Translated by Andrew Vanburen from a Chinese-language piece in Securities Daily

IF CASH IS KING, who's sitting on the throne in China?

Cash flow per share is often seen as a reliable barometer of a listed firm’s financial health.

Here are the tops in China, with a Shenzhen-listed fertilizer firm taking top honors.

No bull!

We are at a crossroads.

Unlike Hong Kong-listed enterprises, A-share listcos in Mainland China must report their earnings every three months, as per regulations from the capital markets watchdog – the China Securities Regulatory Commission (CSRC).

The reporting deadline has come and gone.

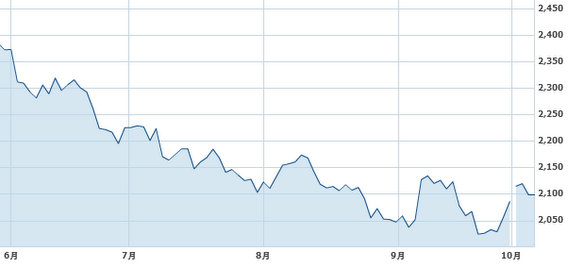

Of the 2,471 A-share firms reporting earnings for the July-September period, total net profit stood at 1.5 trillion yuan and cash on hand stood at 3.34 trillion.

After all it is not just the most impressive margins, or aggressive bottom line growth or even share price acceleration that should attract the most savvy of investors.

But by some measures, the cash flow status of listed enterprises is often the bellwether of the most wholesome listcos in Shanghai and Shenzhen

That is because this barometer of vitality represents not only the measure of financial discipline among management, but also the ability of the listco in question to exercise both prudency and frugality.

Stanley Fertilizer Co Ltd (SZA: 002588) is a bullish stock, at least on the cash management side of things.

Its average operating cash flow per share stands at a staggering 6.74 yuan, a figure in the troposphere in China given the local propensity to hoard, spend or expand at the drop of a hat.

This represents a net income per share of 1.46 yuan, a near 19% year-on-year jump, which tops the A-share body of listcos.

Net asset value per share stood at 13.4 yuan, not bad relative to its share price in this extended Chinese bear market.

The chemical fertilizer’s play expects a bottom line increase of between 10-20%, to hit between 270-295 million yuan.

Next on the bulging wallet list is Bank of Ningbo (SZA: 002142).

Its operating cash flow per share is currently at 5.74 yuan.

Considering the volatile interest rate and reserve requirement ratio (RRR) fluctuation this past year emanating out of Beijing, for a large-scale commercial lender like Bank of Ningbo to maintain such a healthy balance sheet is a testament to its tenacity.

The benefit to winners in this category is that they are in a more formidable position to offer even more generous dividend payouts to their respective shareholders.

Barring that strategy of loyalty-building, they may opt to reinvest all that cash on hand into capacity expansion or technical upgrades.

Regardless, companies in this position are only to be envied for the range of options they have at their avail with all that cash.

See also:

PARTY TIME: Top Five PRC Earners

POINTING FINGERS: ‘Immature’ Investors At Fault In China?

ONE MAN’S TRASH... Time To Look At ‘Garbage’ A-Shares?

CHINA CONSENSUS: Things Are Looking Up