Kingsway: CHOW SANG SANG 'Top Pick'; Cold Consumer Summer Ahead

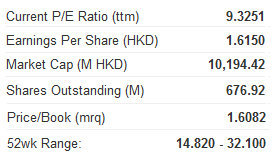

Kingsway Research said jeweler Chow Sang Sang (HK: 116) is its “Top Pick” in the industry, with its 21.9 hkd target price enjoying a head-turning 46% upside.

“Differentiation is the key.

"Despite a weak macro environment, Chow Sang Sang achieved over 20% YoY and 30% YoY sales growth in Hong Kong and China during 5M12, respectively, supported by 15% and 10% SSSG in Hong Kong/China and new store contribution."

Kingsway added that in June, Hong Kong/China SSSG maintained at mid-teens/single-digit levels.

"We continue to believe CSS’s differentiation strategy with larger stores and more international brand products are keys to achieve resilient SSSG amid industry slowdown.”

Chow Sang Sang is mainly engaged in the manufacture and retail of gold and gem-set jewellery products, retail of watches, wholesale of precious metals, securities and commodity broking, and gold bullion trading and property investment.

As at 31 December 2011, the Group had cash and cash equivalents of 631 million hkd (2010: 273 million), and total unutilized banking facilities of approximately 2.663 billion (2010: 1.689 billion).

Kingsway said it recently trimmed CSS’s earnings forecasts of 2012/13E by 7% and 10%, respectively, on lower SSSG and margins assumptions.

The research house now forecasts 13% and 28% earnings growth in 2012 and 2013.

“Why do we like the stock? CSS remains our industry top pick. We like its differentiated market position which attracts a slightly different customer group compared with Chow Tai Fook and Luk Fook, reducing impact from direct competition.

“We also expect CSS to achieve an above-average China store grow rate of 22% in 2012, which mitigates slowing sector SSSG.”

Kingsway’s target price is based on 12x 2012E PE.

Cold summer

As for consumer plays as a whole, Kingsway said things will get worse before they get better.

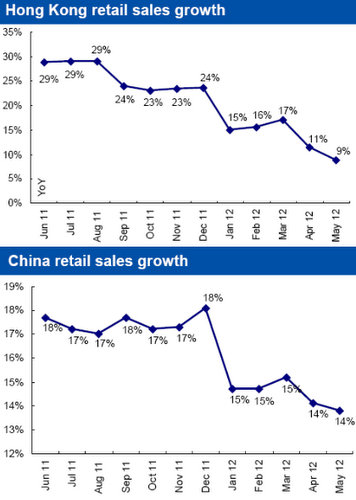

We are entering a cold summer. We expect SSSG to remain soft in 3Q12 due to a weak outlook on the global economy and a slowdown in the spending appetite of Chinese consumers.

“Investors have previously expected a meaningful SSSG recovery in 2H12 but we now believe the chance is slim.”

The research house added that it sees a higher chance for SSSG to rebound in 4Q12 due to lower base, especially for jewelry retailers.

“We have trimmed the earnings forecasts by 6-20% for most stocks under our coverage. Now we expect most stocks to achieve 10-17% earnings growth in 2012 with a selected few experiencing earnings decline.”

Undemanding valuation

On a positive note, sector valuation has become undemanding which presents medium-term value in our view, Kingsway said.

Many consumer names are now trading at single-digit to low-teens forward PE and 30-50% discount against historical average.

Our likes and dislikes

“We currently have 'BUY' on Chow Sang Sang, Luk Fook, Trinity, YGM, and Kosmopolito Hotels. We dislike Baofeng Modern, Chow Tai Fook, Lilang, and Moiselle.

Investors and companies’ management have been expecting a SSSG recovery in 2H12 over the past few months.

However, as recent consumption growth suggests that the situation has become weaker than expected, investors are increasingly cautious of a weak 2H12 with only moderate SSSG recovery.

“We hold a slightly positive view that the slowdown in SSSG has stabilized but will likely stay weak in 3Q12. We believe a potential SSSG recovery is likely in 4Q12, driven by a lower comparison base,” Kingsway said.

Looking ahead, the research house said it expects 3Q12 SSSG to remain soft due to the following.

“Recent economic figures such as China PMI, loan growth, etc suggests economic growth may remain soft in the coming months, although it seems to be bottoming out.

See also:

Five China Sectors About To Get Hot

BUCKING TREND: China Shares Ready For Rebound?

CLSA: Valuation premium of staples over discretionary reaches 3-year high

CLSA said that the share price premium of Hong Hong-listed consumer staples like rice, meat and cooking oil over the discretionary consumables sector has increased to 49%, a new high since March 2009.

“The market’s earning expectations on discretionary names have been well managed down but some negatives in staples names have not been well priced in. We expect good entry point for quality discretionary names post interim results,” CLSA said.

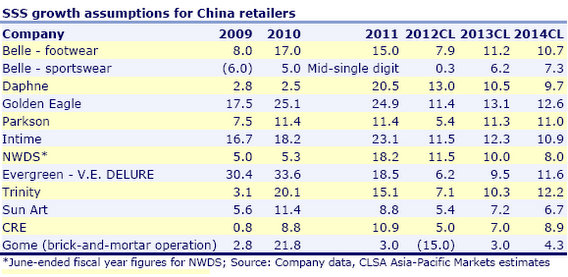

Belle and Golden Eagle are the research house’s top picks in consumer discretionary space while Want Want and Vinda are our preferred staple plays.

Photo: Li Ning

“We expect top-line slowdown and EBIT margin erosion for almost all of our covered discretionary names in 2012. But we expect profit growth outlook in 2H12 to be better than 1H12 for most discretionary companies.”

CLSA added that it expects Li Ning, Dongxiang and Gome (most of which have issued profit warnings) to have the biggest interim results disappointments.

“We expect Belle to report one of the highest 1H12 profit growth in discretionary space but anticipate Parkson to report mid-single digit 1H12 net profit decline.

“In the staple space, we believe disappointments in volume growth (due to consumer trade-downs and demand elasticity) and SG&As (due to competition) will offset some positives from the margin expansion.”

It expects a positive interim earnings surprise at Want Want (25%+ 1H12 profit growth) but EBIT margin disappointment at Sun Art (trading at 24x 13 PE) in 1H12.

“Despite the sales and earning slowdown in 2012, we continue to be positive on the long-term outlook of China consumption. We have downgraded Hengan and Trinity from BUY to O-PF and cut Li Ning, Lilang and NWDS from U-PF to SELL.”

CLSA has also upgraded Anta from O-PF to BUY, due to a “cheap valuation.”

“In our view, the underperformance of China consumer discretionary sector (down 25%) vs staples (down only 7%) in 2Q12 has mostly reflected investors’ lowered 1H12 and FY12 earning expectations for discretionary names.

“Despite accelerated new openings in 2011 and 2012, we expect top-line growth of most discretionary names to decelerate in 2012 vs 2011.”

See also:

RED FLAGS: Over 100 HK Listcos Warn Of Poor Results

EXPERT OPINION: Bulk Of PRC Brokerages Bullish On 2H