This article by Kevin Scully (left), executive chairman of NRA Capital, was recently published on www.nracapital.com and is republished with permission.

This article by Kevin Scully (left), executive chairman of NRA Capital, was recently published on www.nracapital.com and is republished with permission.STOCK MARKETS around the world have been falling since October 7 or 8, 2014. The Dow has shed 3.9% to 16321 while the Hang Seng has fallen 1.3% and our own FSSTI has dropped 1.5%.

In a radio interview yesterday I was asked what I felt about the "SELL OFF" - I corrected the interviewer by saying its not a SELL OFF but a long overdue correction.

Don't forget that stock markets have been in a BULL market since 2009 and a meaningful correction has been long overdue.

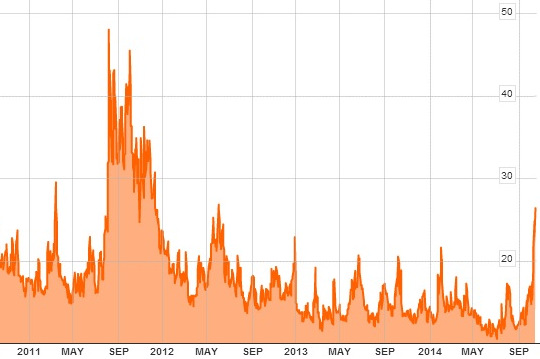

The VIX index which is a good indicator of uncertainty and volatility has risen and closed at 24.6 overnight.

In my latest talk at a Lim & Tan seminar about Defensive Strategies - I highlighted a number of risk factors and also told investors of a number of indicators to look out for that would trigger a correction. One of these was the VIX index and I said that once it crossed 20 - we should be alert and once it crossed 30 that would be quite negative.

VIX chart: Bloomberg.

VIX chart: Bloomberg.|

|

Recent story: @ NRA seminar: Kevin Scully, Song Seng Wun, China Aviation Oil, MTQ, Jason Marine, Kim Heng Offshore