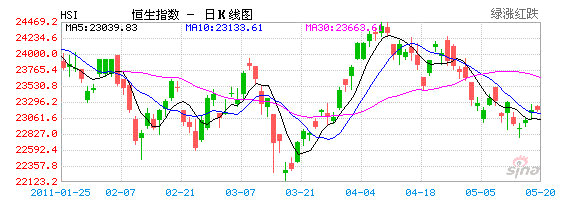

HONG KONG’S benchmark Hang Seng Index shed 0.3% this week but bounced back 0.2% today to finish at 23,199.39 led mainly by solid performance from banks, and analysts see few near-term upside drivers on the cusp of major IPOs.

Meanwhile, the Shanghai Composite Index which tracks A and B shares in the PRC edged down 0.04% today to close at 2,858.46 on a nearly four-month daily trading turnover nadir.

The Hang Seng’s Financial Institution Sub-index helped the benchmark Index finish in positive territory today, itself rising 0.22%, while the Industrial Sub-index did slightly better, adding 0.23% today.

Meanwhile, while usually rising or falling in tandem with banks and insurers, the Hang Seng’s Property Sector Sub-index edged down 0.21% on the day.

In a Chinese language piece in Sinafinance, analysts were cited as saying investors are likely to take a wait and see position in the coming days as the Hong Kong stock exchange prepares for major upcoming listings, including the trading debut of Swiss commodities giant Glencore on Wednesday.

Of the top 38 blue chips tracked by the Hang Seng, 20 rose today while 18 fell.

China Unicom (Hong Kong) Ltd (HK: 762), boosted by robust April mobile subscription growth figures, added 4.66% to 16.62 hkd, with the telecom firm recently outperforming domestic rival China Mobile Ltd (HK: 941).

However, local fashion retailing giant Esprit Holdings Ltd (HK: 330) fell 2.72% to 30.35 hkd on disappointing recent results.

Select energy stocks also enjoyed a technical bounceback.

Coal behemoth China Shenhua Energy Company Ltd (HK: 1088) finished up 1.53% at 36.6 hkd while PetroChina Co Ltd (HK: 857) added 0.19% to 10.66.

Property developers, one of the largest components in terms of capitalization of the Hang Seng Index, finished mixed.

Wharf (Holdings) Ltd (HK: 4) closed up 1.47% at 55.2 hkd, Cheung Kong (Holdings) Ltd (HK: 1) added 0.67% to 119.6, China Overseas Land & Investment Ltd (HK: 688) rose 0.13% to 16.04 and Henderson Land Development Co Ltd (HK: 12) edged up 0.10% to finish at 51.35.

However, Swire Pacific Ltd (HK: 19) dropped 0.77% to 116.8 hkd while local peer Hang Lung Properties Ltd (HK: 101) fell 2.13% to 32.15.

Investors clung to banks today amid general stability in the sector.

Bank of China Ltd (HK: 3988) added 0.47% to 4.27 hkd while China Construction Bank Corp (HK: 939) finished up 0.28% at 7.23.

“There aren’t too many upside drivers on the near-term horizon, but upcoming listings will help kick-start trading turnover,” Sinfinance cited one analyst as saying.

Another analyst agreed, saying the recent low turnover was symptomatic of a lack of both confidence and drivers.

“Looking ahead, I see 23,800 as offering near-term resistance,” the analyst added.

See also:

HK Weekly Wrap: Index Adds 0.5%, 0.9% Today Despite Tighter Credit

PRC HYPERMARKETS, TEXTILES: What Analysts Now Say...