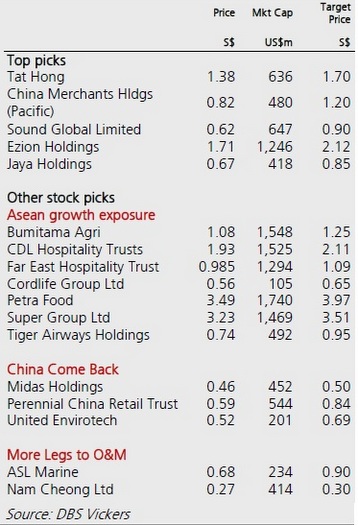

Excerpts from DBS Vickers' excellent 47-page report released today (7 Jan 2013).

Analysts: TAN Ai Teng and LING Lee Keng

Singapore Small Mid Caps (SMC) and the DBSV SMC universe have both outperformed the FSSTI’s 20% gain in 2012, rising 31% and 39% respectively.

But, as SMC’s earnings growth is projected to outpace large caps (LC) at 13% to 9%, we see SMCs having more legs to run and would continue to beat the STI, which consensus expects to have a <10% return.

Bank on external growth. Singapore is expected to lag behind the rest of Asean with little growth and high inflation this year. We prefer companies with external growth, particularly those leveraged on Asean.

Our picks are Petra Food, Super Group, Tiger Airways and Tat Hong, which generate >50% of their sales from non-Singapore markets, whereas Bumitama sells globally.

Although 70% of Cordlife’s sales are domestic, cord blood banking offers a stable pool of recurring income.

Although CDL Hospitality draws 80% of its income domestically, these are mainly supported by overseas tourists to Singapore.

We expect the re-rating on Super to continue and have raised its TP to $3.51.

NextInsight file photo

Ride on China’s recovery. With no sign of recovery in exports to major economies like the US and Europe, China looks set to accelerate other engines of growth namely investment and consumption.

Our infrastructure picks Sound Global and United Envirotech are poised to benefit from China’s will to improve environmental protection.

We believe Midas will continue to re-rate along with the revival of China’s high speed railway programme. Our proxies to a rebound in China’s consumption are PCRT (retail) and China Merchant (traffic flow).

Small mid cap O&M to remain in favour. We expect a continuation of robust exploration and production activities for the oil & gas sector.

Hence, stay invested in OSVs players like Ezion, Jaya, Nam Cheong and ASL Marine.

Recent stories:

TECHNICS OIL, NAM CHEONG: Positive developments

MIDAS, BIOSENSORS: What analysts now say

UNITED ENVIROTECH, CHINA MERCHANTS HLDGS: What analysts now say

CORDLIFE: Undervalued at PE of less than 10?