|

AEM Holdings has teamed up with Intel Foundry to make its proven System-Level Test (SLT) and Burn-In services available not just for Intel’s own chips but for other chip designers as well.

A DBS Research analyst notes that while this partnership opens up new markets for AEM, real sales growth will depend on Intel Foundry turning customer interest into large, repeat orders. |

| What the Collaboration Entails |

AEM will provide:

- Configurable SLT and Burn-In test units that can handle devices drawing over 2,000 watts and packages up to 200 mm × 200 mm.

- Advanced handlers, test consumables, and the PiXL™ Active Thermal Control system to maintain precise temperatures during testing.

- Software and engineering support to integrate these tools with customers’ own test boards.

|

AEM |

|

|

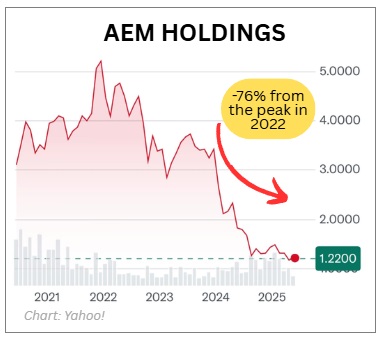

Share price: |

Target: |

Intel Foundry will bundle AEM’s equipment and services into its broader offering, which includes:

- Factory automation systems that move devices through test stages.

- Adaptive test data management to monitor results and optimize processes.

- Turnkey Burn-In Board solutions, test program development, board integration, and full product debug support.

Key Benefits for Chip Designers

- Faster Time-to-Market: Using a platform already proven in high-volume fabs cuts development delays and leverages expert support from both companies’ global engineering teams.

- Lower Capital Investment: Customers tap into an existing install base of thousands of test systems worldwide, avoiding the cost of building new test lines.

- Local Support in the U.S.: On-the-ground teams speed up deployment, handle standards-based qualifications, and carry out High Temperature Operating Life tests.

This partnership deepens a long-term AEM-Intel relationship and lets AEM address a wider market beyond Intel’s in-house needs. |

Why This Matters Now

- Growing Chip Complexity: AI, HPC, and chiplet-based designs push power and thermal requirements to new heights, making robust Burn-In and SLT essential to catch defects before products ship.

- Reliability Demands: Post-assembly testing under real-world stress—ensured by precise thermal control—reduces field failures and warranty costs.

- Cost Pressures: Outsourcing to a proven, scalable test ecosystem helps fabless companies avoid major upfront investments in test infrastructure.

As Intel Foundry rolls out these expanded services, its success in signing and retaining fabless clients will determine AEM’s revenue gains.

AEM’s global manufacturing footprint—in Singapore, Malaysia, Indonesia, Vietnam, Finland, South Korea, and the U.S.—positions it to support a growing number of customers worldwide. Management says these are multi-year, "sticky" projects with significant long-term revenue potential, and the full financial impact will build as production ramps. |

See also: AEM's Journey From R&D to Reality: Big Leaps in Chip Testing, As Told at 2024 AGM