Terence Wong, CFA, is head of research at DMG & Partners. This article of his was published in a DMG report yesterday.

Over the past year, our small cap team has been actively initiating coverage of quality but under-researched companies. Quite a few of them were diamonds in the rough which eventually morphed into gems. In fact, in a recent ‘internal audit’, we found a quarter of our key picks actually returned over 50% in the first six months of 2010.

Given our large (and growing) coverage universe, I have often been asked by fund managers ‘Where would you put your money?’I wish I could, but given compliance reasons, I don’t invest in stocks that my team covers. So the next best thing is to show what I would do if I were given S$1m to invest.

Target return. For this portfolio, I am gunning for annual returns of 15%, or 15% over the benchmark STI, whichever is higher.

Assumptions. I have assumed that I can trade at market prices, which in the real world, don’t often happen that way, especially with the small caps. There will be no minimum liquidity requirements, so as long as it is a quality stock that is covered by DMG, there is a chance of being added to my portfolio.

In some cases, I will give myself the liberty of snapping up counters which are not under our coverage universe. I have also assumed transaction costs to be next to nothing (privilege of being an employee of DMG).

Monitoring Performance. The portfolio performance can be monitored regularly on my weekly billion&below, and will be formally reviewed on a quarterly basis. Week to week changes are not important to me, as I would be focusing on the long term. If there are any changes in the portfolio, investors would be alerted.

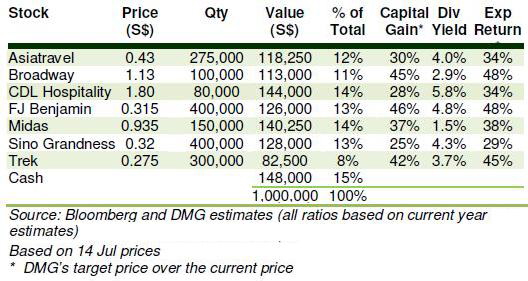

PORTFOLIO

The stocks I have picked are in sectors which I think will see the most exciting prospects, including Hospitality (24% of AUM), Technology (18%), Agriculture(13%), and Consumer (13%).

Cash amounting to 15% of the start-up capital will not remain in the bank for too long, as I am out hunting for one other company to add to the portfolio, possibly another consumer stock.As with my personal investments, I will try not to over-diversify and keep the holdings within 10 stocks. We kick-start our model portfolio with the following seven counters:

Asiatravel

Asiatravel, an online travel service provider, recently rolled out a state-of-the-art Online Packaging Module with instant confirmation to end-consumers. Travellers and contracted travel agencies can now book travel packages through its website, to all major destinations in Asia with instant confirmation. We think that recovery in average room rates (ARR) can be supported with increased visitor arrivals and longer visitor days. Earnings for the current 2HFY10 (Y/E Sep) are likely to be dampened by start-up costs, but we believe things have started to turn around last month. Asiatravel is currently trading at 17.5x FY10 earnings.We expect Asiatravel to be able to maintain its dividends, which translates into a decent yield of 4.7%. BUY, with TP of S$0.56.

Broadway

Primarily a hard disk drive (HDD) component supplier that derives the bulk of its earnings through the manufacture of actuator arms, the macro outlook for the HDD industry is looking highly positive with worldwide HDD shipments anticipated to increase by 22.8% to 674.6m units in 2010. Furthermore, Broadway's semiconductor equipment business is also forecasted to be out of the red in FY10 after incurring losses of more than S$10m in 2009.

Given tha tthe valuations for the company are also among the lowest as compared to the other SGX-listed HDD players despite its market capitalisation being one of the largest, we thus have a BUY recommendation with TP of S$1.46 based on 6.9xFY10 P/E.

CDL Hospitality Trusts

As the only hotel REIT in Singapore, CDLHT will benefit from the current tourism boom. Visitor arrivals to Singapore continued to power ahead, surging 30% YoY in May to reach 946,000 visitors – its highest ever recorded for the month of May. RevPAR for upscale (4-star) hotels rose 44% to S$206 in the Apr-May period. Referencing against these figures, we believe CDLHT’s hotels may have likely registered a 30-43% surge in RevPAR for 2Q10. We expect Singapore to register its record 1m visitors in July – a banner figure for the media; hence creating significant euphoria within the sector and engendering further re-rating for hospitality-related stocks. BUY, with TP of S$2.30.

FJ Benjamin

FJ Benjamin, a retailer of mid- to high-end fashion labels with a strong presence in South East Asia, is expected to be a beneficiary of the improving regional economy, better consumer sentiment and recovery in visitor numbers. It targets to have 168 shops in the region this year, including four new outlets at the new Marina Bay Sands (MBS) Shoppes. Its proprietary Raoul brand is also making waves in the international fashion scene. FJ Benjamin established a showroom in NYC, one of the fashion capitals of the world, to showcase its Raoul label to the fashion outlets there, such as MACY's and Saks Fifth Avenue. We derive a TP of S$0.52, based on DCF valuation.

Midas

With China expected to spend RMB823.5b in 2010 on public transportation infrastructure spending as compared to RMB600b in 2009, we believe that Midas is thus set to benefit from this positive development through the ramp up in production capacity of its aluminium alloy extrusion and downstream fabrication lines. With the impending addition of three extra aluminium alloyextrusion production lines, the company’s annual production capacity is expected to increase from the existing 20,000 tonnes to 50,000 tonnes by end-2010. We have a BUY recommendation with TP of S$1.28 based on 19.9x blended FY10/11F P/E.

Sino Grandness

Sino Grandness is China’s top exporter of canned asparagus and long beans,accounted for 8% and 3% of total export respectively in 2008, and a top three exporter of canned mushroom. Its recent venture into PRC consumer market is gaining headway with domestic sales making up 18% of FY09 revenue. We expect net profit to grow at 20% CAGR over the next three years. Increase in production capacity of ~15% per year, new product offerings e.g. tomatoes and chilli sauce, and entrance into new markets will help sustain export growth momentum.

Beverage sales is expected to grow at >50% CAGR over 2010-12on the back of new Fruit&Veg contribution. Trading at attractive valuation of 4xFY10E P/E and dividend yield of 5%, we believe Sino Grandness will likely rerate as management delivers on growth. BUY, with TP of S$0.40.

Trek 2000

Best known as the inventor of the ubiquitous ThumbDrive, Trek is a provider of design solutions of numerous IT products. Major customers of Trek 2000 includeToshiba (owns 15% of Trek), Imation, TEAC, Verbatim, Lenovo and JVC.

While the company’s fortunes had dwindled in recent years due to heightened competition, we believe that this playbook is set to change as Trek has recently unveiled its new brainchild known as the FluCard, a form factor of the SecureDigital (SD) Card.

As we expect this invention to boost Group earnings by over five times in FY10, we have a BUY call with TP of S$0.39 based on 5.6x FY11P/E. This is very much a concept play, and not a stock for the faint hearted.

DISCLAIMER:

This research is issued by DMG & Partners Research Pte Ltd and it is for general distribution only. It does not have any regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this research report. You should independently evaluate particular investments and consult an independent financial adviser before making any investments or entering into any transaction in relation to any securities or investment instruments mentioned in this report