TECHCOMP HOLDINGS has again demonstrated the resilience and growth potential of its business.

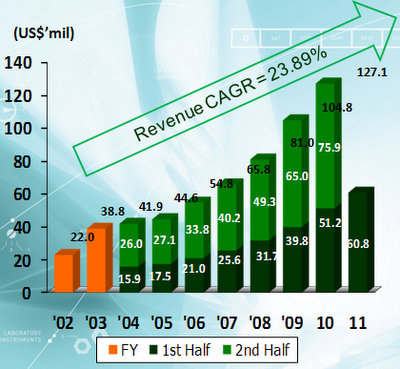

Its 1H revenue grew 18.8% to US$60.8 million, making it a record six months, thanks mainly to the growth of its manufacturing business in Europe and China.

Overall gross profit margin rose 1.1 percentage points to 30.5%.

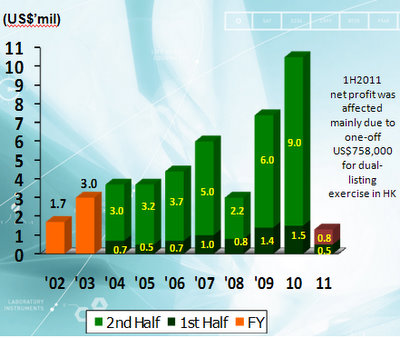

Net profit, however, came in at USD604,000, down 59% because of a one-off US$758,000 expense for its dual-listing exercise in Hong Kong.

In addition, shipments of products (for distribution) from Japan were delayed due to the Japan earthquake and tsunami. The bottomline was affected by a stronger Japanese yen and Swiss franc.

Techcomp is a manufacturer and distributor of highly advanced scientific instruments, analytical instruments, life science equipment and laboratory instruments.

To investors unfamiliar with the seasonality of Techcomp’s business, the second-half revenue has usually made up about 60% of the full-year’s.

Net profit has risen in tandem, except for 2008 when yen volatility hit Techcomp's bottomline, as the charts on the right show.

Here are some of the highlights of the Q&A session management had with analysts and investors on Friday at Tower Club:

Q: What is the expected expense for the dual-listing exercise in 2H?

Richard Lo, President: We are expecting another US$1.2 million in the second half.

Q: Historically, your revenue split is 60-40 for 2H-1H. Are you expecting a higher percentage in 2H because of more sales carried over from 1H as a result of the delay in shipments of products from Japan?

Richard: Yes, hopefully the 2H will be slightly stronger than 60%. We have put in improvements in Europe operations but we are countered by the stronger Swiss franc.

Q: If the stock markets deteriorate further in 2H, how long more can you stretch your dual-listing plan?

Richard: We are going to list via introduction, not a placement, so the ups and downs of the market don’t affect us. We still are trying very hard to list in Hong Kong by this year. We have no plan to raise any capital, but our sponsor is pushing for a placement. Our position is, if the price is right, we will consider it.

(Writer's note: On the HK bourse, a listing by introduction will see only existing shares being listed. No new shares will be issued and no additional funds will be raised. On the Singapore bourse, Techcomp stock recently traded at 36.5 cents, translating into a market cap of S$85 million at a historical PE of 6.7X)

Q: Your 2H2010 net profit of US$9 million was a 50% increase year on year. Are you confident of maintaining your gross profit margin of 2H2010?

Richard: There are positive factors such as higher profit margins from the manufacturing sector, improved efficiencies and economies of scale. But there are negative factors that we cannot control, such as the impact of currency movements. Overall, we are expecting a steady improvement in the gross margin.

Q: Can you explain how you will counter the effects of currency fluctuation?

Richard: We can hedge, and we can try to pass on any cost increase to our customers. Of course, we have to sacrifice some margin to maintain some minimum sales.

For more information on its financial results, click here.

Recent stories:

TECHCOMP: US fund manager, major shareholder shares insights with analysts

TECHCOMP: Record profit of US$10.5 million in FY2010, Europe to contribute to bottom line this year.

TECHCOMP: 'One Of The Most Consistent Companies I Have Researched On...'