This article was recently published on www.nracapital.com and is reproduced with permission

AEM and SPIL enter into a Sales & Purchase agreement.......this is a very important development and increases my fair value by 30% for a start

I first added AEM to My Stock Picks on 12 April 2012 when it was confirmed that the company was taken off the watchlist.

I had originally set my fair value at S$0.12 which is close to its NAV of S$11.9 cents.

Since then we have had its Q1-2012 results and the company has also announced that its paying a maiden dividend since its returned to the black.

The dividend is 0.35 S cents with the ex-date on August 3, 2012.

The company recently made an important announcement involving one of its wholly owned subsidiaries Microcircuit Technology Singapore Pte Ltd (MCT).

The first announcement was on 28 June 2012 and the more important one was on 16 July 2012.

Based on this announcement alone and am for a start raising my price target by at least 30% (for the actual target and benefits (see My Stock Picks section).

In the announcement Siliconware Precision Industries Co Ltd - a Taiwanese company listed in Taiwan and Nasdaq with a market capitalisation of about US$3bn.

SPIL will be investing US$20.5mn for a 42.27% stake in MCT. This means that MCT is worth an implied value of US$48.49mn or about S$61.1mn.

AEM owns 57.7% of MCT - so AEM's investment has an implied value of S$35.25mn which is almost equal to the current market capitalisation of AEM of S$37.7mn.

This means that based on SPIL's valuation of MCT, AEM's implied NAV is likely to be much higher (depending on what the carrying value of MCT is now.

Why am I excited about this investment ?

Besides the increase in implied NAV of AEM, there are many implied benefits from this investment by SPIL into MCT which you can read in My Stock Picks section - the key is that MCT is the substrate arm of AEM which has been the main albatross of the group for many years especially after Kimoda (its major customer) went bust.

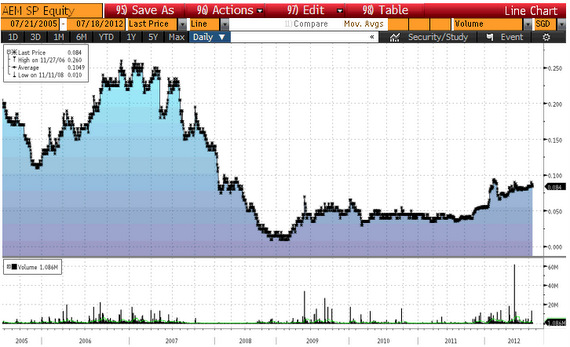

The chart of AEM above shows just what AEM shares were doing in its hey day when substrate was profitable and before its founder got into trouble with the CPIB.

The question is whether SPIL as an investor in MCT can help the business turnaround and return to the black......

Recent story: AEM on comeback trail, OXLEY sees insider buying

Good company seldom recommend, always recommend those stagnant counter.

Don know what is Mr Market doing

Why the TW company pays for subsidary MCT , when they can own parent AEM with US$20 millions as a majority

Anyway PCB biz is not sexy.

No signs of recovery.