"Our third quarter top line will continue to be healthy," says Chow Sang Sang CFO Thedore Tam (second from right), with Director & Deputy GM Winston Chow (right). Photo: Frances Leung

"Our third quarter top line will continue to be healthy," says Chow Sang Sang CFO Thedore Tam (second from right), with Director & Deputy GM Winston Chow (right). Photo: Frances LeungCHOW SANG SANG Holdings International Ltd (HK: 116), one of Hong Kong’s most recognizable names in jewelry and gold retailing and with a rapidly growing presence in the PRC, expects strong results for the July-September period.

“We should report double digit growth for the third quarter,” CFO Mr. Theodore Tam told an Aries Consulting-sponsored investment meeting last week.

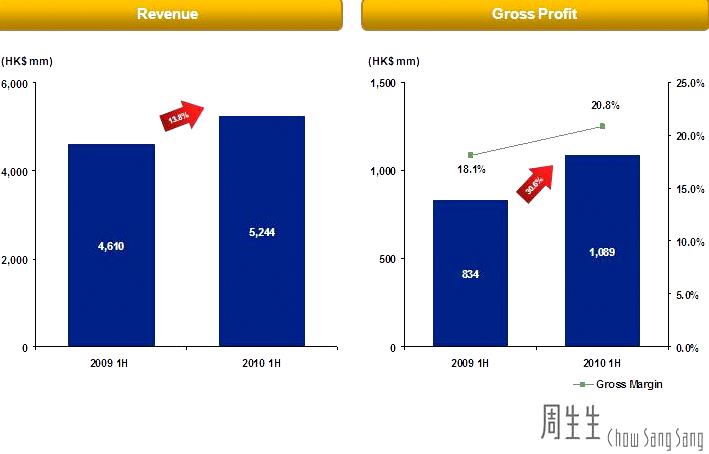

This follows the strong first-half performance for Chow Sang Sang in which revenue rose 13.8% year-on-year to over 5.2 bln hkd leading to a 23% bottom line growth of around 300 mln hkd.

"Our third quarter top line will continue to be healthy," Mr. Chow added.

A major reason for the company’s strong recent success and general bullishness among management going forward is the massive and still relatively untapped mainland market just next door to the company’s Hong Kong headquarters.

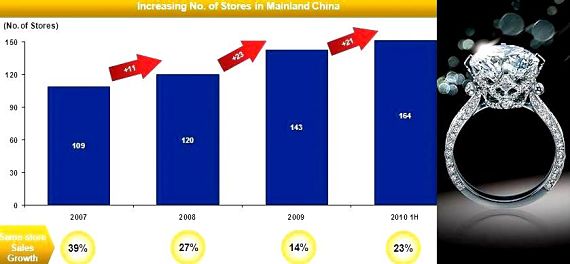

“PRC customers coming to Hong Kong to shop are a growing market segment for us over the past three years. However, our sales within China in the third quarter were also very strong and our shop opening plan in the PRC is on target,” he said.

“Mainland Chinese visitors to Hong Kong generally spend more than their local counterparts and are more adventurous.”

He added that the record high prices for gold bullion of late is actually a boon for the company’s sales.

"High gold prices actually encourage more non-gold jewelry sales.”

This was a welcome phenomenon given the fact that average profit margins for gold-based sales were 8-12% compared to the 35-40% margins enjoyed on gem-set jewelry retail sales.

“Average selling prices for gold products are 3,000 hkd per piece, while ASPs for jewelry are 11-12,000 hkd per piece.”

Founded in 1934, Chow Sang Sang has grown to become a premier jewelry retailer.

Chow Sang Sang Jewelry Co Ltd operates 39 Chow Sang Sang shops and eight Emphasis shops in Hong Kong. In Taiwan and Macau it operates 22 and three Emphasis shops, respectively. There are 174 Chow Sang Sang shops across the PRC with many more to come. It is now in over 60 Mainland Chinese cities and has a presence in every province except Qinghai and Tibet.

"China is our major growth area," he said.

And the Hong Kong-listed firm is betting on the PRC to be the major growth driver going forward.

“In Hong Kong we enjoy around a 35% market share in our sector, but are at just 2% in the PRC so there is a lot of room for expansion.”

I asked him if Chow Sang Sang was also eyeing the world’s current No.1 gold and jewelry market as a growth driver.

“Yes, India is tops in both areas in terms of consumption, but we are just getting started in China and I believe there is tremendous untapped potential in the PRC, so there’s no rush to expand into India at this point. With rising incomes and education levels on the mainland and continued strong GDP growth, we are growing there along with the economy,” Mr. Tan said.

This was probably a good idea for now because not only was Chow Sang Sang in the midst of a steady expansion into the PRC, but India had no shortage of competition with an estimated over 300,000 jewelers already having set up shop on the subcontinent.

And Chow Sang Sang was all about jewelry retailing in the world’s most populous country.

“We do derive 10% of our group revenue from precious metals and securities trading in Hong Kong, but this segment only takes 8-10 staff to administer. The remaining 90% of our group revenue comes from jewelry manufacturing and retailing, and this is our primary focus in the mainland market,” Mr. Tan said.

“We aren’t giving up on gold, but we are seeking the higher margins from jewelry retailing. The latter is more important to us now because is it more value added and allows more product diversification.”

He said the new wealth being generated in the PRC and the enhanced spending power this produces are the biggest lures of the mainland market.

“Weddings and gift-giving are becoming big drivers for us in the PRC and our focus there will be more jewelry-oriented than gold, so our product differentiation there is more pronounced with more variety. In China, we are also given more prominent retailing locations,” Mr. Tan said, citing the much more affordable selling spaces available.

Indeed, product differentiation was a key ingredient to successfully competing against the established names.

“We have put a lot of emphasis on unique product development. Cartier and others have their own iconic products so we are hoping to move more in this direction.”

He said each outlet opened in the PRC required a 10 mln yuan investment, with one mln for the structure itself and nine mln for inventory.

Meanwhile, 50 mln yuan was required to set up shop in Hong Kong, due to much more expensive commercial real estate prices.

“In Mainland China we enjoy higher margins due to lower rental costs and salaries,” Mr. Tan said.

And how did Chow Sang Sang expect to perform in the current quarter?

“The fourth quarter is still running well, but December of last year was a record month for us so it is a high base of comparison.”

See also:

CHOW SANG SANG Has Gem Of A Half On Retail Strength

"Our third quarter top line will continue to be healthy," says Chow Sang Sang CFO Theodore Tam, second from right, with Director & Deputy GM Winston Chow at far right. Photo: Frances Leung