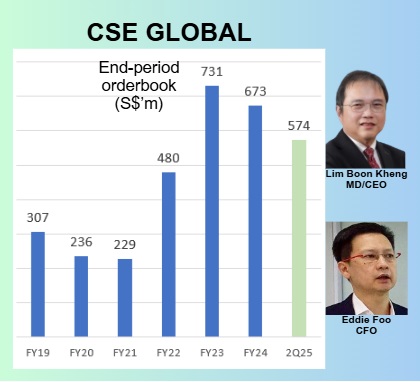

Remaining orderbook stands at SGD573.8m as at Jun 2025, which we believe will likely improve once larger orders are secured in 2H25E which will likely lift margins, especially on a net level, with better operating leverage.

| Larger data centre order wins to be expected |

Key types of electrification projects by CSECSE made a strategic move to reserve capacity and focused on clients in the data centre and utility spaces.

Key types of electrification projects by CSECSE made a strategic move to reserve capacity and focused on clients in the data centre and utility spaces.

CSE, in Aug 2025, unveiled a SGD59m data centre extension order from its existing US hyperscaler customer.

The first order was SGD20+m 3 years ago and a second was secured in Apr 2024 at SGD49m followed by the third in Aug 2025.

The speed as well as contract sizes have been increasing and we believe this will likely continue.

CSE is also in the midst of qualifying with another 1-2 hyperscaler clients and a win would add significant earnings growth for FY26-28E.

We remain bullish on the outlook for CSE and see potential for a multiyear growth story. |

→ See full report here.

→ See full report here.

→ Read about another data centre play: ISDN: 1H25 Core Profit Jumps 35%, Powering Ahead with Automation and Hydropower