• Singapore’s stock market is set for a strong second half of 2025, says Maybank Kim Eng in a new report, raising its end-2025 target for the STI to 4185 from 4020. |

Excerpts from Maybank Kim Eng report

Analysts: Thilan Wickramasinghe & Toh Xuan Hao

Singapore Market

Solid footing

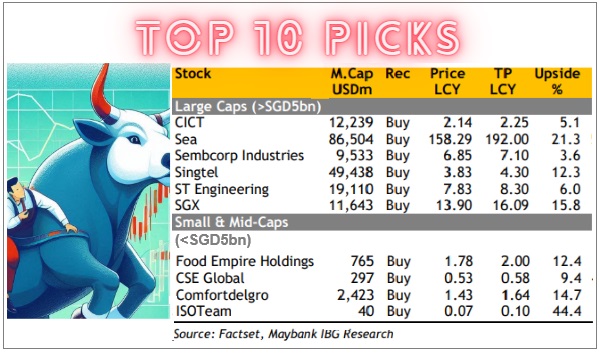

| Potential EPS upgrades, policy reform to drive 2H25 Amidst US tariff and policy uncertainty, we expect capital rotations to accelerate. Singapore stands to benefit given strong policy certainty, and a government with a clear mandate to cushion extreme outcomes. Policy reforms could give the market renewed momentum. This could be catalysed by five themes: domestic resilience, positive spill-over from China’s recovery, accelerating corporate capital returns, opportunities from JS-SEZ and AI-led efficiencies. We raise 2025E STI target to 4185. Top picks: CICT, CD, CSE, Food Empire, ISOTeam, Sea, SGX, SCI, ST, STEng.  Food Empire is benefiting from a 30% strengthening of the Russian ruble vs the USD. Russia is a key market for Food Empire while Southeast Asia is catching up fast. Additionally, falling prices of coffee beans, a key raw material, is no less a help for Food Empire's 3-in-1 coffee products. Food Empire is benefiting from a 30% strengthening of the Russian ruble vs the USD. Russia is a key market for Food Empire while Southeast Asia is catching up fast. Additionally, falling prices of coffee beans, a key raw material, is no less a help for Food Empire's 3-in-1 coffee products. |

Shortlisted fund managers under the MAS Equity Market Development Program (EQDP) are expected be announced by 3Q25.

While qualifying criteria are unknown, investment mandates with active management strategies in Singapore equities that focus more on non-index stocks are likely to be preferred.

Extrapolating from the adjustments to the GIP program, mandates that invest in S-REITs may rank lower in the selection criteria, in our view.

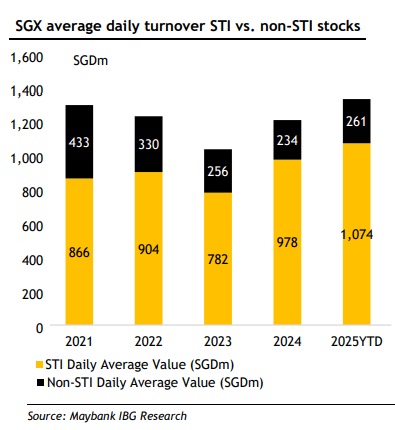

We believe deploying SGD5bn to non-index stocks can deliver a significant boost to market liquidity. Indeed, in 2025 YTD, 80% of SGX average daily value (ADV) originated from STI components. Indeed, in 2025 YTD, 80% of SGX average daily value (ADV) originated from STI components. The rest contributed just SGD261m of ADV. So the EQDP could potentially boost segment liquidity by 19x when fully deployed. If matching is required, where qualified fund managers have to proportionately deploy their own capital, there could be a significant multiplier effect, in our view. |

Top Sectors: Theme winners We believe given clear near-and-medium term catalysts, the STI should trade higher.  Thilan Wickramasinghe, analystWe raise our end-2025E target to 4185 from 4020. Thilan Wickramasinghe, analystWe raise our end-2025E target to 4185 from 4020.Our 50:50 weighting of bottom-up fundamentals and target PE/PB methodology is unchanged. However, we raise target PE/PB to +1SD from mean vs. mean valuation earlier. We prefer sectors geared towards the 5-key themes: POSITIVE on Industrials, Internet, Gaming, Property Developers & REITs, SMIDs, Telecom, Transport, NEUTRAL on Banks, Healthcare, Plantations, and NEGATIVE on Tech Manufacturing. |

Full report here

See also: ISOTeam’s Comeback: Smarter, Greener, and Ready for More