Translated by Andrew Vanburen from a Chinese-language blog in Sinafinance by Victory Securities market watcher Gao Juan

THERE ARE PLENTY of drags on Hong Kong shares these days, not the least of which are recent lower-than-expected GDP and trade figures for the Special Administrative Region’s giant neighbor to the north – China.

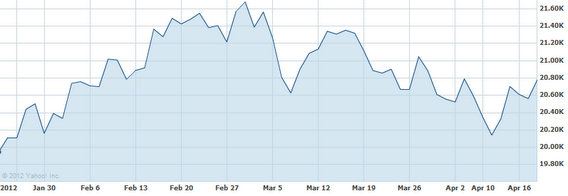

This is all taking its toll on Hong Kong shares in the form of volatility.

So investors should think and act like institutional investors during the current market instability, get defensive where necessary and don’t let emotions get the best of them.

In short, don’t forget the Golden Rule of maneuvering the market: Buy Low, Sell High.

After all, this is how the pros operate and succeed, all done while keeping a cool, analytical distance from the hype.

In short, now is more appropriate a time than ever to mimic the mindset and mentality of an institutional investor.

After all, they are typically investing someone else’s money... so it is relatively easy for them to be cool, calm and collective.

But in times of topsy-turvy turmoil, retail investors need to do so as well.

For not only are the level-headed among us less likely to lose our shirts in a fit of panic, but a more sober, even-keeled take on the market outlook before us is far more likely to bring forth opportunities than those driven by fear or emotion might overlook.

A bit about the overall prevailing climate...

On Wednesday, Hong Kong’s benchmark Hang Seng Index bounced up after gains on Wall Street overnight, and ended 1.06% higher on the day at 20,780.

Daily turnover once again was relatively robust, gaining on the previous trading day.

This was mainly due to Tuesday’s strong finish in New York, which in turn was cheered by the relatively healthy demand for Spanish bonds.

Adding to the upbeat mood was a new forecast from the IMF saying global economic growth would likely provide a slight surprise on the upside next year.

A-shares in Mainland China were also spurred on this week by the likely doubling of the trading band for the yuan currency.

And generally in-line results from the wave of listed firms in the PRC and Hong Kong flowing in now are helping to stabilize indices of late.

But there are so many delicate balances that could be upset with a burst of bad news from a variety of fronts.

That is why, at least as things stand now, I am bullish on brokerages.

There is a clear and present need for more risk management consulting services to help both professional and small-scale investors negotiate through the choppy waters that are likely to reappear.

And with the upward trend in daily turnover, trading commission income is becoming a major revenue driver for brokerages.

In particular, I like Citic Securities Co Ltd (HK: 6030) for the above-mentioned reasons.

I am also quite keen on Haitong Securities, which will be launching its IPO soon.

See also:

China IPOs Putting Pressure On Large Caps

NEW KID ON BLOCK: 21 A-Shares In Red; 4 In Hot Water

History Professor: 'PRC Headed For Hard Landing’

KINGS OF THE HILL: 12 Banks Produce Over Half Of All Listcos’ Profit