Kingston: UNI-PRESIDENT’S Rapid PRC Expansion

Kingston Securities said Uni-President China (HK: 220) is benefiting greatly from rapid expansion of sales of instant noodles across the PRC.

The Group’s quarterly profit surged 290% year-on-year to 39.9 million usd.

“Uni-President further developed products with higher GPM. Last year, the Group completed its dealers or distributors network in the southern and northern Chinese markets from tier-1 cities to prefectural-level cities, counties and rural towns for instant noodles,” Kingston said.

The instant noodles segment swung to a net profit of 165 million yuan compared to a loss in the previous year.

“The business accounted for 35.1% of total revenue and its market share grew from 9.5% to 13.5%. Contrarily, the beverage market share remained at 19.6%.”

Kingston’s buy-in price for Uni-President is 7.1 hkd, the target price is 7.85, and the stop-loss price is 6.9.

The Group not only sped up construction of its production base and increased investments, but also added promotional and marketing campaigns, causing its selling and marketing expenses to rise 30.4% to 4.29 billion yuan in 2011.

Meanwhile, administrative expenses increased 69.1% to 548 million yuan.

Last month, the Group entered into a revolving facility agreement for 170 million usd and one billion yuan with a syndicate of banks, and another 30 million usd in mid-August, to finance its general working capital.

“Overall GPM declined due to rising raw materials prices. Yet, the inflationary pressure was obviously reduced this year, and may benefit the Group.

“Moreover, the Group’s overall financial position remains sound with a reasonable gearing ratio and net cash position,” Kingston added.

See also:

Juice Wars: PRESIDENT Squeezing HUIYUAN'S Hold Over China

Kingston: YURUN FOOD’S ‘Chilly’ Half

Kingston Securities said it is monitoring chilled and frozen meat giant Yurun Food (HK: 1068) after the Hong Kong-listed firm reported a 93.3% decline in net profit for the first half to 107 million hkd.

Basic EPS dropped 93.3% to 0.059 hkd for the six-month period.

The Group recorded a turnover of 12.53 billion hkd, representing a decrease of 23.9%.

Overall GPM decreased by 10.5 percentage points to 2.1% from 12.6% in the same period last year.

The processed meat products reported a loss of 31 million hkd, while segment profit from chilled and frozen meat decreased 81.6% to 250 million hkd.

See also:

Food Firms WANT WANT, YURUN, TINGYI: Buy Or Sell Them?

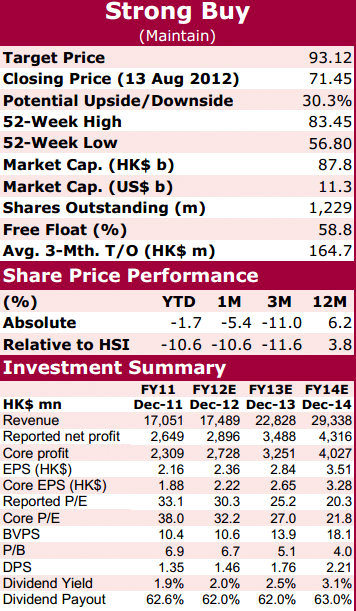

Capital: Keeping ‘Strong Buy’ On Hengan

Capital Securities said it is maintaining its “Strong Buy” recommendation on Hengan International (HK: 1044) thanks in part to the firm’s strong snack food performance.

“Hengan has become the largest sanitary napkins manufacturer, the second largest disposable baby diapers manufacturer, the main adult diaper manufacturer, personal hygiene products manufacturer and household paper manufacturer.

“But its food and snacks sector revenue has done very well, with first half revenue up 28.3% y-o-y to 1.54 billion hkd and gross profit up 14.8% to 500 million hkd.”

Capital said the slight decline in gross profit margin for the food and snacks sector was due to the prices of major raw materials such as sugar, seasoning and flour “increasing significantly.”

Priced at 71.45 hkd, Hengan trades at Capital’s FY12E and FY13E core P/E 32.2x and 27.0x.

“Based upon our Discounted 3-Stage FCFE H Model with CAPM 7.5%, gs 14.7%, gl 4.0% and H factor of 4.0 , we revise down our 12-month target price from 96.02 hkd to 93.12.

"That being said, at the same time we maintain our ‘Strong Buy’ recommendation on Hengan International.”

The target price will result in FY12E core P/E of 41.9x.

“Of course, raw materials costs and intensifying competition are our prime concerns.

"The well-established brand name, scale of production, distribution channel, increasing living standards and hygienic level of Chinese are also of paramount importance.”

Capital added it likes Hengan’s “strong” balance sheet, especially its net cash position.

“That said, we dislike the lack of transparency about the details of the revenue breakdown.

"Its strong market leader position and distribution network make it a defensive player in the bear market.”

See also:

HK-LISTED CONSUMER PLAYS: Inflation Busters Vs Inflation Crashers