|

Excerpts from UOB Kay Hian report

Analysts: John Cheong & Heidi Mo

| Engineering Specialist With Strong Orderbook And Positive Outlook |

|

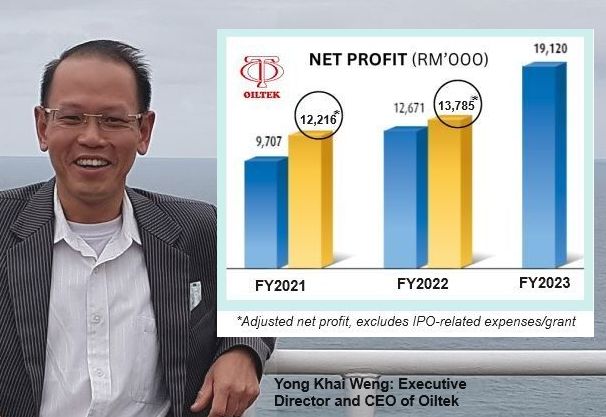

Oiltek posted a strong growth profile with three-year EPS CAGR of 40% (2021-24) and a record orderbook of RM401m for 9M24, ensuring good profitability in the future. |

| INITIATE COVERAGE |

• Strong track record and growth profile; expect double-digit earnings growth for 2024- 26. Founded in 1980, Oiltek International (Oiltek) is an engineering specialist in vegetable oil refineries and processing plants for major agricultural commodities, including palm, soybean and rapeseed oils.

| Oiltek | |

| Share price: $1.01 | Target: $1.22 |

Oiltek’s solid track record is evidenced by its ability to deliver close to US$1b of total contract value and to win repeat orders regularly from its major customers.

It has operations in 36 countries across five continents and services prominent clients in the agricultural commodities market.

On the back of Oiltek’s strong and growing orderbook, its earnings are expected to grow 39%/15%/11% in 2024/25/26.

• Accelerating demand for Oiltek’s engineering services should boost orderbook. We expect Oiltek’s orderbook to grow around 10% annually to RM440m in 2025 and RM480m in 2026, driven by:

| a) higher biodiesel blending requirements in Malaysia from B10 to B20 and in Indonesia from B35 to B40, b) new biodiesel facilities in Indonesia and Malaysia for more comprehensive logistics coverage, and c) the growing importance of sustainable aviation fuel (SAF). |

The International Air Transport Association (IATA) estimates that SAF production would triple to 1.5m tonnes in 2024.

At this rate, SAF would make up only 0.5% of total aviation fuels in 2024.

Based on the global current project pipeline, SAF production could reach 51m tonnes by 2030, as the EU, the UK, Japan and more countries and regions mandate flights to use 3-10% SAF by 2030.

• Initiate coverage with BUY and a PE-based target price of S$1.22, based on 18.9x 2025F PE, pegged to 0.9x PEG. This is derived from our estimated three-year EPS CAGR of 21% for 2023-26.

We have ascribed a 10% discount to 1x PEG, as we monitor for an improvement in trading liquidity which could lead to a better price discovery.

Oiltek is trading at 15x 2025F PE, which is at a discount of about 25% vs its peers’ average of 21x.

| STOCK IMPACT |

• SAF gaining importance as international aviation industry targets to reduce emission. The international aviation industry has set a goal to reach net zero CO2 emissions by 2050.

This will require an increase in SAF production, which could contribute around 65% of the reduction in emissions needed by aviation, according to the IATA.

|

Stock price |

$1.01 |

|

52-wk range |

20 c – $1.07 |

|

Market cap |

S$144 m |

|

PE (trailing) |

20 |

|

Dividend yield (trailing) |

2.55% |

|

1-year return |

370% |

|

Shares outstanding |

143 m |

|

Source: Yahoo! |

|

SAF is a liquid fuel that can be produced from various sources like hydro-treated vegetable oil (HVO).

As Oiltek has solutions to treat vegetable oil-based raw materials as feedstock in HVO production, the growing demand for SAF could lead to more contract wins for Oiltek in the future.

• High-margin, low-capex and cash-generative business. Oiltek has been able to generate superior net margins of around 9% and ROE of 30% over the last three years as it leverages on its proprietary process technologies and strong project execution team.

Oiltek outsources plant fabrication and installation work to third-party plants, which minimises its capex needs.

In addition, it has generated strong cashflows and is currently sitting on a net cash pile of RM104m (around 20% of its market cap).

EARNINGS REVISION/RISK

• Expect strong earnings growth for 2024-26 with three-year CAGR of 21%. For 2024-26, we estimate total revenue at RM233m-300m (three-year CAGR of 14%) and net profit at RM27m-34m (three-year CAGR of 21%).

The key growth drivers will be:

| a) the strong orderbook of Oiltek, which stood at RM401m as of 3Q24; b) more order wins on higher demand from biodiesel facilities, expansion of palm oil refining capacity and increasing work scope for turnkey solutions; and c) a gradual improvement in gross margin from better economies of scale. |

• We initiate coverage with a BUY recommendation and target price of S$1.22, implying a 25% upside.  John Cheong, analystThis is based on 18.9x 2025F PE, pegged to 0.9x PEG. This is derived from our estimated three-year EPS CAGR of 21% for 2023-26. John Cheong, analystThis is based on 18.9x 2025F PE, pegged to 0.9x PEG. This is derived from our estimated three-year EPS CAGR of 21% for 2023-26. We have ascribed a 10% discount to 1.0x PEG, as we monitor for an improvement in trading liquidity which could lead to a better price discovery for Oiltek. In addition, we think good project execution and more contract wins could lead to further re-rating of the stock.  Heidi Mo, analyst• We think the market has overlooked the strong financial metrics and attractive asset-light business model of Oiltek, which could make it an attractive takeover target. Heidi Mo, analyst• We think the market has overlooked the strong financial metrics and attractive asset-light business model of Oiltek, which could make it an attractive takeover target. Oiltek is trading at an around 25% discount vs its peers in terms of 2025 PE multiple. SHARE PRICE CATALYST • Higher-than-expected order wins. • Better-than-expected gross margins from better economies of scale. |