CHINESE SHARES listed in Hong Kong are expected to move within range this week after letting off steam on Friday and in trade today, a Westcomb Financial market watcher told NextInsight.

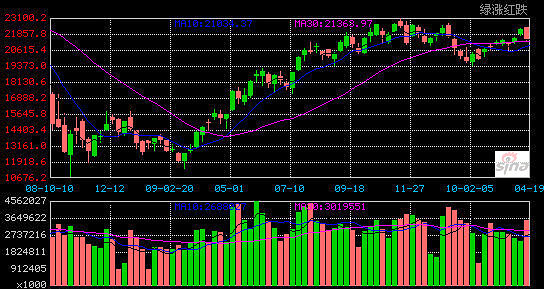

The Hang Seng Index fell 1.3% on Friday to end the week at 21,865.26, its lowest level in two weeks.

Meanwhile, the benchmark Shanghai Composite Index ended Friday down 1.1% on the day at 3,130.3, finishing 0.5% lower for the week.

Both indices took a hit from anxiety over more regulatory measures meant to slow down China’s white hot property market.

And today, the two bourses took another dive as investors digested the updated real estate rules released over the weekend.

The Shanghai Composite fell 4.8% today to hit 2,980.30, its lowest level since March 15.

And the Hang Seng shed another 2.1% today to finish a bearish Monday at 21,405.17.

Chinese shares were also dragged down by recent investigations into Goldman Sachs on suspect financial products.

Mr. Kevin Lim, a Singapore-based equities analyst, said Beijing may be crying wolf again on its longstanding campaign to cool down fast-rising home prices, but the stricter measures over the weekend are giving more credibility to their initiative.

“The Hong Kong market fell no thanks to the new slew of measures introduced by the Chinese government on new cooling measures to curb the overheated property sector. The general sentiment, as usual, would be that it would have an impact on property developers and banks, and hence pull down the indices,” he said.

He added that there were several key aspects to the new macromeasures, which increase down-payment requirements on third homes for investors.

What is key is that

1) it seemed that the central government is finally moving resolutely on this, instead of the surprising inaction taken by Premier Wen on March 14 at the end of the annual parliamentary meetings.

2) The announcement on lending curbs for third homes is a very strong signal to private wealth groups not to ‘hoard’ any more houses.

“This latest weekend announcement is very interesting, as I think it must have incorporated some immediate feedback on how the measures initially announced on Thursday were not really adequate.”

He added that the real problem is that it is the funds and private wealth investors that are driving this property bubble.

“Only they would have the funds to snap up hundreds of units at one go.”

News from the US was also impacting global markets once again.

“As for the US, my opinion is that it may be déjà vu all over again, as we have seen in late January this year, as Wall Street puts up its latest fight against the new financial regulatory measures to be effected by the end of the year.

“I think the ‘echo effect’ will get smaller each time we see such news (ie: the market reacts with shock, then quickly recovers, as rational thinking and fundamentals quickly take hold. Who knows, for example, when some other banks are ‘exposed’ via new revelations, and perhaps the markets may even rally as investors get tired).”

Therefore, he says he expects the Hang Seng and A-shares to remain relatively rangebound after absorbing hits the past two trading days.

“I am neutral on H-shares this week. All in all, I expect the Hong Kong market to have a ‘smaller’ reaction this time as opposed to what we have seen in January this year. The wolf-crying can only go on so long and I’m quite sure the market would have got these two issues -- China tightening and US financial tightening -- very well priced in, by now.

“This week I would put the focus on the US jobless claims as we have seen two rises in a row for two weeks.”