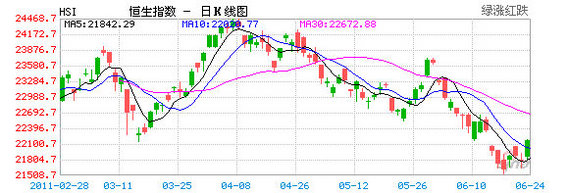

HONG KONG’S Hang Seng rose 2.2% on the week to close today up 1.9% at 22,171.95, the benchmark index’s first weekly rise in a month, with sentiment boosted by assurances from PRC Premier Wen Jiabao that inflation would firmly be kept under control this year.

Meanwhile, the Shanghai Composite Index, which tracks A and B shares in the PRC, had its biggest daily jump in over four months, adding 2.16% today and 3.9% on the week to 2,746.21.

Signs of Greece taking concrete steps to tackle its sovereign debt crisis -- a situation that threatened to drag the EU down with it -- also cheered Hong Kong and PRC markets, as the EU is Mainland China’s largest export market and home to billions of dollars in Chinese investment.

The Hang Seng’s Financial Sector Sub-index ended the week strong, rising 1.98% today, while the Property Sub-index did even better, adding 2.19% on Friday.

Sparking upbeat sentiment today were remarks that PRC Premier Wen Jiabao made to foreign media on the country’s relative success in controlling domestic price hikes.

“Price rises will be firmly under control this year,” he said, adding that the country will continue to produce strong economic growth.

"There is concern as to whether China can rein in inflation and sustain its rapid development. My answer is an emphatic yes," he was reported as saying.

The news comes at a time of growing concern over both a possible slowdown in the world’s second biggest economy and the nagging specter of rapidly rising inflation, which Beijing has used repeated credit control measures to help tame.

The premier’s confidence in economic activity at home and the suggestion that price control measures other than interest rate adjustments may also be employed going forward was welcome tidings for banks and property developers, who live and die by the availability of credit, said a Chinese language piece in Sinafinance.

Leading the charge today was China Resources Land Ltd (HK: 1109) which shot up 6.49% to close at 13.46 hkd.

China Overseas Land & Investment Ltd (HK: 688) added 4.65% to 16.64 hkd, New World Development Ltd (HK: 17) rose 2.42% to 11.86, Chinese Estates Holdings Ltd (HK: 12) added 1.97% to 49.15 while Sun Hung Kai Properties Ltd (HK: 16) was up 1.74% at 111.3.

Meanwhile, industry peer Cheung Kong Holdings Ltd (HK: 1) was up 1.65% at 110.8 hkd, Hang Lung Properties Ltd (HK: 101) rose 1.62% to 31.45, Hutchison Whampoa Ltd (HK: 13) added 1.59% to 83.1 and Swire Pacific Ltd (HK: 19) jumped 1.29% to 110.1.

Smaller daily gains were seen by Wharf Holdings Ltd (HK: 4, up 0.96% at 52.5 hkd) and Sino Land Co Ltd (HK: 83, up 0.66% at 12.24).

Lenders and insurers also celebrated the upbeat remarks from China’s premier.

HSBC Holdings (HK: 5) added 0.59% to 76.35 hkd, China Construction Bank Corp (HK: 939) jumped 3.51% to 6.49, ICBC (HK: 1398) was up 2.97% to close at 5.89, Bank of China Ltd (HK: 3988) rose 2.94% to 3.85 and Bank of Communications Co Ltd (HK: 3328) ended up 2.21% at 7.39.

Insurers had a strong finish to a robust week.

Ping An Insurance Group Co of China Ltd (HK: 2318) surged 4.29% to close at 78.95 hkd while peer China Life Insurance Co Ltd (HK: 2628) added 3.63% to 25.7.

“All eyes will be on economic numbers out of the US and whether or not any more quantitative easing measures are on the table. I see the Hang Seng having solid support at the 21,500 level over the short term,” Sinafinance cited an analyst with Li & Fung as saying.

The PRC will release June PMI figures on July 1, with the data seen as a barometer of overall manufacturing activity, and many investors are anxiously awaiting to see how the world’s No.2 economy will perform.

See also:

HK WEEKLY WRAP: Index Sheds 3.2%, 8.4% In June On Global Gloom

MAN WAH: Sofamaker’s FY11 Sales Surge 30% To 3.8 Bln HKD, US Mkt Afire