Translated by Andrew Vanburen from a Chinese-language piece in Securities Times

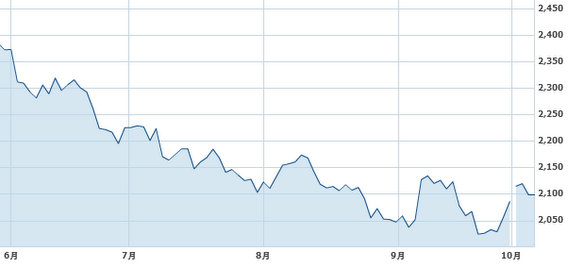

IN LATE SEPTEMBER, China’s benchmark Shanghai Composite Index – the chief tracker of A- and B-shares listed on the PRC’s two bourses in Shanghai and Shenzhen – was down over 20% from year-earlier levels.

But thanks to a less bearish month of October, that year-on-year comparison has shrunk to around 15%.

Nevertheless, 2012 has been a very depressing year for investors in Chinese equities, and everyone is grasping at anything in the wind which might point to a turnaround.

Now that the requisite third quarter reporting season has come to a close for A-shares, visibility on future trends is a bit more cloud-free.

Not only is better visibility on the horizon, but an uptick in volatility – not always a bad thing – has been evident of late.

This means that investor enthusiasm is picking up, and the potential exists for a buying spree if only a few positive signals were to suddenly appear.

And what have been the trends we can put our fingers on of late?

Banks and property developers along with other cyclical plays have been trending up, underpriced counters and beneficiaries of a stronger yuan like importers and oil firms have also been showing more muscle of late.

Meanwhile nearly all listcos on the country’s SME and ChiNext boards – the latter often called “China’s Nasdaq” – have seen nearly universal weakness of late.

In a comprehensive market report, Haitong Securities said most signs suggest the worst of the domestic economic slowdown – i.e. slower than customary growth – is nearing an end, and closer to more expected double-digit GDP expansion figures are likely on the docket for next year and beyond.

If the Shanghai Composite is to serve as a barometer of the nation’s economy, the past half-year period has seen nearly continuous declines in share prices which helped reinforce negativity in the market and the idea that the economy was softening.

With the overall economy in apparent decline and the outside world doing far worse, there wasn’t much appetite for share investing and the general climate has been one of high risk aversion.

And getting back to the afore-mentioned third quarter earnings statements...

The general consensus is that things turned out slightly better than expected on the P&L front, and that prospects may finally be turning a corner on the earnings front, and hopefully by extension... the share price front.

And Haitong says that the stronger-than-expected bottom lines for the July-September period may just be the first upward step in a sustained ascent for A-shares.

The all-important PMI – the chief litmus test of manufacturing health in China – saw its second straight monthly rise in October.

New factory order growth and raw material demand also returned to positive territory, suggesting that overall economic activity was on the upswing.

This will be critical to helping clear out inventory buildups and making room for new demand.

And when these things all happen in unison, A-shares engaged in everything from far upstream mining activities down to the furthest downstream counters involved in retail sales all stand to benefit.

See also:

CASH IS KING: Top Cash Per Share China Plays

PARTY TIME: Top Five PRC Earners

POINTING FINGERS: ‘Immature’ Investors At Fault In China?

ONE MAN’S TRASH... Time To Look At ‘Garbage’ A-Shares?