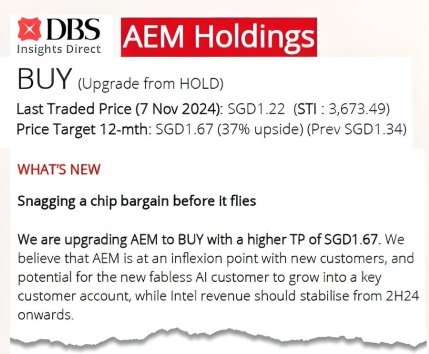

• It's a surprising move. Just 3 trading days before AEM Holdings reports its 3Q earnings, DBS Research issued what it called a "non-consensus upgrade" on the stock, catalysing a 7.4% rise to $1.31. • No one expects AEM's 3Q report card to be a glowing one given the weakness in key customer Intel Corp. That's why it's all the more interesting that DBS decided it was time to call a buy on the stock.  For background, AEM had been sinking through FY23 and this year. Setback after setback happened during those times. There was a US$20 million legal settlement with a competitor, there was a S$21.1 million inventory writedown, the CEO resigned, etc.  Amy Leong, who took on the CEO role in July 2024, will front the 3Q results briefing and Q&A with analysts/investors next Wed.All that in the midst of a sharp fall in profit owing largely to a downturn in the semiconductor cycle (which appears to be on the mend now, though). Amy Leong, who took on the CEO role in July 2024, will front the 3Q results briefing and Q&A with analysts/investors next Wed.All that in the midst of a sharp fall in profit owing largely to a downturn in the semiconductor cycle (which appears to be on the mend now, though). • But there were big positives too, which set the stage for a potentially great comeback by AEM. Primarily, this has to do with new customers. Reducing its dependency on Intel Corp, AEM has secured five new customers -- one in memory, two in xPU (processing units), and two in systems and hyperscalers. One of them potentially can become as big a customer as Intel is to AEM. • For why they are the story for 2025, read excerpts of the DBS report below ..... |

DBS analysts: Amanda TAN & Lee Keng LING

| AEM Holdings Ltd -- Non-consensus upgrade on turnaround Investment Thesis: Retains technological superiority in system-level test. AEM is a pioneer in providing SLT (system-level test) solutions and is around one generation ahead of its competitors. Given its technological superiority, we believe AEM is well positioned to ride on the growing SLT market that has benefitted from the increased complexity of chips and higher test coverage requirements, alongside the need for advanced heterogeneous packaging. |

New technology drives growth in test spend, leading to higher demand for AEM’s offerings in the long term. Notwithstanding near-term volatility, the semiconductor industry is well poised for growth, owing to the push towards digitalisation.

|

AEM |

|

|

Share price: |

Target: |

McKinsey projects that the semiconductor industry will become a trillion-dollar industry by 2030.

Industry megatrends such as artificial intelligence (AI), 5G, and Internet of Things (IoT) will pave the way for growth in test spend, from higher test volumes and test times.

Longer test times would also require more of AEM’s consumables due to wear and tear.

At the cusp of a multi-year rollout for new customers. In the past few years, AEM had announced several customer wins.

As at 1H24, AEM was still mainly in the lab verification tool phase but will see a shift into production in 2H24.

We believe that AEM is near an inflexion point and foresee its customer diversification strategy yielding more significant returns starting from end 4Q24 onwards.

Ling Lee Keng, analyst Our TP is based on 18x FY25F earnings, which is close to -0.5SD of the historical mean and c.50% discount to peers. Ling Lee Keng, analyst Our TP is based on 18x FY25F earnings, which is close to -0.5SD of the historical mean and c.50% discount to peers. AEM is currently trading at undemanding valuations of c.13.8x FY25F earnings. We reduce our FY25F earnings estimates by 24% due to more conservative estimates on new customer contributions, industrial weakness affecting CEI, and lower gross margin assumptions. Despite the earnings revision and consensus having a negative view on the stock, we take a contrarian stance, believing that most of the negatives should be in the rearview mirror and call for a BUY as we look ahead to FY25 and beyond where AEM is at the cusp of a multi-year rollout for new customers. |

Full report here.