|

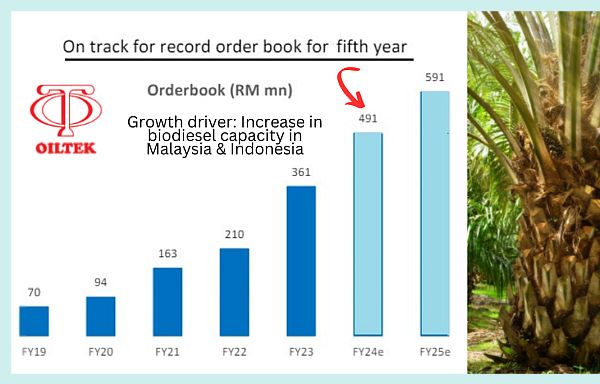

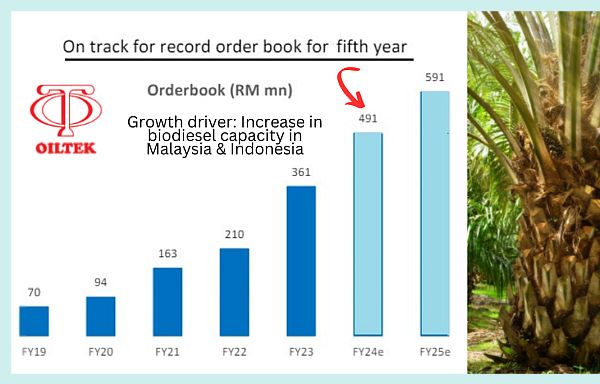

• Oiltek International's stock is a darling of investors who rode it up nearly 400% in the past 1 year -- from 23 cents to $1.04.

Oiltek's asset-light business model, zero borrowings, high profits -- are among the features that investors appreciate.

Its cash balance as at June 2024 stood at RM104 million, while property, plant and equipment amounted to only RM3.8 million.

• How does RM3.8 million of fixed assets generate ~RM250 million of revenue a year? By the way, its staff headcount is only around 80.

Answer: Outsource plant fabrication and installation; focus on in-house proprietary technology; offer maintenance services and retrofitting services, etc.

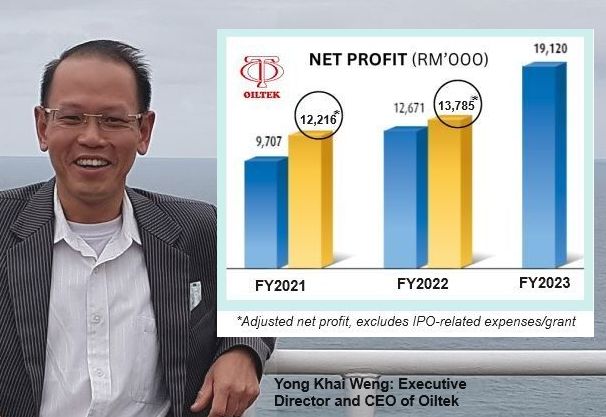

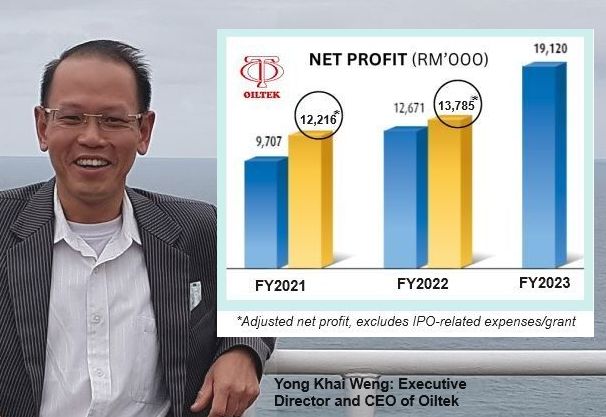

Oiltek is forecast to achieve RM28.4 million in net profit in 2024 by CGS International. Oiltek is forecast to achieve RM28.4 million in net profit in 2024 by CGS International.

• Its business is technical and one of its kind on the Singapore Exchange, where it listed in March 2022.

But business clarity is improving owing to its quarterly reporting and -- more importantly -- coverage by 4 research houses.

• And last Friday (10 Jan), Oiltek's CEO presented at a webinar hosted by Phillip Securities.

See edited excerpts of the Q&A session below...

|

Q: What does "asset light" mean for Oiltek?

A: "Asset light" means Oiltek minimizes its capital expenditure by keeping a large amount of cash on hand and minimizing investments in fixed assets.

Instead of large overseas offices, it collaborates with exclusive agents to expand its market.

This strategy keeps operational costs low and makes the company more financially stable.

Q: Will Oiltek maintain its zero gearing policy in the future?

A: Oiltek values its low gearing approach, especially with rising interest rates.

However, it may consider borrowing in the future if a new opportunity offers high returns, or if it needs to raise capital for new business ventures.

Q: Why is demand for downstream palm oil processing increasing in the Americas?

A: The demand is rising due to significant growth in palm oil plantations, leading to an increased need for processing facilities.

Latin American countries like Colombia, with abundant land and favourable climates, are driving this demand.

Q: What are the technological barriers to building Sustainable Aviation Fuel (SAF) plants?

A: The bigger challenge is the availability of sustainable feedstock, not technological barriers.

SAF plants need non-edible oils, like used cooking oil, and securing a reliable supply of these is crucial.

Q: How do rising palm oil prices impact Oiltek's customers and their downstream expansion plans?

A: Higher palm oil prices benefit upstream producers but increase costs for downstream processors.

However, the market has adapted to these price fluctuations, understanding that expansion is necessary to meet the growing demand for palm oil products, regardless of price.

Q: What measures is Oiltek taking to enhance operational efficiency and reduce costs?

A: Oiltek maintains tight control over its operations and office functions, which is reflected in its increasing profit margins.

The growth in net profit margin is consistently exceeding revenue growth, indicating improved efficiency.

|

Stock price

|

$1.04

|

|

52-wk range

|

20 c – $1.11

|

|

Market cap

|

S$148.7 m

|

|

PE (trailing)

|

20.8

|

|

Dividend yield (trailing)

|

2.4%

|

|

1-year return

|

395%

|

|

Shares outstanding

|

143 m

|

|

Source: Yahoo!

|

Q: What are Oiltek International's key technological advantages in the renewable energy sector?

A: Oiltek International boasts a diverse portfolio, including biodiesel, SAF, and biogas. It can process various feedstocks using different catalysts to create a wide range of biofuels.

Additionally, it is a leader in waste-to-energy solutions, converting wastewater into usable biogas.

Q: How does Oiltek plan to expand its market share in regions like Africa?

A: Oiltek has a long history in Africa, with a strong presence in East and North Africa for over 20 years.

It leverages these relationships and extensive experience in the region to secure new contracts.

Q: Can you elaborate on Oiltek's strategy to address concerns about its diversified portfolio potentially affecting focus and relevance?

A: Oiltek sees diversification as a strength, mirroring the operations of their clients in the vegetable oil industry who are also diversified.

This allows Oiltek to understand and support their clients' needs across the entire supply chain.

Its global presence and commitment to innovation further reinforce their position as a reliable and cutting-edge solutions provider.

Q: Can you share any instances where Oiltek did not win contracts and the reasons behind these losses?

A: Like any company, Oiltek doesn't win every contract.

It carefully analyse losses, considering factors like price competitiveness, payment flexibility, and contract terms. Every failure is seen as an opportunity for improvement.

Q: How does Oiltek determine its dividend payout policy (not less than 40% payout ratio) while balancing shareholder returns with operational needs?

A: Oiltek strives to maximize shareholder returns while ensuring the company's financial health.

It projects profits conservatively and prioritizes maintaining enough resources to support operations and growth. Its track record demonstrates a consistent ability to achieve this balance.

• CGS's report is here.

• UOB Kay Hian's is here.

• Phillip Securities' is here.