Some years ago, Veronica transferred a dozen stocks from her CDP (Central Depository) account to Phillip Securities to participate in its Securities Lending Programme.

It enables her shares to be loaned out to any third party for a fee.

The programme suits her to a T, as she holds a portfolio of stocks for the long term.

Veronica explains her investing style: "My decision to purchase a stock depends on its fundamentals. I buy stocks for their dividends and potential capital gains. My holding period usually exceeds six months and, in a few cases, several years," she says.

"I believe that to reap meaningful gains, I have to stay the course for a meaningful period of time and to invest in mid- and small-caps which have a growth story. I know they come with higher risks but this is compensated by the potential upside from their growth and by their relatively low valuations, as compared to blue chips."

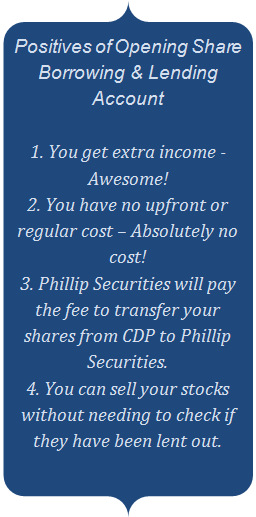

The share borrowing and lending (SBL) account she opened with Phillip Securities became an avenue to earn extra passive income from her stocks.

"Over the years, the fees I have earned from my SBL account have been more than satisfactory. So far I have enjoyed upside and faced no downside from taking part in securities lending."

At the moment, she has 4 counters which are on loan (see screenshot below) and giving returns of between 3 and 4 per cent per annum, which translates into about S$200 a month.

Phillip Securities adopts a flexible rate system, in which lending fees usually vary between 0.25 percent and 5 percent per annum. The rate is determined by the supply and demand of that particular security.

For example, if stock A is readily available in the lending market and the supply of stock A outstrips demand, the rate that is paid to the lender will be lower as compared to say stock B, whose demand outstrips that of its supply.

When a client's shares are loaned out, the client will be paid 50% of the lending fee which Phillip Securities collects from the borrower or no more than the rate that Phillip Securities can obtain in the auction market.

For example, if your shares are lent out at 8%, you get 4%. If Phillip Securities is able to obtain the same counter from an institutional lender at 2%, the retail lender will then get 2% instead of 4%.

Phillip Securities says: "Every loan is unique and, therefore, the interest rate can only be confirmed at the time of the loan."

The lending fee is computed daily, based on the closing price of the counter involved.

Bonus income from SBL

By no means can any lender hope to obtain regular income from lending his shares.

As Veronica says: "I consider it as a bonus income. You should not be surprised that share lending activity is neither regular nor predictable. The amount of lending fee I receive varies from month to month. Sometimes, I get nothing.

"The interesting thing is, on an annual basis, the income is not insignificant as it can amount to a four-figure sum. This is most welcome as it adds to the dividends I get from the stocks, so my total return is bumped up."

Veronica prefers to leave it in the account until a certain level, say, $5,000. Then she would go to her online account and request for a cheque to be issued to her, or for the money to be transferred to her bank account.

She says: "Sooner or later, the money goes to buying shares and the new shares end up in my SBL account, ready to be lent out. As you can see, it's a virtuous cycle!"

While her shares are on loan, she can still go ahead to sell a counter if she so wishes. It's not an issue at all.

"If a particular stock has reached my target price, or if I deem that its fundamentals are not as good as I originally thought, I will just sell it via Phillip Securities. I don’t even have to check my SBL account to see if it has been loaned out."

Neither does she have to be concerned about dividends and bonus issues when the stocks are on loan. She is entitled to these payouts.

Although securities lending involves a transfer of title, the beneficial ownership remains with the lender. The lender is still entitled to all economic benefits.

That includes voting rights at AGMs and EGMs -- but the lender must notify Phillip Securites in advance of his intention to attend a meeting. The stock broker would then do the necessary paperwork and send it to the company concerned.

CDP transfer fee to be borne by Phillip Securities

Phillip Securities says: "There is no additional cost at the moment as PhillipSBL is absorbing the CDP transfer charge of S$10.70 per counter, inclusive of GST, when clients transfer their shares to PhillipSBL for lending.

"However, this charge will not be absorbed if our lenders eventually decide to transfer their shares back to their CDP account. Lenders may choose to sell their shares through Phillip Securities to avoid incurring this CDP transfer cost."

A question that investors often ask is: What happens to shares that are loaned out?

Veronica reckons that the borrower is very likely planning to short the stock. "Sometimes, I get a little worried that the stock price would fall. However, as I believe in the stocks’ fundamentals, I soon become indifferent to it if I have no plans to divest the stock."

Phillip Securities says that some investors view that in the short-term, the lending of a security may create downward pressure on the share price due to short-selling activity. "However, what is sold must ultimately be bought back. As such, securities lending will not really aid in depressing share prices in the long run."

Beside shorting, shares may also be borrowed for hedging, arbitraging or market-making activities.

In fact, some studies have shown that securities lending adds liquidity and reduces the volatility of the security concerned through the process of price discovery and transparency; hence, creating an efficient market. Lastly, it also aids in the efficiency of trade settlement.

Are there risks to lenders?

Yes, counterparty risk.

However, it is mitigated as Phillip Securities is a reputable and strong financial institution.

Furthermore, to provide security to the lender, Phillip Securities collects collateral of at least 105% of the market value of the loan from borrowers, marked to market on a daily basis.

"And our borrowers are also obliged to return the shares either on demand or at the end of the loan term."

If you have any queries on SBL, or intend to open an account, send an email to

Lending Shares to Phillip SBL

1) Participants can lend any amount of shares, in standard lot size

2) Lending rates vary from 0.25% to 5% p.a., depending on the prevailing market rate of the counter involved.

3) Shares lent out to PSPL can only be sold using Phillip Securities’ platform.

Lending Shares to CDP

1) Participants have to lend at least 50,000 shares or S$50,000 in value

2) Current lending rate is at 4% p.a. for all counters.

3) Shares lent to CDP can be sold at any broking house which you hold an account with.

Borrowers of Phillip SBL include both institutions and retail. As such, the rates charged by Phillip SBL have to be in line with market rates to remain competitive. We seek our lenders’ understanding to give us the flexibility to determine the lending rates, so as to encourage demand for borrowing from Phillip SBL.

Currently, the borrowing rates for CDP are fixed at 6% p.a. for all counters.

http://www.sgx.com/wps/wcm/connect/sgx_en/home/depository/retail/about_cdp_services/Securities+Borrowing+and+Lending?presentationtemplate=design_new/PT_Print_Friendly

Calvin

http://www.investinpassiveincome.com