Excerpts from latest analyst reports…

BOCOM initiates CHINA HIGH SPEED TRANSMISSION (HK: 658) with ‘buy’ and 17 hkd target

Analyst: George Yin

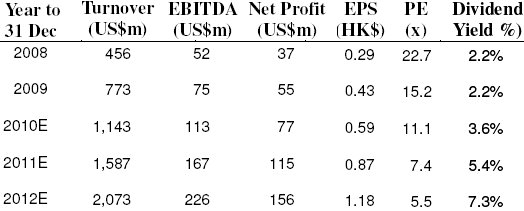

Demand for wind power installation remained robust under China’s promotion of green energy policies. According to the 12th Five Year Plan, installed wind power capacity of the country would reach 100 GW by 2015, 2.5 times higher than the current level, representing a CAGR of around 20% over the next 5 years. While the growth slows down from that of the 11th Five Year Plan, demand growth remains robust.

Production and sales of wind turbine gearboxes could achieve a y-o-y growth of 30% in 2011. China High Speed Transmission’s new production lines will achieve full capacity in 2011, bringing its total capacity of wind turbine gearboxes up to 12 GW. Sales of its wind turbine gearboxes reached 9 GW in 2010. The company has currently secured 6 GW orders and is in talks for another 6 GW orders. Based on this, sales of wind turbine gearboxes could grow 30% y-o-y to 12 GW in 2011. Despite slower growth, CHST maintains the growth at a satisfactory level of 30%.

High speed locomotives and CNC machine tools businesses may contribute more in the future. At present, CHST develops the transmission equipment for high-speed locomotives with France’s Alston. It has achieved steady results in tests under 300km/h. Sales of transmission equipment for high-speed locomotives and urban light rails could achieve over 100% growth in 2011. CHST may substitute the imported products and fall into the sourcing chain of CSR and CNR in the future, thus bringing considerable profit growth to the company.

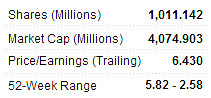

Investment opportunity lies on cheap valuations. Given the assumption of 30% sales growth in principle products in 2011 and the new growth drivers arising from increased contributions from other operations from 2012 onwards, we expect FY11F/FY12F EPS to reach 1.15 yuan/1.39 yuan. Our “Buy” rating assigned for initial coverage with a TP of 17 hkd corresponds to a FY11F 13x PE. The stock currently trades at FY11F 9x PE, representing a rather high safety margin.

Recent story: HU AN CABLE: Powering Up For Greater Investor Interest

Guoco maintains ‘buy’ and 4.20 hkd target for CHU KONG STEEL PIPE (HK: 1938)

Analyst: Garrett Tse

In 2011, we see positive demand-side signs. Overseas demand is the first driver. Overseas orders have been picking up since 4Q10. In a recent announcement, CKSP noted that it received additional new orders of 133,000 tonnes of steel pipes, adding to the total orders of 475,000 tonnes as at 3Q10, with 60% of the new orders from overseas customers. These orders are scheduled for delivery in 1Q11, signaling overseas customers’ eagerness in catching up a delayed production schedule, in our view.

Domestic demand will add more contribution in 2H11. During our recent discussion, management expressed that they felt a likely recovery of domestic demand in 2H11. In the near term, bidding results of CNOOC’s 50k tonnes of deepwater pipes and 140k tonnes of shallow-water pipes are due in March 2011. As CKSP is the only PRC company that managed to manufacture deepwater pipes and supplies around 80% of CNOOC’s shallow-water pipes, we believe the counter has good chance to seize a significant portion of these biddings.

Domestic demand from PetroChina is a wild card for CKSP in 2H11. Industry sources reported that PetroChina has planned to build more than 40k km of oil and gas pipelines between 2011-2015. This translates into 16 mln tonnes of steel pipe demand by our estimates. It is likely that PetroChina would start some projects in 2H11, which might add more contribution to CKSP’s order book in 2H11.

According to consensus estimates, CKSP is currently traded at 23.3x 2010 PER and 10.0x 2011 PER. Consensus 2011 earnings estimate is built upon a general view that CKSP could deliver 400k tonnes in 2011. We believe this expectation is conservative as CKSP’s undelivered orders on hand amounted to 354k tonnes of steel pipes.

As the company’s production lead time is around three months, we believe its earnings could beat the market expectation in 3Q11. We estimate CKSP’s earnings will reach 134 mln yuan (EPS 0.13 yuan) in 2010 and 350 mln yuan (EPS 0.32 yuan) in 2011, with EPS growth of 146% in 2011. According to our estimates, CKSP is currently trading at 23.3x 2010 PER and 9.1x 2011 PER. Valuation is not demanding given the strong earnings growth prospects.

Recent story: Insider Buys: QINGMEI, SINOPIPE, HLN, XINREN ALUMINUM

Cinda initiates REGENT MANNER INTL (HK: 1997) with ‘buy’ and 10.5 hkd target

Analyst: Kenneth Li

Regent Manner is a leading Surface Mounting Technology (SMT) solutions provider for TFT-LCD panels, LED back light modules and LCD TVs. The new businesses of LED light bars, TV main boards and variable speed air conditioner control boards are the key growth drivers for the coming three years.

Regent is riding surging LED TV and monitor penetration. It is in a leading position to benefit from strong LED TV and monitor penetration. LED TV and LED monitor shipments will enter into a robust growth phase in the next three years as LED TV shipments should surge by a CAGR of 75% and LED monitors by a CAGR of 51% between 2010 and 2013.

Regent could cooperate with global LED lighting giants for LED lighting SMT services. The LED lighting market is heating up due to improved luminous efficacy and falling usage costs. Philips forecasts that LED lighting will record robust growth from 5% of total global lighting sales in 2010 to 50% by 2015 and to over 85% of total global lighting sales by 2020.

Recent story: CHASEN: Logistics Beneficiary Of Semiconductor Boom