Translated by Andrew Vanburen from

明白獎勵機制 大行報告不宜盡信 (中文翻譯,請看下面)

GARDEN VARIETY retail investors jump at flashy broker calls from respected brokerages, and take their tips as Gospel.

Buy, sell, hold, accumulate... no matter what the leading houses say, there is a steady stream of market players willing to take every broker call full-on hook, line and sinker.

Oftentimes, if the broker says to sell short, traders jump on board en-masse, with egos and emotion overriding basic laws of logic or supply and demand.

Or when several houses say upside valuation drivers are far and few between for a particular stock, sometimes all it takes is one house – no matter how well known or reputable – to raise its target price, and herd mentality takes over, because oftentimes we respond most aggressively to the newest, freshest information.

We rationalize away the significance of the four brokerages rating a stock “sell” and calling it overpriced in favor of a single house raising the target.

Why? Perhaps because we believe the odd-man-out call either has privileged information on the counter, or perhaps because the report was issued a day or two later, we feel the analysts have fresher information at their avail.

And if... big if... we act upon a particular call and make a small killing, we tend to prematurely canonize that house or that house’s analyst as speaking nothing but Gospel, and blindly jump onboard his or her bandwagon.

That is, until we are burned by the next ill-advised advice coming from said analyst.

In the investing business, it is far better to be a scrutinizing, cautious lone-wolf market player than a blind “disciple” of a particular house or houses.

It only takes one “miracle” to convince some investors that a particular analyst is their financial savior.

But I believe the successful investors are those who raise their eyebrows at the first miraculous act and put for the timeless tandem of queries:

“What else can you do?” and “What have you done for me lately?”

Not only must we take into consideration an analyst’s professional positioning (“buy side” or “sell side?”), but we also overlook at our peril the disclosures at the distant bottom of broker calls saying that such-and-such a house works on behalf of the very stocks that are being aggressively hawked.

For example, take what market guru Charlie T Munger – Warren Buffett’s right hand man – said about one of the best known US blue chips, FedEx.

He said that anyone can buy a few trucks and deliver packages to legible addresses. But having the wisdom to invest in the logistic manpower and equipment to ensure timely, seamless damage-free delivery of parcels around the world separates FedEx from the lesser fold.

In fact, Memphis, Tennessee-based FedEx has allowed the city to be the busiest cargo airport in the world since 1992.

So knowing which sector plays have the foresight to be both operational and effective on any scale defines success in the express delivery business, and knowing which stocks stand out from their peers in both actual performance and unrecognized share value is also critical to succeeding in the investment world.

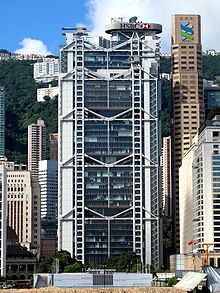

As soon as retail investors understand the often hidden value of counters, and the incentives that drive their businesses, they are likely to suddenly realize why the big players flock to certain stocks, such as HSBC’s (HK: 5) takeover of HI, or Manulife Financial Corp’s (HK: 945) acquisition of John Hancock.

Vigilant attention to market fundamentals and the oftentimes unappreciated metrics of particular counters – not reflex trading on the advice of broker reports – will also allow you to be your own mini-HSBC, or Manulife.

See also:

INVESTMENT STRATEGY: Lessons From A Military Genius 改變投資陋習 目標非黑即白

明白獎勵機制 大行報告不宜盡信

(文: 黃國英, 豐盛融資資產管理部董事)

大行報告,散戶追逐,視為必勝貼士。

好短炒,追逐無妨,人多跟飛,每多自我實現-如某大行二三線股分析員,尤好在股價受制 阻力時,出報告勁調升目標價,撻爆阻力。好追破頂之徒,一湧而上,股價直飛雲霄。來回幾次得手,人人視之為股海明燈,奔走相告大名,下次出報告,信徒更 多,威力更大,自我實現力更高。

若作戰 time-frame,以年來計,欲識股皇於草莽微時,看大行報告,則絕對勞而少功。「唔係嘛?大行精英,飽讀詩書,見多識廣,佢哋都會搵唔到未來股皇?」 無意看輕同行,而全因賣方分析員 (sell-side analyst) 的「獎勵機制」作崇。

何謂「獎勵機制」?股神拍檔芒格 (Charlie T. Munger),曾撰文解釋:聯邦快遞 (FedEx) 的 一段往事,是了解獎勵機制的最佳案例。速遞業成功與否,簡單不過:快而準,交遞妥貼。知易行難,要員工三更半夜,將貨物搬來運去無停手,「啋你都嘥氣!」 或放慢手腳,或粗心大意,不一而足。管理層扭盡六壬,軟硬兼施,卻發現不論好言相勸,抑或惡言相向,總有某一環節中棍,好似唔遲唔安樂。

後來有一管理層靈機一觸,作出一項小改變:裝運工不以工時支薪,而是以班次計人工。政策一出,成班人脫胎換骨,真正成為聯邦「快」遞。何解?以往不論效率如何,總之搬足一個鐘,就收一個鐘錢,話之你遲飛早飛,與我何干?最好加班,呃埋OT雙工錢,更是妙不可言。但以班次計工資,最緊要快手搞掂,人工袋袋平安,又可早啲番屋企。「獎勵機制」的小小改變,將「揼波鐘」的誘因消除,快而準則有賞,自然事半功倍,變革水到渠成。

大行日耗千金,養住班賣方分析員,免費派貼士,當然不是善心爆棚,普渡股海迷途散戶,早日得成正果,而是相信「貼士 造就成交」。

故仔越多,成交越多,佣金自然越多。好公司,真股皇,一買就長揸一世,有入無出,無佣金番,強烈推介,想倒自己米乎?此外,市值太低、成交稀 疏者,對己無益,少寫為妙。

市值大,消息多,股價剒,公睇好有理、婆睇淡有理,有大量衍生工具的股票,最受大行歡迎。了解「獎勵機制」,你就會明白,自己 操作,緣何好在二三線股堆中尋寶-四野無人,跟進者稀,找出長期錯價股票的機會,遠高於大股。

一旦明白「獎勵機制」,看世事,會通透很多。

例如內銀股管理層,真正老闆係阿爺,借錢給地方起廉租房,利微,隨時本不歸,但唔借要捱鞭,就算萬一出事,到時應已退休,與我何干?

匯豐(5)收購H.I.,宏利(945)收購John Hancock,前人風光收購,後人咬牙供股,是為前例。

政治借貸,輸就 write-down 幾成,贏就息差一釐,內銀股估值唔低,真係有鬼。

同一道理,自己新開基金,先行舉家重注認購,遠勝萬言說詞。

請閱讀:

改變投資陋習 目標非黑即白