After his recent articles on Keppel Land and InnoTek, Value Investor contributed the following to NextInsight this morning.

MARKETS ARE awash with liquidity as a result of interest rates being on the floor. Equity markets have also started 2012 on a tear since Europe unveiled its form of quantitative easing aka the LTRO (Long-Term Refinancing Operation).

It is no wonder that two of the previous names which we flagged as special dividend plays have rallied hard too.

Keppel Land traded at S$2.50 on 29 Jan when we raised the possibility of the counter being a special dividend play. It did not disappoint and doled out a hefty S$0.20 cent payout.

At close of S$3.47 last Friday, its return over the past 38 days has been approximately 39%, far outstripping the return of the local index.

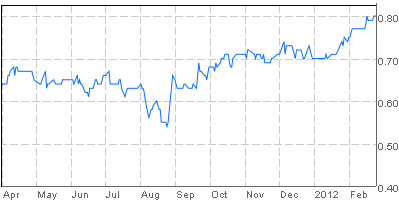

In the small cap space, we pointed out Innotek on 27 Jan. It traded at S$0.42 then. A month later, Innotek has piled on 19% to close at S$0.50 last Friday after management continued with a generous S$0.05 dividend payout. As they are still trading below their RNAV/NTA, there could still be further upside to both names.

Would we get third time lucky?

We all would if the management of GK Goh obliges when it announces its full-year results soon.

The investment company cashed in on its holdings in Bursa Malaysia-listed E&O in Sept last year by offloading its 9.6% stake for RM243.8 million to Sime Darby.

GK Goh Holdings expects to recognise a gain of $51.2 million from the sale. More cash was on the way when in September it entered into an agreement to sell its property (21 Tanjong Pagar) for S$32.9 million. The transaction was completed in December.

Hence, GK Goh is expected to be sitting on a net cash position of approximately S$0.50 per share.

In its third quarter result, GK Goh announced also an interim dividend of 2 cents a share (FY2010: nil) payable in November.

The last time GK Goh sat on a large cash pile was in 2005.

Then it sold its stockbroking business to CIMB for S$239 million. Management promptly dished out a special dividend of S$0.20 to reward shareholders that August.

With a cash cushion of S$0.50 per share and NTA of S$1.12 as at end-Sept, GK Goh is probably inexpensive at S$0.80 per share.

As GK Goh is now an investment holding company, management could well withhold the cash as it seeks new opportunities. Otherwise, should they feel good deals are scarce and decide to make a large payout when it announces its FY2011 results, the stock could rally and trade closer to its NTA.

Recent stories by Value Investor:

INNOTEK: Will its dividend payout be as generous as before?

KEPPEL LAND: Will it propose a special dividend today?

The Group owns approximately 31% of the associated company, Value Monetization Limited (“VML”), which is a private equity fund. On 29 February 2012, VML completed the sale of its 64% effective stake in Dormitory Investments Pte Ltd (“DIPL”) for S$30.3 million. DIPL’s major asset is an 8,600 bed workers’ dormitory in Tuas.

VML’s manager has since informed its investors that it has received payment for its DIPL stake, although the final consideration is subject to an audit of the completion accounts. Based on available information, it is estimated that the Group will recognise a profit of approximately S$7.5 million from VML in the first quarter of 2012 as a result of the sale. In addition, VML is expected to receive its share of DIPL’s retained profits by the second quarter of 2012 upon the audit of the completion accounts. The Group’s share is estimated to be approximately S$0.7 million.

Worthwhile to hold for longer ride.

NEXT INSIGHT - please feature more of VI's articles! Could you organise a seminar or meeting with VI to chat about ideas, strategy etc?