WHAT GOES UP must come down, as the saying goes.

Luckily for China’s capital markets, the reverse is also true.

Four expert opinions from the mainland addressed medium-term forecasts on where the country’s A-shares are headed after the benchmark Shanghai Composite Index shed nearly 30% in the first half, the second worst performer globally.

The mainland media polled the domestic brokerages, with many respondents concurring that vague or shifting policy is more damaging to share price growth and stability than either clearly pro-property or anti-property equivalents.

SWS Research said that a mixture of anxiety and anticipation over the erratic property sector has been fueling instability for much of the first six months of the year.

The brokerage put part of the blame at the feet of the media, which SWS said needed a daily lead to hang the market behavior du jour hat upon.

"If the media repeatedly report that a new property levy is on the horizon, and then the government denies it the next day, how can investors put credence in much of any policy-related news and its effect on the markets?” SWS said.

This almost always resulted in unpredictable behavior for the indices, it added.

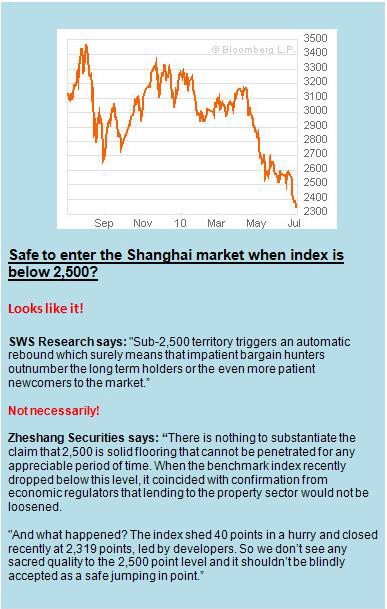

The brokerage also said that the Shanghai Composite Index, the benchmark tracking A shares, seemed to have a reflexive aversion to lingering below the 2,500 level for long, at least if first half history is a reliable guide.

"Sub-2,500 territory triggers an automatic rebound which surely means that impatient bargain hunters outnumber the long term holders or the even more patient newcomers to the market,” it said.

SWS expected more consolidation over the near term before finding a groove above 2,500 upon which to rebuild.

West Securities also said that as property goes, so goes the market.

"Property developer shares have been the talk of the town on the A-share markets and there doesn’t seem to be any end in sight to their exposure,” West said.

The brokerage added that the fact that the property index jumped over 3% in two recent trading sessions and the strong positive recovery in the Shanghai Composite reveals the important place that this one single sector plays in the capital markets.

"On Tuesday, the property index then just as suddenly fell over 3% on more market rumors. We think that in this atmosphere of directionless policy and lack of clarity, we will see even lower share prices than witnessed in even the dour first half before the market bottoms out and begins climbing back. The chief culprit is policy uncertainty and the required guesswork on the part of investors.”

Cinda Securities says that some investors are putting economic performance ahead of policy movies – actual or potential – in making decisions on what to buy, sell or hold on the stock market.

But the brokerage cautions that a ‘chicken or egg’ type scenario may be applicable here because in many ways, macroeconomic policy not only influences economic performance, but in some cases makes growth itself possible.

"We must remember that government policy is intended to speed up a sluggish economy and cool down a torrid one. So investors should be wary of the slowdown effects of policy when things are expanding a bit too fast, and also be able to make investment choices accordingly.”

Therefore, if in fact reports of looser property credit in first tier cities proves true, then the market would likely respond accordingly, and quickly to eventual policy confirmation.

Finally, Zheshang Securities weighed in with a more bearish medium-term outlook for A shares.

It suggested that there was no intrinsic logic to the assertion that the market would not tolerate too many trading days in sub-2,500 point territory.

"There is nothing to substantiate the claim that 2,500 is a solid flooring that cannot be penetrated for any appreciable period of time. When the benchmark index recently dropped below this level, it coincided with confirmation from economic regulators that lending to the property sector would not be loosened.

"And what happened? The index shed 40 points in a hurry and closed recently at 2,319 points, led by developers. So we don’t see any sacred quality to the 2,500 point level and its shouldn’t be blindly accepted as a safe jumping in point.”

At the end of the day, the brokerages said that solid company research was key, while keeping in mind that properties’ inordinate influence on market sentiment would not go away anytime soon, and investors would still do well to keep an eye out for policy shifts on this front.

Yesterday, the Shanghai Composite Index rose 0.82% to close at 2,470.44.

See also: CHINA'S TRILLION $ STIMULUS: White goods sector benefits most