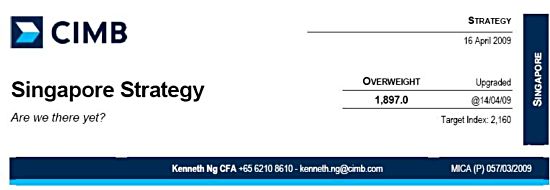

| Price S$ |

Target price S$ | Core PE CY08 |

Core PE CY09 |

3-year EPS CAGR (%) |

P/BV (X) CY08 |

ROE (%) CY08 |

Div yield (%) CY08 |

|

Celestial |

0.76 | 1.45 | 4.8 | 4.6 | 12.5 | 1.1 | 25.7 | 3.7 |

| China Zaino | 0.41 | 0.95 | 4.1 | 3.4 | 29.9 | 1.7 | 61.8 | 4.8 |

| FerroChina | 1.14 | 2.44 | 4.8 | 3.7 | 65.7 | 0.6 | 14.1 | 1.3 |

| China Sky | 0.77 | 2.62 | 3.8 | 2.5 | 21.7 | 0.9 | 26.2 | 5.3 |

| FibreChem | 0.60 | 1.54 | 4.8 | 3.4 | 13.4 | 1.0 | 23.7 | 4.2 |

| Sino Techfibre | 0.54 | 1.76 | 3.9 | 2.7 | 26.6 | 1.1 | 32.7 | 2.6 |

IN A report this morning, CIMB-GK highlighted its top S-chip picks with sustainable competitive advantages, the ability to pass on cost increases or fat enough margins to cushion rising costs, and low valuations.

The broker said its bias was towards the larger cap stocks.

Noting the slowdown in China’s export growth and the weak global economy, CIMB-GK analyst Ho Seng Choon wrote that companies focusing on domestic consumption are likely to outperform the exporters.

CIMB-GK said it continued to like:

* Celestial (Outperform, S$0.76, target S$1.45), a beneficiary of China’s rising income and robust domestic consumption growth, for its strong pricing power and potential catalysts from expansion;

China Zaino's backpack.

* FerroChina (S$1.14, Outperform, target S$2.44) for its robust cost-plus business, clear expansion plans and potential positive corporate developments;

* Fibre companies (China Sky, FibreChem, Sino Techfibre) for their low valuations and still-fat margins.

”We believe that the valuations of fibre companies have been held down partly by concerns over rising raw material costs as a result of spiralling oil prices. The recent decline in oil prices should alleviate some of those concerns and restore some confidence in the sector,” wrote Ho Seng Choon.

CIMB-GK Research is organising a seminar "Ride The Dragon - Opportunity amid Gloom". To register, click here.