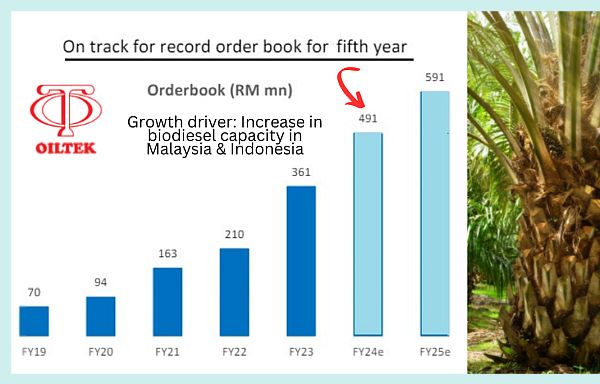

• To little investor interest, Oiltek listed on SGX in March 2022 at 23 cents /share. Its stock price languished over months and then into early 2024. Its sterling FY23 results triggered investor interest and, voila, the stock's up 157% year-to-date, from 22 cents to 56.5 cents. • In June, finally, one broker -- Phillip Securities -- launched an initiation report of Oiltek. Today, it put out its second report. The Malaysian-based company's orderbook and profitability have done nicely in recent years.  Orderbook forecasts for FY24 and FY25 by Phillip Securities. Orderbook forecasts for FY24 and FY25 by Phillip Securities.• Oiltek (current market cap: S$81 million) has a 68% shareholder -- Koh Brothers Eco Engineering, a listco on the Singapore Exchange -- which may be why trading liquidity is typically tight. • Oiltek's business is one-of-a-kind on the SGX: It provides turnkey solutions for refineries and processing plants in the vegetable oils industry. • While it has customers all over the world (including Wilmar, Sime Darby and Sinar Mas), Indonesia's players in the palm oil supply chain accounted for 78% of its FY23 revenue. This time, it reported a large contract from Colombia in Latin America. For more, see excerpts of Phillip Securities report below... |

Excerpts from Phillip Securities' report

Analyst: Paul Chew

|

▪ Oiltek announced a RM45.5mn contract in Latin America.

|

The growth in palm oil production in Latin America is driving a surge in downstream capacity.

| Oiltek | |

| Share price: 56.5 c | Target: 70 c |

Oiltek is a global leader in palm oil process technology, including refining, fractionation, and phytonutrient extraction.

The new area of growth is renewable energy.

The expected spike in sustainable aviation fuel production from 1.5mn tonnes in 2024 to potentially 51mn by 2030 is another opportunity.

Highlights

Compounding of the order book. Oiltek's order book has compounded at an annual rate of 51% over the past four years, from 2019 to 2023.

Our year-end target for the order book is unchanged at RM491mn.

New orders secured this year are RM197.8mn, still below the record RM322.1mn in 2023.

|

Stock price |

56.5 c |

|

52-week range |

20 – 57 cts |

|

Market cap |

S$81 m |

|

PE (trailing) |

11.3 |

|

Dividend yield (trailing) |

4.46% |

|

1-year return |

157% |

|

Shares outstanding |

143 m |

|

Source: Yahoo! |

|

New opportunities in Latin America. Colombia is the 4th largest producer of palm oil globally.

After a lull during the pandemic, production has returned to growth with a 22% rise to 1.9mn MT over the past 3 years.

The jump in production will require more downstream processing capacity.

The global market share of Colombia’s production remains tiny at around 2%.

However, there is huge potential.

According to Fedepalma, the government has identified 5mn ha of land (Malaysia: ~3.3mn ha) suitable for palm without the need for deforestation.