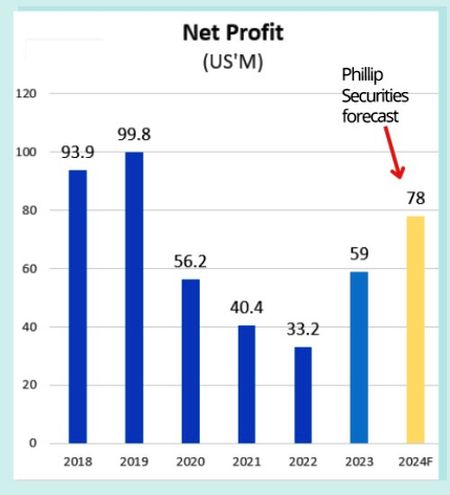

• Among the Singapore listcos announcing interim results, one that Lim & Tan Securities is flagging to be a performer is China Aviation Oil (CAO) which will release its results on 14 Aug. CAO has been benefitting, somewhat slowly at first but more so in recent times, from the recovery of domestic and international travel in China post-pandemic.  CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou. CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou.• One of the largest jet fuel suppliers in the region, CAO reported FY2023 net profit of US$58.9 million (+77% y-o-y). CAO's profit recovery is expected to extend into 2024 as air travel continues to recover, as this chart below suggests.  • Another positive is that CAO's business has been low in capex and high in cash generation, leading to a cashpile which is about 66% of its current market cap (S$748 m). It has zero borrowings. For more, read what Lim & Tan Securities says below ... |

| As China Aviation Oil / CAO (S$0.87, up 1 cent) is set to announce its 1HFY24 results this week, we continue to reiterate our BUY recommendation as valuations appear attractive at 7.7x FY24F P/E relative to its historical average of 12.2x. CAO remains a beneficiary of the stronger-than-expected international air traffic in China. The Civil Aviation Administration of China (CAAC) reported a sharp rebound in international flights in the first half of 2024, exceeding its previous estimates. Measures made to facilitate ease of entry for foreign travellers into China has started to bear fruit, and will further stimulate tourism recovery in the second half of the year. |

After several years of a weakened aviation industry, CAO is poised to see an increase in jet fuel supply volumes and earnings growth ahead.

Based on CAO’s 30% dividend payout policy (excluding the one-off 30th anniversary special dividend in FY23), we see an upward trajectory in normal dividends from 2.71 S cts in FY23 to 3.40 S cts in FY24F and 3.68 S cts in FY25F, a decent 3.9%/4.2% forward yield respectively.

|

CHINA AVIATION OIL |

|

|

Share price: |

Target: |

Recovery in international flights have beaten expectations. In the first half of the year, China’s international routes recorded more than 29.7 million trips, jumping 254% yoy.

The international air passenger market recovered to 81.7% of pre-covid levels, exceeded the CAAC’s previous estimates that it will hit 80% of pre-covid levels by the end of 2024.

Since February 2024, the recovery level has exceeded 80% for five consecutive months. Going forward, CAAC remains optimistic that the international passenger market will further recover for the rest of the year.

Relaxed entry requirements to boost tourism. China has introduced several measures in January to facilitate the ease of entry for foreign travellers.

These include expanded visa-free policies, simplified procedures and more convenient mobile payment methods for foreigners in China.

So far, the policies have borne fruit with a 153% yoy increase to 14.6 million foreign inbound trips in 1H 2024.

| Surge in foreign inbound trips |

| "China has introduced several measures in January to facilitate the ease of entry for foreign travellers. These include expanded visa-free policies, simplified procedures and more convenient mobile payment methods for foreigners in China. So far, the policies have borne fruit with a 153% yoy increase to 14.6 million foreign inbound trips in 1H 2024." |

The government has also collaborated with various industry players such as Trip.com to increase the accessibility and allure of inbound travel, demonstrating China’s adaptability in promoting economic recovery.

CAO’s key asset – SPIA, to benefit from return of international travellers.

CAO owns a 33% stake in Shanghai Pudong International Airport Aviation Fuel Supply Company Ltd (SPIA), the exclusive supplier of jet fuel and into-plane services at Shanghai Pudong International Airport and one of the busiest airports in the PRC in terms of air passenger numbers.

Contributions from SPIA jumped 63.7% yoy to US$31.5mln in FY23.

SPIA is a major earnings contributor and given its 47% drop in earnings since the pandemic, we see runway for outperformance in 2024 as China enters a post-Covid world.

The restoration of international flights should boost jet fuel demand and we forecast 31% / 14% growth in SPIA’s share of profits to US$41.2mln / US$47.1mln over the next two years.

China’s international air travel market has hit 81.7% of pre-covid levels in the first half of 2024 and the market view is that a full recovery by the end of 2025 is possible.

Domestic air travel has already seen full recovery at 12.4% above 2019 levels.

Concrete steps taken by the Chinese government to boost aviation travel both to and from China should start to close the demand gap between international flights and domestic flights.

China National Aviation Fuel Group (“CNAF”) is the controlling shareholder of CAO with its 51.31% stake. A state-owned enterprise, CNAF is the largest aviation transportation logistics services provider in the PRC, providing refuelling services at over 200 airports in China. CAO is CNAF's key overseas subsidiary and platform for international aviation fuel trading and procurement to support China's civil aviation industry. Photo: CAO.Capitalized at S$748.4mln, CAO trades at 7.7x FY24F P/E, 0.6x P/B with a dividend yield of 3.9%. China National Aviation Fuel Group (“CNAF”) is the controlling shareholder of CAO with its 51.31% stake. A state-owned enterprise, CNAF is the largest aviation transportation logistics services provider in the PRC, providing refuelling services at over 200 airports in China. CAO is CNAF's key overseas subsidiary and platform for international aviation fuel trading and procurement to support China's civil aviation industry. Photo: CAO.Capitalized at S$748.4mln, CAO trades at 7.7x FY24F P/E, 0.6x P/B with a dividend yield of 3.9%.With zero interest-bearing debt and a cash pile of US$373mln, CAO remains shielded in an elevated interest-rate environment and has the firepower to support acquisitions in the jet fuel and oil products ecosystem. Maintain BUY with an unchanged target price of S$1.24, pegged to 11.0x FY24F P/E. |