Nam Cheong has recently corrected to 65 cents, an attractively low level with a trailing PE of 3-4X. |

Excerpts from CGS report

Analysts: Meghana KANDE & LIM Siew Khee

Pacific Radiance Ltd (PACRA) -- Turnaround story coming through

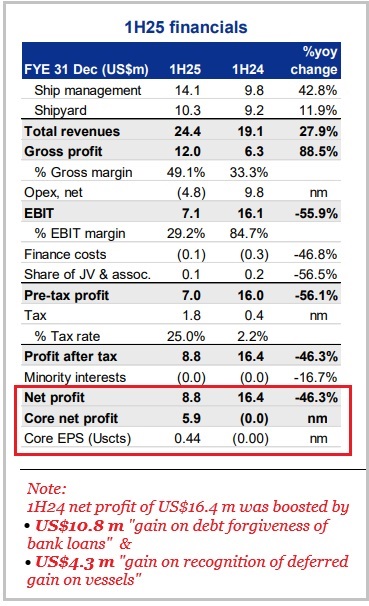

| ■ With all vessels fully reactivated, PACRA posted strong revenue growth of 28% yoy to US$24m in 1H25, in line with our expectations.

■ We were pleasantly surprised by PACRA’s 49% GM in 1H25, thanks to the reactivation of accommodation work barge, likely to be sustainable in 2H25F. ■ Successful delivery of its self-constructed CTV highlights the yard’s newbuild capabilities, in our view. ■ Reiterate Add with a higher TP of S$0.09 (7x FY26F P/E). Vessel additions to its fleet could catalyse the stock, in our view. |

||||

1H25: margin improvement shines

Pacific Radiance (PACRA) delivered a strong 1H25 gross margin of 49% vs. 32% in 1H24.  We attribute this to

We attribute this to

| 1) the reactivation of its last vessel (an accommodation work barge) which started work in early-2025 and 2) a favourable revenue mix shift towards ship management. |

1H25 revenue of US$24m (+28% yoy) was in line at 50% of our FY25F forecast, while 1H25 core PATMI beat expectations at US$6m, ahead of our FY25F forecast of US$5m.

| All vessels back in play |

Ship leasing and chartering revenues in 1H25 were up 31% yoy to US$9m, largely driven by contribution from its reactivated vessels.

Excluding the impact of the third-party charter income it earned in 2024, we estimate the underlying revenue uplift could have been stronger.

As of end-Jun 25, PACRA had four vessels deployed in the Middle East on 1-3 year contracts.

Our channel checks suggest resilient OSV demand from upstream players in the Middle East, which could drive higher vessel charter rates ahead, in our view.

|

Name |

Type |

Location |

Comments |

|

Pacific Radiance’s fully-owned vessels |

|||

|

Crest Radiant |

Multipurpose support vessel |

Abu Dhabi |

In operation |

|

Crest Mars |

Workboat |

Abu Dhabi |

Started working since 2Q24 |

|

Crest Mercury 2 |

Anchor handling tug and supply vessel |

Abu Dhabi |

Started working since 3Q24 |

|

Crest Station 1 |

Accommodation work barge |

Abu Dhabi |

Started working since 1Q25 |

|

Vessels under Taiwanese JV Mainprize Asia (49% stake) |

|||

|

Prosperous 1 |

Crew transfer vessel |

Taiwan |

12 pax, 5 crew, built 2020 |

|

Prosperous 2 |

Crew transfer vessel |

Taiwan |

12 pax, built 2013 |

|

Prosperous 3 |

Crew transfer vessel |

Taiwan |

24 pax, built 2023 |

|

Prosperous 5 |

Crew transfer vessel |

Taiwan |

24 pax, built 2024 |

|

New CTV delivered in 2H25 |

Taiwan |

2025 |

Source: CGS

| Added 1 newbuild CTV in Taiwan, with 1 more to go |

PACRA has 4 crew transfer vessels (CTVs) servicing offshore wind farms in Taiwan, as of end-Jun 25.

We understand from management that it delivered one of 2 CTVs under construction at its yard to its Taiwanese JV, with contribution expected from 2H25F.

The second CTV is pending sale agreement, which would bring total CTV count to 6 units.

Apart from this, yard revenues (+12% yoy in 1H25) were healthy due to higher repair volumes

We raise our FY25F-27F core PATMI estimates to US$13m-15m from US$5m-8m to factor in higher GM assumptions (49-50% vs. 37-40%).  Meghana Kande, analystOur Add call is backed by its sustainable profit turnaround. Meghana Kande, analystOur Add call is backed by its sustainable profit turnaround. Given its US$15m net cash and an active, contracted fleet, we think new vessel additions will be a key re-rating catalyst for the stock. Other catalysts: sale or contract for its second CTV under construction, and higher-than-expected vessel charter rates. With consecutive core net profit over the past 12 months, we believe P/E is a more representative valuation method for PACRA and now peg it to 7x FY26F P/E, a 30% discount to peers’ 10.5x given the former’s smaller fleet (previously c.0.7x FY25F P/BV). Downside risks: weak ship repair demand for yard and lower-than-expected fleet utilisation affecting revenues. |

Full report here.