Excerpts from a monthly investment outlook by Financial Alliance (FA) sent to its clients recently.

In November 2008, Financial Alliance (www.fa.com.sg) became the first and only Financial Adviser Firm in Singapore to achieve both the Singapore Quality Class and the People Developer status.

Key points:

• Our belief remains that the next few months will see equity markets hit a “soft” patch. They will be expected to remain volatile, although less than what we have experienced over the past 12 months. They will meander gradually to the south, sagging investors’ confidence along with them. We believe the second half will see more of a traditional challenge: slower global growth.

• Economic data would be increasingly negative, consumer sentiment would wane as the global slowdown hits employment and financial markets would slide lower as investors lose confidence and liquidate their investments. But this would be an excellent time to rebuild one’s equity position.

• We are advocating a dollar cost averaging strategy to re-enter markets over a 10-month period. Such a strategy will see investors take on risk in a gradual manner, i.e., an investor’s exposure to the equity market increases over time.

Q. What does the second half of 2012 hold for markets?

FA. . Our belief is that the next few months will see equity markets hit a “soft” patch. They will be expected to remain volatile, although less than what we have experienced over the past 12 months. They will meander gradually to the south, sagging investors’ confidence along with them.

This is because, while credit risks – and thus volatility – remain, we believe the second half will see more of a traditional challenge: slower global growth. Already we have the Fed lowering the growth outlook for the U.S. With Europe now facing the threat of a prolonged recession given the ongoing crisis, emerging markets, specially Asia, will not be able to avoid this slowdown. We believe that it will be this slowdown in global growth that will weigh on market sentiment and performance in the second half.

This will inevitably weigh on corporates’ bottom lines and stock prices. In our view, investors have not yet fully priced this in into their expectations.

Q. In spite of all this, you believe that this period will be the best time to re-enter markets?

FA. Yes, exactly. Economic data would be increasingly negative, consumer sentiment would wane as the global slowdown hits employment and financial markets would slide lower as investors lose confidence and liquidate their investments. But this would be an excellent time to rebuild one’s equity position.

A typical conversation with an investor today would go something like this:

“Do you think, if we look beyond the present storm and into the horizon to late 2013 or 2014, emerging economies will have resumed their growth path? As a result, equity market in these countries will be likely to move higher after being in a wide sideways

consolidation since 2008?”

“Yes, quite likely.”

“So shouldn’t we be buying now in anticipation of such a recovery?”

“Yes, but I am afraid markets may go lower after buying.”

“So when will you start to buy to position yourself for this?”

“When I am confident the market has bottomed.”

“And that will likely be when markets have moved up 30% to 50% from their lows, when you see good economic data and when everyone you know is going in?”

“Yes, I guess that would give me confidence to say we’ve seen the bottom.”

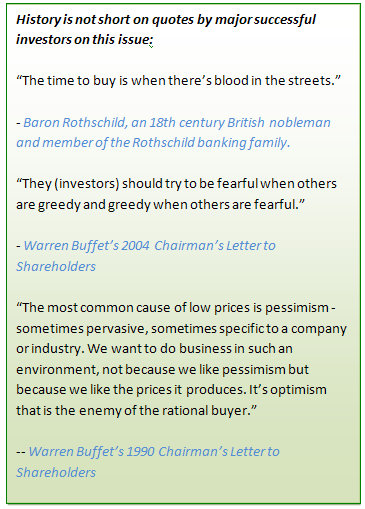

The above conversation, while fictitious, is probably a good reflection of how a typical investor behaves. Yet, time and time again, we are reminded that the best time to invest is also normally one of the worst times in terms of sentiment or even economically.

Take for example the bottom in the Dow in 1942, barely a year after Pearl Harbour and right in the middle of a World War. What about March 2009 when seemingly all hope was lost as the world came to the brink of a great depression? How many investors would have dared to venture into markets at those points, let alone anticipate the 80% to100% rebound in the 12 months that followed?

And which investor would have had the will to go on after being hit by the Asian crisis, the Russian crisis, the Dot Com meltdown, the 9/11 sell off, the Gulf war and SARS scare between 1997-2004 - only to realise that the subsequent 4 years would be among the best ever for global equities?

We are advocating a dollar cost averaging strategy to reenter markets over a 10-month period. Such a strategy will see investors take on risk in a gradual manner, i.e., an investor’s exposure to the equity market increases over time. Hopefully this strategy will help investors overcome their fear of re-entering the market under the present uncertain environment.

Q. How are you proposing investors re-enter the market?

FA. In essence, we have been on a defensive mode since August last year and have thus sat out the volatility that has swept equity markets. However, the FA Investment Committee believes it is now time to re-enter and re-build our equity positions. The Committee is proposing that clients move back into equities in the following manner:

1. for existing clients following one of our five risk-based portfolios, there will be a gradual switch back into equities over the next 10 months. These switches are likely to be done every 2 to 3 months and will also involve a switching of funds into regions/countries/sectors which we believe will do well when the next upswing in global growth occurs,

2. for new clients or existing clients with new inflows, we are introducing 4 Market Recovery Portfolios (MAP*) which involves a monthly investment over a 10-month period into regions/countries/sectors which we believe will do well when the next upswing in global growth occurs. These 4 portfolios will suit investors with moderately conservative, moderate, moderately aggressive and aggressive risk profiles;

3. for new and existing clients who are somewhat risk-averse to the volatile environment but would want some exposure to the equity market, we are introducing an Endowment-Unit Trust Structure (EUTS*). This should work for those seeking some form

of capital preservation.

Recent story: SANI HAMID: "Be prepared to re-enter markets -- by dollar cost averaging"