Uni-Asia Finance Corporation chairman and CEO Kazuhiko Yoshida. Photo: annual report

Uni-Asia Finance Corporation chairman and CEO Kazuhiko Yoshida. Photo: annual report Uni-Asia Finance's business is an unusual mix offering investors exposure to shipping, property, and hotel industries. Its just-published 2012 annual report features an interview with the chairman & CEO, Kazuhiko Yoshida, where he gives clarity on the the business model. We reproduce excerpts below. For the full-blown annual report, visit the SGX website.

Please explain the rationale for the combination of shipping, property and hotel as your core businesses.

We position ourselves as an alternative investment company, where alternative investment includes investment and asset management of vessels and properties. Hotel operation business is an extension of our asset management business for hotel funds and we started it to supplement our asset management business of hotel funds.

We believe that the combination of ship investment business and property investment business including hotel operation is a good product mix for the Group for the following reasons:

i) Vessel investment and property investment are similar in that they are based on foreseeable cash flow of the assets and our management team’s expertise as ex-bankers can be fully leveraged to manage these investments.

ii) Though commonly influenced by the global economy, the shipping industry and property industry are not directly linked and correlation is not always strong. Take for example, if we observe the market trend of global shipping market, property market in Japan and property market in Hong Kong after the Global Financial Crisis to date, they showed different trends. We thus achieve a lower risk on our investment portfolio through diversification rather than

ii) Though commonly influenced by the global economy, the shipping industry and property industry are not directly linked and correlation is not always strong. Take for example, if we observe the market trend of global shipping market, property market in Japan and property market in Hong Kong after the Global Financial Crisis to date, they showed different trends. We thus achieve a lower risk on our investment portfolio through diversification rather than

concentrate on one particular class of asset.

iii) By having two different classes of assets as our alternative assets investment products, we are able to capitalise on the opportunities of these products’ different cycles to maximise value for our investors. We are also able to offer our customer more investment choices depending on our customers’ preference.

iv) Our hotel operation business not only supplements our asset management business but also provides more business opportunities for the Group. When we provide hotel investment brokerage service to hotel owners, we are also able to provide hotel operation service as a package

deal. Thus, the hotel operation business differentiates us from other players, and adds value to our services as an integrated service provider in relation to property investment.

I would also like to highlight that both business models of ship investment / management and property investment / management enable us to secure multiple income sources which helps our risk diversification strategy. We earn not only investment returns as a principal investor / co-investor but also receive fee income from our integrated service, which strengthens our income foundation.

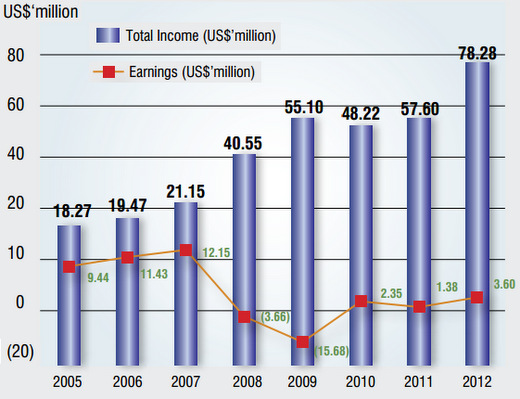

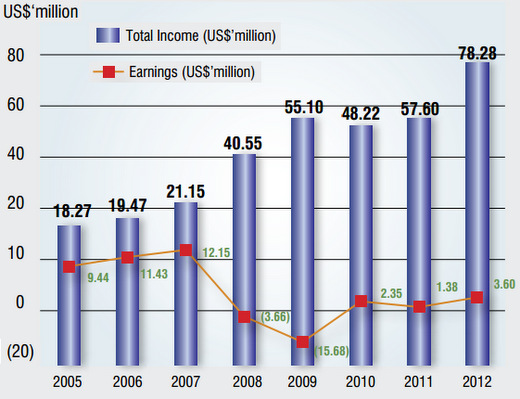

The Group has returned to profitability since FY2010.

The Group has returned to profitability since FY2010.

Please explain how the ship investment / management business and ship owning business will overcome the prolonged sluggish market expected in 2013. What is the strategic direction of the ship investment / management business and ship owning business?

There is strong demand from vessel owners for financing and re-structuring arrangements such as sale and leaseback in these challenging times. With our product knowledge, knowhow on tax driven financing and strong connections with global financial institutions, we are confident of catering to this demand with our integrated suite of services for vessel investment.

I would also like to highlight that both business models of ship investment / management and property investment / management enable us to secure multiple income sources which helps our risk diversification strategy. We earn not only investment returns as a principal investor / co-investor but also receive fee income from our integrated service, which strengthens our income foundation.

The Group has returned to profitability since FY2010.

The Group has returned to profitability since FY2010.Please explain how the ship investment / management business and ship owning business will overcome the prolonged sluggish market expected in 2013. What is the strategic direction of the ship investment / management business and ship owning business?

We currently manage the Akebono Ship Investment Fund (“Akebono Fund”) and invest in it as one of the sponsors. Apart from the Akebono Fund, we are co-investors in five vessels in which our shareholding interest is not more than 50%. We also provide asset management & administration services for these co-investments. Our strategy for ship investment / management

is to expand the vessel portfolio to increase fee income from our services for the fund and co-investments. We expect good opportunities to acquire vessels due to a prolonged sluggish

market. We believe that investors now view commercial vessels as an alternative investments category, and are returning to the market given the dampened vessel prices. The Group will

consider organising additional ship investment funds to boost the asset management fee income base should the opportunity arise.

We believe FY2013 will bring good opportunities for the Group to expand our fleet under Uni-Asia Shipping. As the shipping industry continues to remain weak, we expect that more vessels

will be released into the market at attractive prices. Under such a circumstance, we may increase our fleet size at reasonable costs and at the same time increase our recurrent charter

income. We have acquired five vessels under Uni-Asia Shipping to date, of which four have been delivered.

This business combination of ship investment / management and ship owning / chartering business provides us flexibility in the mode of investment, i.e. majority / full interest, joint

investments in vessels or ship investment fund. There is strong demand from vessel owners for financing and re-structuring arrangements such as sale and leaseback in these challenging times. With our product knowledge, knowhow on tax driven financing and strong connections with global financial institutions, we are confident of catering to this demand with our integrated suite of services for vessel investment.

Because of the age profile of existing vessels and the demand and supply situation, the company has been focusing on handysize bulk carriers between 25,000 dwt to 39,999 dwt. According to Worldyards Handysize Supply Profile, approximately 576 out of 1,824 vessels (32%) are over 21 year old as at 31 December 2012. This means that a significant number of vessels are expected to be scrapped in the near term while the supply of new vessels is limited. Although the pace of

recovery would be affected by the economic environment, we foresee that demand for this category of vessels will pick up as the demand and supply situation rebalances.

What is the strategy for property investment / management business in Japan (UACJ), China and Hong Kong (Non-consolidated UAF) going forward?

Chief Operating Officer Michio Tanamoto answers a question during a results briefing. At right is Lim Kai Ching, CFO. NextInsight file photoWe position UACJ as an integrated service provider in relation to property investments in Japan. UACJ currently focuses on small residential property development projects, acting as a

Chief Operating Officer Michio Tanamoto answers a question during a results briefing. At right is Lim Kai Ching, CFO. NextInsight file photoWe position UACJ as an integrated service provider in relation to property investments in Japan. UACJ currently focuses on small residential property development projects, acting as a

Chief Operating Officer Michio Tanamoto answers a question during a results briefing. At right is Lim Kai Ching, CFO. NextInsight file photoWe position UACJ as an integrated service provider in relation to property investments in Japan. UACJ currently focuses on small residential property development projects, acting as a

Chief Operating Officer Michio Tanamoto answers a question during a results briefing. At right is Lim Kai Ching, CFO. NextInsight file photoWe position UACJ as an integrated service provider in relation to property investments in Japan. UACJ currently focuses on small residential property development projects, acting as a project initiator and project manager in exchange for project management fees.

We will be able to secure investment returns as the Group enters into these projects as an investor. UACJ also focuses on brokerage services given that many investors, including overseas investors, are looking at property acquisition opportunities in Japan as they view property market in Japan is bottoming out.

There are also opportunities for UACJ to provide asset management services, as a number of asset management companies have been forced to exit the market during the Global Financial Crisis. Income from these activities is expected to make up for the decrease in asset management fees from existing hotel / residential investment funds and boost profit for this business segment.

We will be able to secure investment returns as the Group enters into these projects as an investor. UACJ also focuses on brokerage services given that many investors, including overseas investors, are looking at property acquisition opportunities in Japan as they view property market in Japan is bottoming out.

There are also opportunities for UACJ to provide asset management services, as a number of asset management companies have been forced to exit the market during the Global Financial Crisis. Income from these activities is expected to make up for the decrease in asset management fees from existing hotel / residential investment funds and boost profit for this business segment.

Our industrial office building re-development project in Hong Kong in which we have 10.2% effective interest is progressing successfully. As announced, all the saleable levels of the

building were sold to end users during pre-sale conducted in 2012. We are looking for similar investment opportunities to expand our investment portfolio, as well as to provide investment

opportunities for our clients. In this uncertain economic climate, we will be selective in undertaking projects and shall work closely with our partner First Group, a Hong Kong developer.

Leveraging on our network of investors who are looking at crossborder investment opportunities in Japan and other countries, we aim to derive synergies by supporting our clients’ crossborder investments with various services such as administration and brokerage services.

Recent story: UNI-ASIA FINANCE: Stock for recovery in ship charter rates & asset values

Recent story: UNI-ASIA FINANCE: Stock for recovery in ship charter rates & asset values