This article was posted on remisier Ernest Lim's blog, http://www.ernestlim15.blogspot.com/, yesterday.

However, investor interest gradually dies down since May with dwindling volume and the reduction in analyst coverage.

For investors who are not familiar with Techcomp, it is a manufacturer and distributor of highly advanced scientific instruments, analytical instruments, life science equipment and laboratory instruments. These are used in laboratories for a multitude of industries such as pharmaceuticals, biotechnology, medicine, food and beverage etc.

Manufacturing which commands higher margins, comprises of 19% of its FY09 revenue, with the balance coming from distribution segment.

Consistent track record

Techcomp is one of the most consistent companies which I have researched on. It has posted a 20% compound annual growth rate (“CAGR”) in net profit and revenue since FY02. This means that Techcomp can double its net profit and revenue every four years. Nevertheless, it will be increasingly more difficult to sustain such growth when its revenue and net profit base grow bigger.

Manufacturing arm to grow in the coming years

According to 1HFY10 results briefing, management indicated that the growth of their manufacturing business segment should outstrip that of distribution segment. This view is corroborated by the announcement on 30 Sep 10, where management has inaugurated a new facility to ramp up its production capacity for biological safety cabinets in October 2010. The rapid growth of the manufacturing segment bodes well for Techcomp as manufacturing segment commands higher margins than the distribution segment.

Acquisitions to contribute to bottom line in FY11 and beyond

In 2009, Techcomp acquired a 75% stake in HCC group and subsequently acquired the remaining 25% stake in 2011. It has also bought an 80% stake in Swiss based company, Precisa Gravimetrics AG (“Precisa”) for CHF3.5m in Feb 2010. As of 1HFY10, these acquisitions were still loss-making as there were some one off expenses related to the acquisition. Furthermore, Techcomp also allowed the subsidiaries to invest in R&D and sales networking in Europe to strengthen their presence which resulted in additional expenses (than if Techcomp did not acquire the companies).

According to 1HFY10 results briefing, management believes that these acquisitions should contribute positively in 2011.

Techcomp has lined up a number of new products such as healthcare laboratory micro-plate reader and washer, Virto Diagnostic which will obtain the CE certification and obtain the medical license for the PRC market in the coming months. Secondly, Techcomp is also developing a proprietary Automatic Immunoassay System. This is also used for the clinical diagnostic market as well.

Thirdly, Techcomp’s French subsidiary is also finalizing the prototype for a healthcare product for the blood banking preparation market. Management has made plans to launch the new product by early 2011. Last but not least, Techcomp announced in Apr 2010 that it has entered into a joint venture with Shanghai Precision & Scientific Instrument Co., Ltd. for the manufacturing and distribution of analytical balance products in China. This joint venture has begun operations in 4Q and is expected to turn profitable in 2011.

Recent increase in stake

Kabouter Management which has first emerged as a substantial shareholder since 9 Apr 2008 has recently increased their stake in Techcomp to 9.02%. This was announced on 30 Dec 2010. For a fund to stay (increasingly) invested in a company for so long, there are likely to be some merits in this company worth looking into.

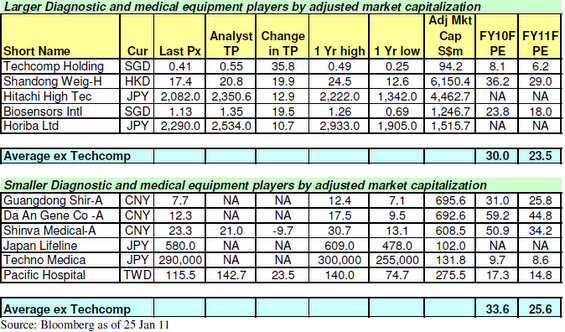

Cheap valuations vis-à-vis its peers

According to Bloomberg (see table below), Techcomp trades at 6.2x 2011F PE. This is at a discount relative to Techno Medical, the next smallest player with a forward 2011F PE of 8.6x. It is noteworthy that the average 2011F PE (excluding Techcomp) for the larger and smaller peers are at 23.5x and 25.6x respectively. Techcomp seems to be trading at a substantial discount for a company with 20% CAGR in both revenue and earnings since FY2002.

Investment risks

lliquidity is the big drawback

According to Bloomberg, the average 30D and 100D volume for Techcomp are about 129,000 shares and 113,000 shares respectively. This is rather illiquid and investors have to take this into consideration when they are evaluating this company.

Insufficient analyst coverage

As mentioned before, Techcomp was covered or at least mentioned in a number of research reports after it posted sterling FY09 results in end Feb 2010. Nevertheless, this interest seems to fade over time. This is apparent after its release of 1HFY10 results where only a couple of research firms wrote a short note on it.

Conclusion

With reference to the table above, Techcomp is trading at a substantial discount to its peers. If Techcomp can consistently deliver on its results and net profits, it is likely that it will capture the attention of the investment community over time.

This is an amended version of the write-up which I have sent to my clients recently.

Recent NextInsight stories:

TECHCOMP: Growth in 1H, much stronger 2H to come

TECHCOMP: Exploring Opportunities, Including European Buyouts