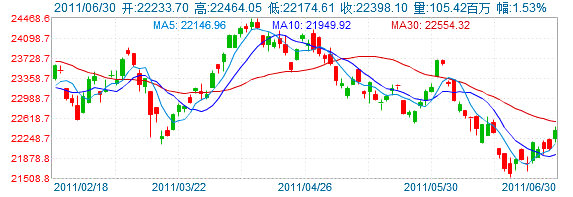

Hong Kong's benchmark Hang Seng Index took a beating in the first half of the year, falling 2.8% thanks to a series of credit tightening measures from Beijing as well as EU debt crises.

Meanwhile, the index added 1.0% in a short trading week to finish Thursday at 22,398.10, jumping 1.53% yesterday alone.

Analysts generally expect Hong Kong shares to see better times ahead as interest rate action in the PRC tapers off and the world works to help stabilize sovereign debt issues overseas.

In a Chinese language piece in Sinafinance, a market watcher with HSBC Securities was cited as saying: “Over the past two trading days, Hong Kong shares have tested 22,000 from both sides and this level should offer support. However, if more transparency and progress on clearing up EU arrears is made, there is sustained risk on the upside.”

Meanwhile, an analyst with Hong Kong-based Christfund Securities said: “There is a palpable sentiment in the market of a general calming down, with perceptively less pressure from outside. I think that the market will be generally taking cues from the PRC bourses over the short term, and a ‘hold’ approach should be the name of the game.”

Finally, an analyst with Sincere Finance was also confident that the benchmark index was due for a sustained climb.

“We have seen a very rough month, with the Hang Seng falling nearly 4.8% in June. However, with creeping optimism about upcoming interim results from major PRC plays, July should mark a return to a steady crawlback.”

Shares on Thursday were buoyed by the prospect of a three-day weekend, with investors looking to hunt for bargains prior to the break, leading to robust turnover on the day of some 74 bln hkd – 7% above the 20-day moving average.

Optimism in both Hong Kong and the PRC has been buoyed these past two weeks following comments from Mainland Chinese Premier Wen Jiabao that he was confident of the country’s ability to control inflation going forward.

Further boosting sentiment was the passing by Greek politicians of a much-anticipated five-year austerity program, which was a condition for the debt-plagued country’s economic bailout, mainly from more financially sound EU member states.

HSBC Holdings Plc (HK: 5) jumped 1.5% on the reassuring news from Europe, finishing Thursday at 77.05 hkd.

Fellow financial sector firms in the insurance business also finished the week stronger, with Ping An Insurance (Group) Co of China Ltd (HK: 2318) and China Life Insurance Co Ltd (HK: 2628) both adding over 2%, to close at 80.35 hkd and 26.60, respectively, following advances across the de facto border in the PRC’s A-share markets.

Real estate developers, another sector heavily dependent on the availability of affordable credit, also saw gains across the board after suffering a very bearish month of June.

Cheung Kong (Holdings) Ltd (HK: 1) ended Thursday up 3.8% at 113.80 hkd while local peer Sun Hung Kai Properties (HK: 16) closed 2.3% higher at 113.30.

Sinafinance said sentiment in the coming week in Hong Kong will be more upbeat as inflationary concerns ease and investors look anew at some of the several attractive valuations in the PRC, especially as they are on the cusp of a raft of first half earnings reports.

Investors will also be on the lookout for any signs of higher-than-expected PMI numbers – chief barometers of manufacturing vitality -- from either the PRC or the US, with figures from both countries due out soon.

See also: HK WEEKLY WRAP: Index Adds 2.2%, 1.9% Today On Premier’s Pledge