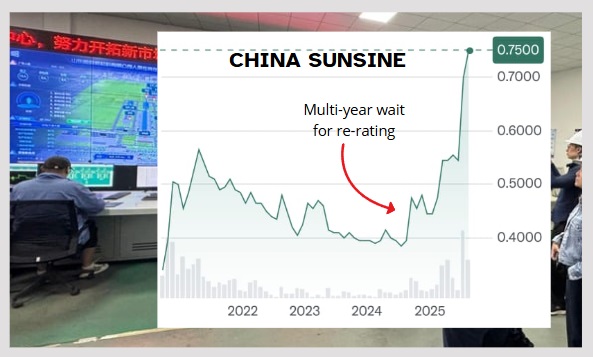

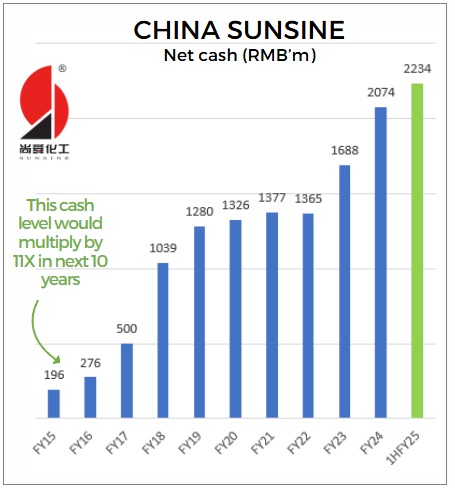

Background photo: Control room which monitors operational and production systems at China Sunsine. Background photo: Control room which monitors operational and production systems at China Sunsine.• China Sunsine stock (75 cents) has risen 69% year-to-date, a long awaited rerating for its shareholders. The business' enduring robustness and strong cashflow have been key attractions for them. You can see that in the company's growing cashpile through the years even as it spent on R&D and regularly expanded its production capacity for chemicals that go into tyre manufacturing. • On top of that, it has been paying dividends, distributing more than RMB 1 billion since its 2007 listing on the SGX, which raised RMB 264 million.

• China Sunsine operates in a competitive industry with volatile prices for input raw materials, which have weeded out a number of players, leaving behind just a few sizeable Chinese peers. That explains why as the world's largest producer of rubber chemicals used in tyre manufacturing, China Sunsine has seen its profitability cruise higher in some years, and lose altitude in others. |

Excerpts from UOB Kay Hian report

Analysts: Heidi Mo & John Cheong

China Sunsine Chemical (CSSC SP)

Sunsine’s 1H25 earnings of Rmb243m (+29% yoy) came in above expectations, forming 56% of our 2025 forecast.

Revenue fell 3% yoy to Rmb1,690m on weaker ASPs, but gross margin held firm at 24.6%. |

|||||

RESULTS

• Earnings beat on lower R&D. China Sunsine Chemical (Sunsine)’s 1H25 revenue of Rmb1,690 (-3% yoy) and earnings of Rmb243m (+29% yoy) formed 48% and 56% of our full-year forecasts respectively.

The earnings outperformance was mainly due to a sharp reduction in R&D expenses to Rmb4.6m (vs Rmb69.9m in 1H24), alongside a record-high sales volume which helped offset softer ASPs.

• Record sales volume. Sales reached a new half-year high of 109,695 tonnes (+4% yoy), with growth across all product categories: rubber accelerators (+1% yoy), insoluble sulphur (+16% yoy), and anti-oxidants (+2% yoy).

Both domestic and export volumes rose 4% yoy, driven by proactive market share capture in China and stronger demand from Chinese tyre makers in Southeast Asia.

| Fortress balance sheet |

"Sunsine remains debt-free with Rmb2,234m (approximately S$398m) in cash as at 30 Jun 25. Net assets per share stood at Rmb451.3 cents (approximately S$0.80), with net cash per share at S$0.42. Current ratio remains robust at 7.5x, highlighting solid financial flexibility." - UOB KH |

• Margins remain resilient. Despite the 7% decline in ASPs to Rmb15,195/tonne, gross profit slipped only 4% yoy to Rmb416m, with the gross margin holding steady at 24.6% (-0.2ppt yoy).

This reflects stable profitability amid the competitive pricing environment.

• Special dividend declared. To commemorate its 30th anniversary, the board declared a special interim dividend of 0.5 S cent/share.

STOCK IMPACT

• Challenging backdrop, steady demand. Sunsine expects trade uncertainties, geopolitical risks and persistent overcapacity to continue to weigh on ASPs.

However, China’s economy remains robust, with 1H25 GDP yoy growth of 5.3% and auto sales up 11.4% yoy.

Replacement tyre demand also continues to be strong at 70% of total consumption, while government measures to curb low-price competition and phase out outdated capacity should support healthier long-term industry conditions.

• Capacity ramp-up to drive growth. Sunsine’s ongoing projects include a 30,000 tonnes/annum insoluble sulphur expansion (commercial production expected by 4Q25), two solvent-based Mercaptobenzothiazole (MBT) projects at Hengshun and Weifang (trial runs by end-25 and early-26 respectively), and the conversion of rubber accelerator lines at Shandong Sunsine (early-26).

By 2026, total capacity is set to rise 7% to 272,000 tonnes, with innovations such as solvent-based MBT production enhancing green manufacturing, improving operational efficiency, and strengthening its competitive advantages.

EARNINGS REVISION/RISK

• We have revised our 2026-27 earnings forecasts upward by around 2-3%, after factoring in Sunsine’s planned capacity expansion.

We expect the additional output from the new facilities and conversion of accelerator lines to support stronger sales volumes.

VALUATION/RECOMMENDATION Heidi Mo, analyst• Maintain BUY with a 19% higher target price of S$0.75 (S$0.63 previously), after rolling over our valuation base year to 2026 and applying a higher valuation multiple of 9.4x 2026F earnings (+1.5SD to mean PE), vs the previous 7.5x 2025F earnings (+1SD to mean PE). Heidi Mo, analyst• Maintain BUY with a 19% higher target price of S$0.75 (S$0.63 previously), after rolling over our valuation base year to 2026 and applying a higher valuation multiple of 9.4x 2026F earnings (+1.5SD to mean PE), vs the previous 7.5x 2025F earnings (+1SD to mean PE). The higher multiple captures Sunsine’s stronger earnings visibility from upcoming capacity expansions. At the current price, the stock trades at an attractive 3x 2026F ex-cash PE while offering a decent 4.4% 2026 yield. SHARE PRICE CATALYST • New manufacturing capacities commencing production. • Higher ASPs for rubber chemicals. • Higher-than-expected utilisation rates |

Full report here.