Excerpts from this morning's analyst reports....

UOK Kayhian says Nam Cheong is major beneficiary of RM300 b capex of Petronas

Last price: S$0.235

Target Price: S$0.30

Nam Cheong is the largest OSV shipyard in Malaysia, commanding a 50-75% domestic market share. Malaysia’s oil & gas sector is set to enter an upcycle, driven by government-owned Petronas which has a 5-year capex plan worth RM300b and we believe Nam Cheong will be a major beneficiary.

Nam Cheong also uses a proven build-to-stock business model, which allows it to stay ahead of the game.

Because of this, it is also able to price its vessels at a 10-20% premium over other similar

vessels.

Furthermore, Nam Cheong is set to benefit from its largest customer’s vessel expansion programme, which could be worth a billion ringgit over several years.

Nam Cheong is well poised to ride on the shift in demand to platform supply vessels (PSV) in Asia as it will complete 16 PSVs this year and next year. Maintain our BUY and target price of S$0.30, based on 9.7x 2013F PE.

Recent story: TERENCE WONG: My model portfolio is up 51% year to date

Maybank Kim Eng goes 'undercover' at Sheng Siong outlets and .....

Analyst: Alison FOK

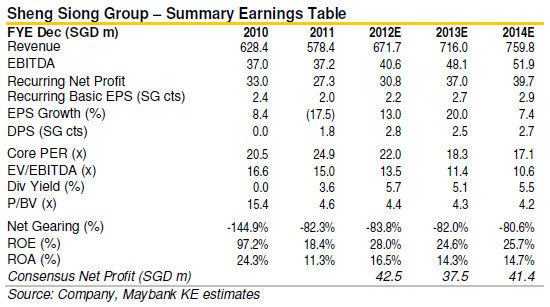

Going undercover. The recent Olam-Muddy Waters scandal has prompted us to go “undercover” and conduct site visits to selective Sheng Siong outlets.

As our earnings assumptions are based on sales per square foot of store space, we visited the three outlets that opened this year and checked out two previously non-performing stores to see if they are now up to scratch.

We also sought to verify the claim that “Sheng Siong’s prices are the street’s lowest”.

Our findings were highly encouraging and we believe that Sheng Siong is on track to meet our earnings expectations this year and achieve decent growth next year.

Low prices, high efficiency. Offering the lowest prices in Singapore’s supermarket hemisphere, Sheng Siong impresses us with its willingness to invest in technology to improve efficiency. The workers, too, were constantly restocking the shelves to ensure that they were filled.

We continue to like Sheng Siong for its high growth potential. We are pegging the counter to Dairy Farm International’s 12-month forward P/E of 27.0x with a 20% discount, and upgrading to SGD0.60. Maintain BUY.

Recent story: JES' strong debut in offshore, SHENG SIONG's show goes on