|

Excerpts from a monthly investment outlook by Financial Alliance (FA) sent to its clients recently. |

Q. Has Financial Alliance’s call to re-enter equity markets continued to work out well?

FA: Yes it has. Our call to re-enter equity markets in June 2012 via dollar cost averaging (DCA) was met with skepticism, especially as many investors were still reeling from the sharp decline in Q2.

Nevertheless, we went ahead as our conviction was – and continues to be – very strong that markets will pick up in the months ahead even in the face of a global economic slowdown.

The DCA strategy which we adopted helped clients to ease back into equities in a comfortable manner, although it also means that we were not fully invested at the bottom of the market in June 2012.

Nevertheless, it has proven to be the best strategy in helping to ease investors’ anxiety as many investors were at that point reluctant to re-enter equity markets at all.

Q. Has Financial Alliance’s view of what to invest in changed?

FA: No. Our present move to accumulate equities focuses very much on Emerging Markets, especially those of the BRIC group (Brazil, Russia, India and China).

Apparently,our bullish outlook on BRIC is shared by Goldman Sachs, who is telling clients that BRICs will make a comeback next year and look to be a prime investment opportunity. We also like resources, specifically gold, as developed countries continue to print money unabated.

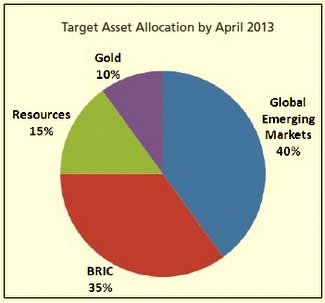

In this respect, our final allocation for our portfolios when the accumulation phase is done with should look something like the pie chart on the right.

We continue to concentrate our focus on these two asset classes (Emerging Markets and resources) as we believe markets will begin to price – in 2013/2014 – the next phase in growth, which we expect to occur later in 2014/2015. We see a future where developing markets will de-couple and outperform developed markets in the next phase of global growth.

While the world is presently mired in a period of below-trend growth, the view is that when the next up phase in global growth occurs, it will be led by developing countries. Developed countries (such as the U.S.and Europe) are expected to continue to be bogged down by structural issues. Many problems relating to the crises in 2008/09 and 2009/12 in both the U.S. and Europe respectively have been masked with the infusion of a massive dose of liquidity. It will take time to resolve these issues.

On the other hand, developing countries are expected to benefit from the influx of liquidity which presently flood the global system and will be looking for investment opportunities once global growth stabilises. Such an influx of liquidity is expected to help improve the credit quality of Emerging Market bonds, help boost equity markets and boost demand for resources, including gold.

Kishore Mahbubani, who is currently Professor in the Practice of Public Policy and Dean of the Lee Kuan Yew School of Public Policy at the National University of Singapore, summed it up nicely in a recent FT opinion piece (“The east will rise above the west” December 28, 2012) where he wrote: “Asia’s underlying trend – its resurgence – will continue in 2013. In 2012, about 500 million Asians enjoy middle class standards.

"By 2020, that number will grow to 1.75 billion. The demand for all kinds of products will grow. India had no cellphones in 1990. It had 752 million in 2010. Now they are switching to smartphones. In 2012, there are 17 million smartphones in India. In 2015, there will be 79 million.Tourism will flourish. New hotels are everywhere. Asian budget carriers grew 23 per cent in 2012 versus 8 per cent for traditional airlines, while analysts project that online bookings for budget airlines will grow 55 per cent from 2011 in 2013. Asians are on the move.”

Q. So what is the biggest risk to investors today?

FA: Ironically, the biggest risk today does not relate to the market risk but to fear: the fear that has grown out of having seen markets move sideways over the past few years and may yet suffer another meltdown; the fear that equities can no longer provide decent returns whereas other asset classes such as bonds or real estate can continue to provide better returns and even safety of their capital.Thus, in our view, the biggest risk for investors is that of missing out on what may be the biggest equity rally in years. The worst case for investors in addition to missing out on the equity rally would be to get hit by both bonds and real estate as liquidity flow from these two asset classes into equities.

Jim Paulsen, chief market strategist at Wells Capital Management, puts it nicely in a CNBC.com report when he said, “Next year (2013) is going to be more of a confidence driven run, not just climbing despite concerns but really climbing because of rising confidence”.

In fact, there may already be signs of this as December 2012 has seen investors preparing to change asset allocations. Flows into stock based mutual and exchange-traded funds have totaled about $8 billion, while bonds have taken in less than $1 billion, based on data provided by Lipper. And this comes in a year in which bonds have taken in about $250 billion and equities have lost more than $130 billion.

Quoted in the same report, Savita Subrmanian, equity and quantitative strategist at Bank of America Merrill Lynch, said in an analysis >>

Next secular bull market? That sounds like Stage 4 of our Market Recovery Model.

Recent story: SANI HAMID: 'Best time now to accumulate equities'