The following article is reproduced with permission of Financial Alliance from its February market outlook which was sent to its clients recently. In November 2008, Financial Alliance (www.fa.com.sg) became the first and only Financial Adviser Firm in Singapore to achieve both the Singapore Quality Class and the People Developer status.

Highlights:

• Equity markets have rallied strongly in the first few weeks of 2012, compelling many of those sitting on the sidelines to move back into the market for fear of missing out on gains.

• We believe this present rally is merely temporary. The rally thus far might be justified - e.g. we have averted the worst case scenario in Europe ― but gains beyond what we see currently will be hard to justify, in our view.

• We keep to our view that markets are poised to trend sideways in 2012 and this is the year to accumulate and rebuild our equity position gradually instead of rushing in and chasing the markets.

Q. Markets have been rallying since the start of the year. Can you explain what has caused this rally?

FA: After the sharp fall in equity markets in August last year, a lot of liquidity moved to the sidelines in view of the heightened risk adversity. Many were awaiting the right time to re-enter the markets They generally held the view that the latter half of 2012 would present such an opportunity.

However, as the markets turned higher in early January 2012, many of those sitting on the sidelines (for example, fund and asset managers) were compelled to move back into equities for fear of losing out on gains.

A key development propping up the markets was the European Central Bank’s (ECB) introduction of the LTRO program in mid-December. This program allowed banks to tap on its unlimited 3-year liquidity supply. This served as a key buffer for the Eurozone as it gave banks the breathing space they desperately needed at a time when the region was on the brink of a catastrophe.

Many investors saw this as similar to the Troubled Asset Relief Program (TARP) the United States government introduced in October 2008 to purchase assets and equity from financial institutions to strengthen the financial sector -- a scheme many credit for having sown the seeds of a recovery in the equity markets later on in March 2009.

This unlimited supply of liquidity provided by the ECB boosted market confidence. Effectively, banks could tap on funds at 1 per cent from the ECB to invest in higher yielding instruments, even in those shunned barely weeks earlier, such as Italian and Spanish issuances. This helps to “kill two birds with one stone”: Firstly, it brings down yields, especially for these distressed countries, to levels which are more palatable, and secondly, it shores up the balance sheets of banks as they make the spread between the cheap borrowing and the high yielding bonds they purchase.

This, coupled with some relatively better economic data coming out of the U.S., prompted money sitting by the sidelines to take on risk again, which led to the recent sharp rally in equity markets.

Q. Do you think this rally is just temporary or have we found a permanent bottom?

FA: We believe this present rally is merely temporary. While optimism is presently high and many are hopeful of a repeat of 2009 (see Chart 1, rectangles A & B) ― when markets bottomed after the post-Lehman crash and rallied strongly thereafter ― we do not see it as such. In our view, the overall environment is more akin to the post-1997 Asian crisis when markets took some time to regain their composure before any sustainable rally could be mounted (see Chart 1 above, rectangles C & D).

It is for this reason that we hesitate to call the lows seen in October a permanent bottom. As the case was between 2000 and 2003, markets meandered sideways. Not only did they fail to break higher, they slid lower instead.

We believe there is a possibility that markets may be heading for a repeat of such an environment. Just as equity markets faced a triple whammy in the form of the Asian, Russian and Dot Com crises back then, markets are now facing the U.S. sub-prime, European debt and Middle East crises. With this in mind, we believe that markets will have to consolidate a while more.

To be fair, we might have averted the worst case scenario in Europe (e.g., the breakup of the Euro, a credit market meltdown, systemic risk in the banking sector, etc), and because much of this was factored in late last year, markets have rebounded to un-wind such expectations. As such, the rally that has occurred might have been justified, but gains beyond what we see currently will be hard to justify, in our view.

Q. Has there been a change in your strategy?

FA: No. Our view remains the same ― markets are poised to trend sideways in 2012 and this is the year to accumulate and rebuild our equity position gradually instead of rushing in and chasing the markets.

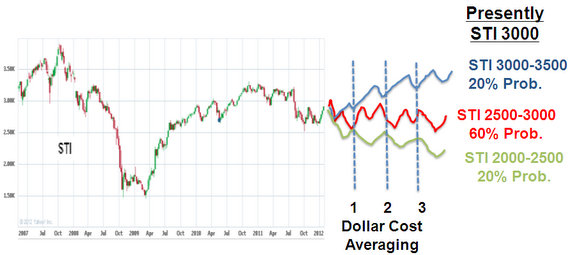

For the year as a whole, we continue to put the odds in favour of markets moving sideways. Taking the STI as an example, we see a 60% chance that the index will end the year between 2,500 and 3,000. Likewise, we see an equal but smaller chance (20%) that the index will either end higher or lower within the 3,000 to 3,500 range and the 2,000 to 2,500 range respectively (see chart 2 below).

The sharp rebound in the markets might have helped to mark out what looks to be the lower end of the consolidation range. Generally this refers to the lows seen in October, for example, on the S&P500 at 1,100 and STI at 2,520.

Presently, we believe markets are around the upper end of this range. In essence, we don’t see markets moving very much higher than the previous highs prior to the sharp fall in August 2011. For the S&P500, this is at 1,400 and STI at 3,200.

In our opinion, the best way to play this scenario is to adopt a dollar cost averaging strategy.

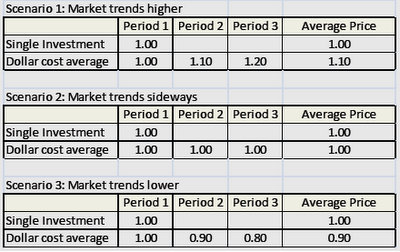

With this strategy, investors will not deviate too much in terms of their average entry level compared to someone who goes in with one lump sum at the beginning (see table on the right).

However, the dollar cost averaging strategy will help smooth out volatilities.

More importantly, it will accord investors the flexibility to delay or bring forth future installments should there be new and unexpected developments in the market. We feel this nimbleness is vital in the current environment in which many so-called landmines, such as a potential Iranian crisis, rising oil prices, the uncertainty over global economic growth, etc, exist.

Previous article: Should investors just forget about 2012?