Source: CIMB-GK

CIMB-GK ISSUED a 13-page Singapore Strategy report yesterday, cautioning against further downside risks of stocks but also gave its selection of top 10 stock picks.

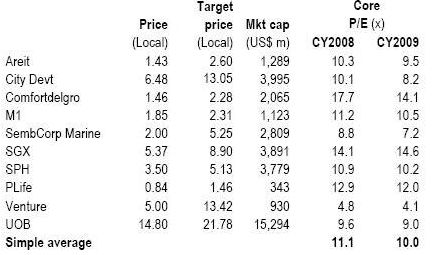

The 10 picks and the excerpts from the report are:

• Ascendas REIT. A-REIT is the only industrial REIT with a significant share of science park/business park space, the best-in-class of industrial space. A-REIT’s relatively long weighted average lease term to expiry (of 5.5 years) and average security deposits (of 10 months) for sale-and-lease back deals provide cash flow visibility. Its industrial tenant mix is also the most diversified among the industrial REITs.

Development projects are expected to boost DPU going forward with such projects offering higher yields than acquisitions. Current asset leverage of 40% is expected to reach 45% by 2010-11 as development projects are completed. Refinancing is manageable with short-term debt of S$255m (or 14% of total debt) rolled over in 2009. Write-downs of asset values are less likely than for offices, as industrial capital values have not appreciated as quickly as those in the office sector.

• City Developments. CityDev has a strong balance sheet with an estimated net debt to re-valued assets of 0.28x. Presale proceeds are expected to come through in the next 2-3 years, of more than S$4bn. Asset write-downs are less of a threat given that: 1) its investment properties are booked at cost; and 2) the bulk of its outstanding residential land bank was bought during the previous cycle or at the early stage of this cycle. In a downturn, CityDev has a good portfolio mix and can afford to cut prices and still book profits, if needed. Valuations are attractive at an estimated 38% discount to our conservative RNAV estimate of S$10.50. Although Keppel Land’s underperformance makes it increasingly tempting on valuation grounds, we have retained CityDev as our top pick given its more robust balance sheet.

• ComfortDelgro. We like its globally diversified transportation business, generating steady earnings in a recession. ComfortDelgro will also benefit from lower energy prices while in Singapore, ridership growth should boost revenue. Revenue is more defensive than for most businesses in a recession. With steady earnings, dividend yields have consistently been above 5%.

• M1. The worst from mobile number portability is over. Dividends have less downside now. M1 could conservatively save S$20m p.a. in FY10 from upgrade to its backhaul and avoid a potentially value-destroying content war next year. M1 is fairly protected from this storm as its revenue is primarily exposed to the postpaid sector where competitive intensity has worn off and it operates in a fairly defensive industry. We estimate that it could return close to 18 cts/share if it does not bid or lose in the OpCo bidding for a 9% yield on top of an annual recurring dividend yield of 8%. Re-rating catalysts could include capital management and stronger-than-expected earnings

• SembCorp Marine – Earnings growth till 2010 is supported by S$10 billion orderbook. Order cancellation is unlikely given strong standing of non-speculative customer base with low risk of credit crunch. Global charter rates for rigs and semi-submersibles are still holding strong given that current demand still outstrips supply. SembMarine is also supported by strong balance sheet with net cash per share of about S$0.40 or 20% of current share price. Valuation attractive at 10-year trough level of about 9-10x.

• SGX. Average weekly stock-market volumes have stayed above the S$1bn mark, even as markets crumble. There is some earnings risk if we enter a protracted period of low trading volumes. However, volatility could also help to support trading volumes. A growing derivatives business should partially take up the slack of lower securities turnover. The key risk is valuation compression. P/E and P/BV valuations look high but are justified by a high ROE business, with little financing needed. If valuation compression worsens, the saving grace is that SGX’s valuation also typically expands strongly when the cycle recovers.

• SPH. Lower adex (typical in a recession) and high newsprint costs could pile some pressure on operational earnings. However, bonus property development profits are coming through and capex needs are muted. This gives some assurance to its dividend outlook. With sustainable dividends yields and amonopoly business, P/E compression should not be that drastic.

• Parkway Life REIT. All assets have long leases of 8-15 years. Lease structures of preceding year's revenues, multiplied by CPI+1%, should limit downside risk for its Singapore properties even if hospital revenue fluctuates. Singapore contributes 80% to group revenue. PLife’s asset leverage is the lowest among REITS under our coverage, at 20%. Refinancing is also not an issue.

• UOB. CY08 P/BV of 1.25x is already in the trough range seen during 2001 and 2003. Our key concern now is potential capital strains when write-offs and provisions occur. Comparing Tier-1 CAR among banks alone is no longer foolproof. Loan book exposure and investment securities exposure are more crucial. But even as higher NPLs and loan loss provisions are inevitable when industry NPLs rise, we are confident that UOB will have the least write-downs, given its typical conservatism.

• Venture. One of the cheapest (P/E) big-cap stocks even if we input a core earnings decline, expected in this environment. Its underlying business is now more stable after the acquisition of GES and successful expansion of mid-sizedOEM customers. Venture has a strong balance sheet and good free cash flow. We expect it to rebuild its cash reserves in the coming years. The stock is usually ignored by most investors during times of uncertain global consumption, but valuations are attractive, at a historical low P/BV, with 9% of its share price backed by cash. Venture also offers dividend yields of more than 10%.

Big-caps

Some of the more interesting stock picks in the big-capcategory are SATS and SIAEC. Both have to fly against the headwinds of adeteriorating aviation industry, but with more than 20% of their current share prices backed by net cash, valuations will look increasingly attractive as share prices fall further.

China Sky

It is in the mid-cap space that we see amazing values emerging after last Friday’s sell-down. In the mass stampede, sellers of some S-chips have pushed share prices down to net cash values already. In ourmid-cap space (defined as S$200m-1bn in market cap), stocks that are trading below or near our FY08 net cash forecasts include: China Sky, Synear, CreativeTechnology, China Hongxing and China Zaino.

China Zaino

Wheelock is expected to recognise more than S$1.2bn of presales revenue over the next three years, with the bulk coming from Scotts Square (70% sold since launch last year). We estimate that it will book over S$1bn of presales revenue from this project alone over the next three years, even assuming zero new sales from here. Wheelock is, in addition, one of the rare developers with net cash and will be able to land-bank at the trough of the cycle again.

Small-caps

Some small-cap stocks also trading at net cash levels, but liquidity could be unacceptable. In the less than S$200m market-cap category, stocks that trade below net cash are China Sports and Sino Environment. Stocks that trade close to net cash are Valuetronics and Longcheer. We expect all to be profitable. Again, even if earnings contract, such marked-down valuations are suggesting distress valuations.Our only grouse with these stocks is that liquidity can be really low, which might not make them practical investments.

Concluding remarks:

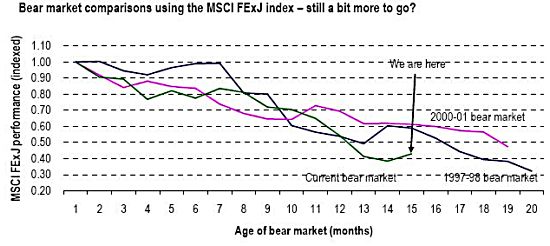

We believe that it is too early to call a final bottom for the STI, as banks and property earnings are at risk. We reiterate that a short-term bottom might emergesoon when the panic subsides. Beyond the current period of panic, we believe that a value approach historically works well and is likely to work again. In the current environment, we would downplay the emphasis on P/E, highlighting that it is extremely fallible. Balance-sheet analysis is recommended and we would consider stocks trading below their net cash levels as bargains, provided that profitability is somewhat assured.

We highlight S-chips trading near net cash levels as deserving some attention. We are typically not advocates of diversification but in this environment, little is predictable. With all manner of risk to consider and with a wide selection of stocks emerging with attractive valuations that can yield outsized returns in the years ahead, diversification will help limit any unforeseen business deterioration.