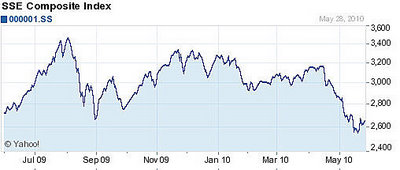

MAY IS historically one of the most bearish of months for share prices, and Beijing’s recent moves to reign in the fast growing property market are helping create a self-fulfilling prophecy.

China’s benchmark Shanghai Composite fell 2.4% today to close at 2,592.1 points, following a flat performance on Friday.

That makes the merry merry month of May quite contrary, with the Index falling some 10% over the period and 21% on the year.

Meanwhile, shares in Hong Kong closed flat today at 19,765.19.

Once again, today’s significant selloff on the Shanghai Composite was triggered by yet another and more substantive sign that Beijing was on the verge of a palpable crackdown on the rapidly expanding real estate sector.

The country’s State Council, which serves as a Cabinet, announced today on its official website that it was ready to implement a new raft of fiscal measures meant to slow housing price inflation and speculation in the industry.

Although the benchmark Shanghai Composite has been crawling back to late 2009 levels of late, today’s fall suggests that a near term major bounce might be unrealistic and traders would continue to place tougher measures on the housing and commercial real estate sector as their top concern.

Today’s Cabinet announcement comes close on the heels of a report that China’s biggest city – Shanghai – had sent a real estate tax proposal to the central authorities.

Shanghai’s main barometer for the sector, the Shanghai Property Index, fell 2.6% today with industry giant Gemdale (SHA: 600383) losing some 4.3% on the day.

Shares in the sector have lost nearly 30% so far this year, an even more precipitous decline than the overall benchmark index itself, which has shed 21% since January 1.

In Shanghai, losing shares outnumbered gainers by 817 to 73, with turnover also falling today to 87 bln yuan from 98 bln on Friday.

Getting Used to 2,600

Analysts said while today’s close was higher than the monthly low on May 21 of 2,481.97, investors would do well to keep a close eye on both timing, character and implementation of new macromeasures meant to slow the property sector.

They expect the Index hover around the 2,600 level for the near term until there is more visibility on real estate.

Also weighing on overall valuations is nervousness about possible tighter controls over Shenzhen’s GEM Board beginning tomorrow.

But another call by PRC President Hu Jintao to keep pharmaceuticals and medical supplies “reasonably affordable” in the country suggested that state subsidies may be on the table to make up the difference.

This allowed two listed drugmakers to rise by their daily 10% limits: Shanghai No.1 Pharmacy (SHA: 600833) and Layn Pharm (SZA: 002166).

However, property plays were the big story today, with respective declines of 3.0% and 6.0% seen for the country’s top listed developer China Vanke (SZA: 000002) and Yi Hua Real Estate (SZA: 111050).

Minsheng Securities was cited by PRC media as saying that things will trend downward over the short term, but policy transparency will offer a break in the cloud cover – if and when it comes.

"Near term economic and market volatility will remain a drag on markets, and no immediate upsurge can be expected. However, with more clarity and understanding of macromeasures meant to moderate over-fast growth in some sectors, we do expect a noticeable rebound,” the brokerage said.

It recommended investors hold regional and industrial plays for now.

See also: Shanghai index soars to close up 3.48% for biggest gain since November