Excerpts from latest analyst reports...

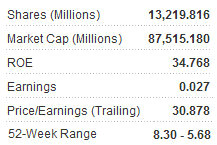

NOMURA: ‘Neutral’ call on WANT WANT reiterated

Nomura Equity Research said it is reiterating its ‘neutral’ call on Taiwanese snack maker Want Want China Holdings Ltd (HK: 151) due to concerns over pricing power, cost pressure, sales distribution channels and new growth drivers.

“We expect gross margin to improve h-o-h in 2HFY11F, given that the company’s product price hike will mainly be reflected in 2H. However, there is a lack of catalysts in the short term, and its current valuation at a 27.5x FY11F P/E looks unattractive,” Nomura said.

By business segment, management reiterated its guidance of 25% y-o-y top-line growth for dried products (rice crackers and snack foods) and 30% y-o-y top-line growth for dairy and beverages for FY11F.

“Management indicated that sales growth was on track in 3Q. In terms of input costs, management had not seen a significant drop in raw material costs lately, and it expects raw material costs to remain high in 2H11F.”

Nomura added that Want Want’s management will continue to improve its product mix and new product launches to maintain its margins. New products account for 2-5% of its top-line growth p.a., according to management.

Modern retailers and traditional distributors account for 10-15% and 85-90% of Want Want’s total sales, respectively.

Some 35-40ppt of the 85-90% distribution sales are generated from tier-3 and smaller cities, while the remaining sales are generated from urban areas (tier-1 and tier-2 cities).

Nomura added that sales through modern retailers are on credit terms, while sales through distributors are on cash-on-delivery basis.

“The company has an exclusive distributor in each of the rural markets to handle all of Want Want’s products and there are 3-5 distributors in each of the urban areas to distribute one segment of Want Want’s products.”

See also: MCDONALD’S & STARBUCKS: Why Stocks Are Near Multi-Year Highs

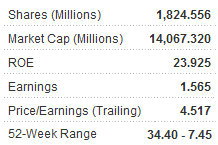

NOMURA: ‘Buy’ call on CHINA YURUN reiterated

Nomura Equity Research said it is reiterating its ‘buy’ call on meat product supplier China Yurun Food Group Ltd (HK: 1068) following a recent share price correction despite ongoing negative media headlines about food safety issues involving the company.

Investors’ key concerns focused on government subsidy, media accusations, the impact of media noise on the real business and management’s recent exercise of stock options.

“Most investors don’t fully understand the company lately and we believe that market sentiment becomes vulnerable to the continuous media noise around Yurun. This could explain the share price weakness in the past months but we don’t see structural change in the fundamentals,” Nomura said.

Even though its downstream sales were affected by the negative media headlines, the brokerage said it expects the impact will be only for the short term.

“Due to the negative media headlines about food safety issues involving Yurun, the company’s downstream sales declined to about 17% y-o-y in July, compared to a 17% y-o-y increase in 1HFY11.”

As the result of a tight supply of live hogs, Yurun’s slaughtering volume growth slowed to around 10% yoy in July, compared to a 25% y-o-y increase in 1HFY11.

”While management has yet to give an operational update for August, management expects that sales growth for August or even the whole 3Q will remain relatively weak compared to the first half given the short-term impact from its food safety issues and the tight supply of hogs.

“However, despite disappointing volume growth, we forecast a 25% y-o-y increase in normalized net profit (excluding government subsidy and negative goodwill) for 2HFY11F amid strong hog prices,” Nomura added.

As to the selling of shares by senior management, Yurun explained it was purely based on personal decisions and did not relate to the operation of the company. Yurun further clarified that it has been the modus operandi for these executives to sell their shares after their vesting period, as they comprise a significant amount of their compensation packages.

See also: BULL RUN: HK Shares To Rise 25% Over Next 12 Months, Says CLSA

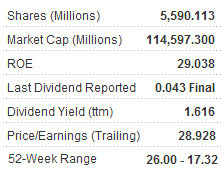

NOMURA: ‘Reduce’ call on TINGYI reiterated

Nomura Equity Research said it is reiterating its ‘reduce’ call on noodle and beverage firm Tingyi Cayman Islands Holding Corp (HK: 322) due to increasing cost pressures, pricing power and heightened market competition.

“We expect that gross margin will remain under pressure in 2H given high input costs and a lack of potential further price hikes. Moreover, according to management, adverse weather conditions have adversely affected the whole beverage sector in 3Q, which is basically a peak season,” Nomura said.

Nomura added that generally, the outlook for 2H does not look promising, and it has yet to see a sign that input costs could come off in the short term.

“There is a lack of earnings catalysts and it currently has a premium valuation.”

1H11 results came in lower than expected for a number of reasons.

“On the beverage side, poor weather conditions affected business volume, while increasing raw material prices affected the gross margin (down from 33.1% to 26.7%).

“On the instant noodles side, government intervention delaying price hikes and also increasing raw material prices reduced gross margin slightly (from 27.7% to 25.1%). Management does not expect any further price hikes in the near term for either instant noodles or beverages,” Nomura said.

For most of the inputs other than palm oil, management doesn’t foresee the likelihood of prices coming off in the short term.

“Management expects that gross margin for instant noodles will likely improve h-o-h due to its recent price hike (August) on bowl noodles, but remains negative on gross margin for beverages given a lack of a price hikes and increasing cost pressure and market competition.”

See also: HK-LISTED CONSUMER PLAYS: Inflation Busters Vs Inflation Crashers