STX OSV shares have been rising in the past month from $1.13 and touched $1.42 this morning, but DMG & Partners is neutral on it.

Noting increasing speculation that a stock sale by the majority shareholder would happen soon, DMG analyst Jason Saw is concerned about a potential revenue shortfall in 2012 amid tight financing conditions for vessels.

According to press reports:

(1) STX Group has hired two investment banks to manage the sale of a controlling stake in STX OSV Holdings.

(2) 18 firms have been invited to consider acquiring the controlling stake. STX OSV’s two largest shareholders are STX Group (shares held through STX Europe) with a 50.75% stake and Och-Ziff with a 20.0% stake.

(3) Sembcorp Marine (SMM) and Keppel Corp have been invited to consider making a bid.

STX OSV has a statement that its majority shareholder is exploring a potential sale but there is no certainty that the sale would take place.

Recent story: STX OSV is 'world class leader' and a steal, Hi-P is fully valued

KIM ENG RESEARCH has initiated coverage of ARA Asset Management with a target price of $1.65.

Analyst Anni Kum recommended a Buy based on a sum-of-the-parts (SOTP) valuation.

“At 13x FY12F PER, ARA appears relatively undervalued compared to its peer, Cohen and Steers, on 19x PER.”

Risks include a drop in market appetite for funds, a decline in asset values of its REITs, and any inability of its REITs to acquire new assets.

ARA Asset Management has a ‘winning formula’ whereby it earns growing fees from managing listed REITs and real estate private funds as assets under management (AUM) grow. The business is scalable, offers geographical diversification and growth opportunities.

Recent story: ARA's lofty goals in 2012 and beyond; CHINA 2012 forecast

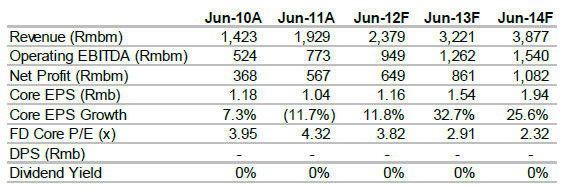

CIMB says China Minzhong is cheap at 3.2X forward PE against a 3-year earnings per share CAGR of 31%.

Analyst Kenneth Ng, CFA, said the house has changed its valuation of the stock, now pegging its target price to 6x P/E, the stock’s average in its short listing history, rather than the broad FTSE China Index.

Its closest competitor China Green’s 5-year average P/E is 11x.

CIMB expects continued strong earnings growth by China Minzhong, and a switch to a Big-4 auditor firm to catalyse the stock.

Recent story: CHINA MINZHONG growth intact, TECHNICS OIL unlocks shareholder value