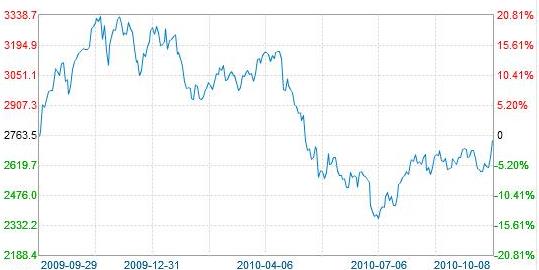

CHINA'S A SHARES, which last traded on September 30, were back in business on Friday (Oct 8) with a vengeance, with the benchmark Shanghai Composite Index soaring 3.1% to 2,738.74, a five-month high.

After the long break, many are naturally wondering where the market is headed.

Most analysts expect bullish behavior going forward, but several have a lot to say about the two recent pillars of the bourse – financials and developers – and it’s not all upbeat.

New property regulations issued on Thursday targeting developers in China’s largest city Shanghai were less restrictive than expected, analysts said, and helped lift listed real estate players higher yesterday.

The country’s largest listed developer China Vanke (SZA: 000002) added 0.5% to 8.44 yuan while Poly Real Estate Group (SHA: 600048) was up 2.9% at 12.72 yuan.

The fact that the newly announced anti-speculation measures limiting homeowners to just two properties in Shanghai while not including a new residential tax cheered investors, helping lift valuations for major listed developers.

Deutsche Bank said in a research note yesterday that domestic tightening measures of late have helped slow property sales, a likely motive for the less onerous than expected homeowner restrictions.

In Tier 1 cities like Beijing and Shanghai, average sales were down considerably over the weeklong PRC National Day “Golden Week” holiday compared to the week prior.

Another reason for yesterday’s sudden surge was also a factor of idle funds being rejuvenated after the extended break, with higher daily trading volume serving witness.

Analysts expect this phenomenon to continue next week with pent-up demand for equities following the weeklong vacation expected to keep A shares trading at near six-month highs, ranging between 2,700 and 2,800 points next week.

The fact that no Central Bank action on interest rates prior and during the holiday also spurred on valuations yesterday and was likely to carry over into next week.

A weakening US dollar and a robust domestic economy meant that strong demand for commodities would be more affordable in the dollar-denominated products.

A-share listed mining and metals counters soared yesterday on the double dose of encouraging drivers, chasing the recent rapid rise in commodities prices.

Copper futures have risen to their highest levels in over two years, while gold continued to surge -- at one point reaching a record 1,364.95 usd per troy ounce on Thursday.

A-share listed Jiangxi Copper (SHA: 600362), Yunnan Copper (SZA: 000878) and Zijin Mining (SHA: 601899) all hit their daily upside 10% limit yesterday.

Jiangxi closed at 34.23 yuan, Yunnan rose to 24.52 yuan, and gold mining firm Zijin finished at 8.00 yuan.

Despite the flurry of upside drivers yesterday, and expectations for a mini bull run lasting for at least all of next week, not all market watchers were eagerly jumping onboard the real estate bandwagon.

“Developers and banks have been causing lots of anguish for investors this year, and just because they show a bit of resilience today (Friday) doesn’t mean I am convinced. In fact, I would argue that real estate firms and lenders should give shareholders the creeps as they have valuations least in touch with market reality,” SinaFinance cited one analyst as saying in a Chinese language piece.

But the analyst had more to say about the real estate sector in China, which the analyst called an “unbalanced monstrosity.”

“The market is divided between residential property owners and real estate developers. For the latter, price controls are set by the Ministry of Land and Resources, while actual prices are dictated by local governments.

“However, residential property owners first have prices suggested by local development banks and governments during purchasing procedures, then raise prices in accordance with perceived demand. Therefore, it is very hard to control this animal.”

The analyst did say investors could take comfort from the fact that China’s two most populous cities – Beijing and Shanghai – had both shown market discipline in the form of recent anti-speculation controls and pricing regulations, a phenomenon which shows some promise for a more stabilized property sector nationwide.

“The single biggest problem in the property market lately has been over-rapid development. With this has come an unreasonable influx of investment and unreasonably high rental and housing prices, most of which are beyond the budget of most people.

“Therefore, it is in the interest of both the industry and shareholders to make more homes and apartments affordable to a wider population, and I believe this reality will cool price inflation and speculation moreso than any new regulations down the pike,” the analyst concluded.

See recent: CHINA SHARES: Up 1.4% After 5-Day Rest; Hong Kong Also Higher