Translated by Andrew Vanburen from a Chinese-language piece by Citic Securities’ Yun Qingquan in Shanghai Securities Journal

Despite stagnation in Europe and the US, all signs point to a comeback for China shares.

Why all the enthusiasm?

First of all, not much on the domestic economic front is going to take the reins and pull the market forward, especially after second quarter GDP growth came in at a three-year low.

It is somewhat encouraging the China's Premier seems to have a realistic outlook, saying that tougher times might be expected and Beijing will make further adjustments when and where necessary.

As for things elsewhere, there is also little to suggest that the debt issues in the EU are any nearer to being fully resolved.

Nor is there much hope for more stable growth in the world’s biggest economy, with even less rosy prospects for anything approaching a bi-partisan cooperation to tackle major issues in the US, especially during a major election year as this.

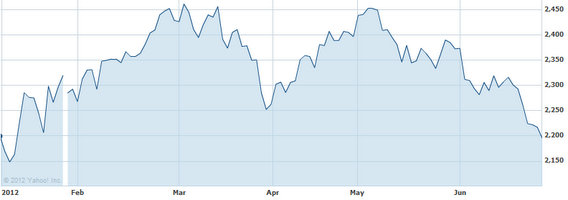

Given the instability in these two major regions, it is no wonder that equity markets in the EU and US showed such volatility of late, and investors are not overly sanguine on prospects of any greater performance or even visibility going forward.

That being said, there is a growing body of ample evidence pointing toward a rebound in China’s stock markets, with the upturn likely to appear sooner rather than later.

Although shares fell nearly 2% in Shanghai last week, A-shares in Shenzhen rose over 1%, which adds a bit of optimism to followers of the benchmark Shanghai Composite Index, which tracks A- and B-shares on both bourses.

But looking at Shanghai and Shenzhen, both have more or less come into harmony and have been showing resistance at certain base levels, and this should be a sign that better times are approaching.

From a quantitative analysis viewpoint, trading turnover measured on a daily or weekly basis has been down in a comparative sense, and last week’s five-day volume of 642.3 billion yuan trading hands was well below the 12-month average.

But looking at things from a different angle, total trading turnover volume over the past three weeks as well as daily figures over the past two weeks have both been showing signs of improvement.

This not only demonstrates a growing interest in the equity markets, but that there is a fair deal of accumulation taking place.

Also, the increasingly healthy trading volume coupled with the relatively restrained volatility of the benchmark index of late suggest that all that new activity will need a release valve sooner rather than later, and experience suggests it will trend to the upside.

Such things tend to happen when benchmark indices linger in valleys over long stretches.

Ever since the 2008 global financial meltdown, economic planners in Mainland China have continued to speak more and more about “decoupling” – i.e. lessening a dangerous overreliance on exports and focusing more on the domestic market.

With the market and economic volatility in the EU and US, perhaps the word will also come into vogue in describing the increasingly independent behavior of China’s capital markets.

If the benchmark Shanghai Composite Index breaks through the 2,240 level this week, I think it can be seen as the start of a possible upward run.

See also:

TOUGH TALK: Dissecting China Market Fall, Fate

What’s Depressing P/Es In China?

DAMAGE CONTROL: Retail Investors Losing Confidence In PRC Mkt?

TOUGH SELL? China Bears May Be Packing Bags